How to fill out Form 08/CK-TNCN on personal income tax commitment in Vietnam?

How to fill out Form 08/CK-TNCN on personal income tax commitment in Vietnam?

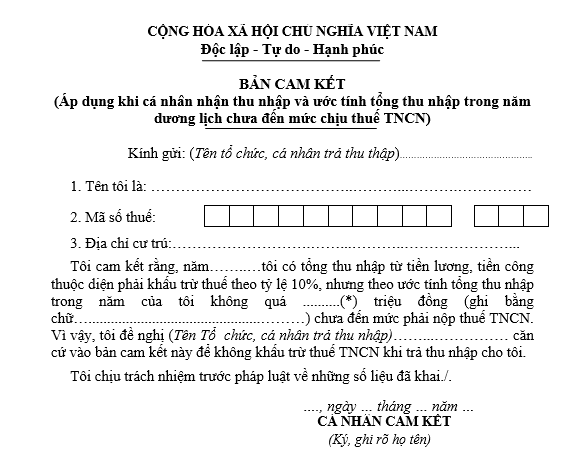

For the method of writing a personal income tax commitment, you can refer to the following six sections in Form 08/CK-TNCN:

(1) To: Enter the name of the organization or individual paying the income; you do not need to enter the name of the tax authority (for example, company, enterprise, etc.).

(2) Enter your full name.

(3) Enter the tax identification number.

(4) Enter your residential address (permanent or temporary residence).

(5) Enter an estimated total income for the calendar year that is below the taxable amount (in both numbers and words).

(6) Proposal: Enter the name of the organization or individual paying the income.

Note: Tax identification number section: Individuals with a 10-digit tax code should enter all 10 digits, leaving the remaining 3 boxes blank.

- The part marked with *: The declared amount in this section is determined by the personal exemption calculated for the year.

Note: Information for reference purposes

How to fill out Form 08/CK-TNCN on personal income tax commitment in Vietnam? (Image from the Internet)

What is the personal income tax commitment form in Vietnam according to Form 08/CK-TNCN?

The latest form for temporarily not withholding personal income tax in 2023 is implemented according to Form 08/CK-TNCN issued along with Circular 80/2021/TT-BTC, specifically:

>> Form 08/CK-TNCN Commitment Declaration: Download

What is the personal exemption for taxpayers in Vietnam?

Based on Article 1 of Resolution 954/2020/UBTVQH14, the regulations are as follows:

Personal exemption

Adjustment of the personal exemption as stipulated in clause 1, Article 19 of the Law on Personal Income Tax No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13, is as follows:

- The exemption for taxpayers is 11 million VND/month (132 million VND/year);

- The exemption for each dependant is 4.4 million VND/month.

Compared to the previous regulations in clause 4, Article 1 of the Amended Law on Personal Income Tax 2012, the contents are as follows:

Personal exemption

- Personal exemption is an amount subtracted from taxable income before tax calculation for income from business, salary, wages of residential taxpayers. This exemption comprises two parts:

a) The exemption for taxpayers is 9 million VND/month (108 million VND/year);

b) The exemption for each dependant is 3.6 million VND/month.

In the event the Consumer Price Index (CPI) fluctuates over 20% compared to the time the law came into effect or the most recent time of personal exemption adjustment, the Government of Vietnam shall propose to the Standing Committee of the National Assembly to adjust the exemption in line with price fluctuations for the subsequent tax period.

Meanwhile, clause 1, Article 19 of the Law on Personal Income Tax 2007 states:

Personal exemption

- Personal exemption is an amount subtracted from taxable income before tax calculation for income from business, salary, wages of residential taxpayers. This exemption comprises two parts:

a) The exemption for taxpayers is 4 million VND/month (48 million VND/year);

b) The exemption for each dependant is 1.6 million VND/month.

As of January 1, 2009, the exemption applied to taxpayers was 4 million VND/month (48 million VND/year).

From July 1, 2013, the Amended Law on Personal Income Tax 2012 took effect and increased the taxpayer exemption to 9 million VND/month (108 million VND/year).

By July 1, 2020, the Resolution 954/2020/UBTVQH14 raised the exemption to 11 million VND/month (132 million VND/year) for taxpayers. This exemption is still applicable to date.

Who is required to pay personal income tax in Vietnam?

Based on Article 1 of Circular 111/2013/TT-BTC, amended by Article 2 of Circular 119/2014/TT-BTC, the provisions are as follows:

Taxpayers

Taxpayers are residential and non-residential individuals as defined in Article 2 of the Law on Personal Income Tax and Article 2 of Decree No. 65/2013/ND-CP dated June 27, 2013, of the Government of Vietnam detailing some articles of the Law on Personal Income Tax and Law on Amendments and Supplements to some articles of the Law on Personal Income Tax (hereinafter referred to as Decree No. 65/2013/ND-CP), who have taxable income as defined in Article 3 of the Law on Personal Income Tax and Article 3 of Decree No. 65/2013/ND-CP.

The scope of determining taxable income for taxpayers is as follows:

For residential individuals, taxable income is generated both within and outside the territory of Vietnam, regardless of where the income is paid;

For individuals who are nationals of a country or territory with which Vietnam has signed an agreement on avoiding double taxation and preventing tax evasion on taxes on income and are residents in Vietnam, their personal income tax obligation is calculated from the month they arrive in Vietnam if it is their first time in the country until the end of the employment contract month and departure from Vietnam (fully calculated by month) without having to carry out consular certification procedures to avoid double taxation under the agreement between the two countries.

For non-resident individuals, taxable income is income generated in Vietnam, regardless of where it is paid or received.

Thus, according to the above regulation, those required to pay personal income tax are both residential and non-residential individuals when they meet the legal conditions stipulated.