How to fill Form 01b-HSB BHXH? Is lump-sum allowance for childbirth subject to PIT in Vietnam?

How to fill Form 01b-HSB BHXH?

Based on Decision 166/QD-BHXH of 2019, which provides specific regulations on sickness policies, the documentation for employees to enjoy such policies is as follows:

Form 01b-HSB BHXH.....Download

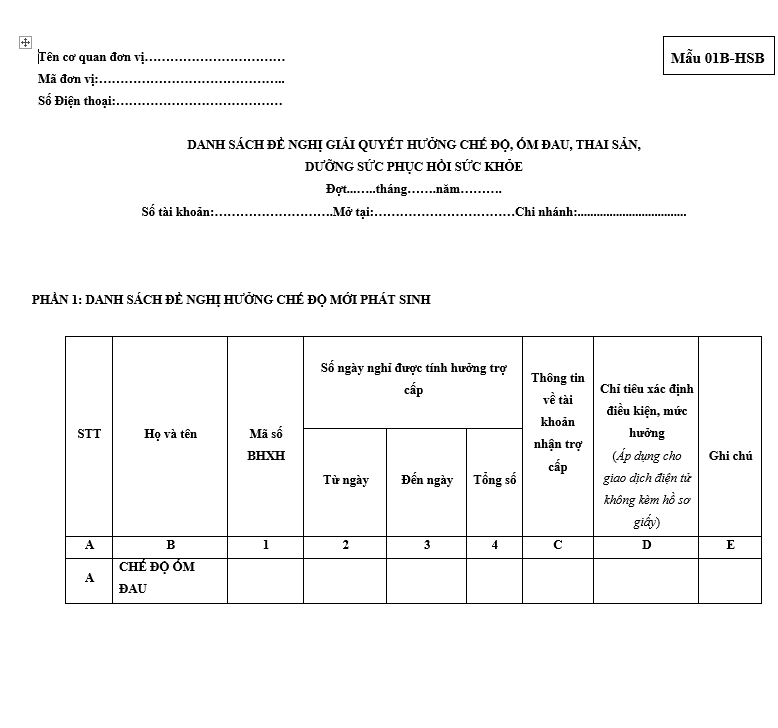

To fill in the information in the List of Benefits for Sickness, Maternity, Recuperation, and Health Restoration (Form 01B-HSB), follow the steps for each section and column in the form as follows:

Here is a guide on how to fill Form 01b-HSB BHXH:

1. Header of the List

- Upper left corner:

- Unit name: Clearly state the full name of the unit.

- Social Insurance registration unit code: Enter the unit's Social Insurance code (provided by the Social Insurance agency).

- Contact phone number: Enter the contact phone number of the unit so Social Insurance can reach out if needed.

- Instalment period in the proposed month, year:

- Clearly state the period (e.g., January 2024 period).

- Account number, bank, bank branch: Provide information about the unit's bank account (where the account was opened for Social Insurance to transfer money to employees). If the employee does not have a personal account, leave this part blank.

- Basis for creating the list:

- Policy resolution documentation: Includes documentation for sickness, maternity, recuperation, and health restoration.

- Timesheets, salary deductions for Social Insurance of the unit: These are supporting documents to prove the leave period and respective insurance contributions.

2. Section 1: LIST OF NEW POLICY BENEFITS PROPOSED

This section lists new cases occurring during the proposed policy resolution period.

- Column A: Enter the serial number of the employee on the list.

- Column B: Enter the full name of the employee.

- Column 1: Enter the Social Insurance code of the employee.

- Column 2: Enter the first date/month/year the employee actually took leave to enjoy the policy (e.g., the start date of sick leave).

- Column 3: Enter the last date/month/year the employee actually enjoyed the policy leave (e.g., the end date of sick leave).

- Column: Enter the total number of leave days of the employee in the period. If the leave is less than one month, enter the number of leave days. If the leave is over one month, enter the number of months and any additional days (e.g., 1 month and 5 days).

- Column C: Enter the account number, bank name, branch where the employee opened an account to receive the allowance. If no personal account, leave blank.

- Column D: Enter criteria to determine conditions and benefit levels (only for units conducting electronic transactions without attaching paper documents). Enter information related to the employee's policy benefits such as:

- For sickness: Enter the disease code (or disease name if there is no code in the documentation).

- For maternity: Provide information about the child's birth date, date of child death (if any), date of mother's death postpartum (if any), or date the mother is not healthy enough to care for the child (if any).

- Sick child: Enter the child's birth date when the employee takes leave to care for the sick child.

- For recuperation: Enter the return date to work or the decision date of the Medical Examination Council in case of recuperation after work accidents or occupational diseases.

- Column E: Enter detailed information regarding sickness or maternity leave:

- If weekly off days are not the legally stipulated weekly off days (usually Saturday, Sunday), state clearly.

- If the employee has a regional allowance, clearly state the allowance level (e.g., PCKV 0.7).

- For sick children: Enter the child's health insurance card code.

Section 2: LIST OF CASES REQUIRING ADJUSTMENT FROM PREVIOUS RESOLUTION

This section lists cases requiring adjustments in the previously reviewed list.

- Columns A, B, 1, C: Enter information similar to section 1.

- Column 2: Enter the period/month/year previously reviewed by Social Insurance, including the document number of the prior review list.

- Column 3: State the reason for adjustment (e.g., errors in previous information, adjustment of leave days, etc.).

Additional Notes:

- Documentation for resolving policies on sickness, maternity, recuperation, and health restoration must be fully confirmed according to regulations to ensure employees receive the rightful benefits.

- Employers need to correctly follow the form-filling procedure and ensure accurate, complete information before submitting to the Social Insurance authority.

Note: The guidelines for filling Form 01b-HSB BHXH above are for reference only.

How to fill Form 01b-HSB BHXH? Is lump-sum allowance for childbirth subject to PIT in Vietnam? (Image from the Internet)

Is the lump-sum allowance for childbirth subject to PIT?

According to point b.6 clause 2 Article 2 of Circular 111/2013/TT-BTC, the following are subject to PIT:

Taxable Income

....

2. Income from salaries, wages

....

b.6) Unexpected hardship allowances, benefits for work accidents, occupational diseases, lump-sum allowances for childbirths, maternity benefits, recuperation after maternity benefits, allowances due to reduced labor capacity, one-time retirement benefits, monthly survivor's pension, severance allowance, job-loss allowance, unemployment benefits, and other allowances according to the Labor Code and Social Insurance Law.

....

Thus, the lump-sum allowances for childbirth is not subject to PIT.

Where is the PIT declaration form submitted in Vietnam?

According to Article 45 of the Law on Tax Administration 2019, specific regulations on the submission location of tax declaration dossiers are as follows:

- Taxpayers submit tax declaration dossiers at the directly managing tax authority.

- In the case of submitting tax declaration dossiers through the one-stop-shop mechanism, the declaration submission location is according to the regulation of that mechanism.

- The submission location of tax declaration dossiers for imported or exported goods follows the Customs Law regulations.

- The Government of Vietnam specifies the submission locations for tax declaration dossiers in the following cases:

+ Taxpayers with multiple production and business activities;

+ Taxpayers conducting production, business activities in multiple areas; taxpayers having emerging tax obligations related to taxes declared and paid on an occurrence basis;

+ Taxpayers having tax obligations arising from land revenues; grant of mining rights for water resources, mineral resources;

+ Taxpayers having tax obligation settlements for personal income tax;

+ Taxpayers conducting tax declaration through electronic transactions and other necessary cases.