How to download the 2025 dependant registration form for personal exemption in Vietnam? What documentation is required to prove dependant?

How to download the 2025 dependant registration form for personal exemption in Vietnam?

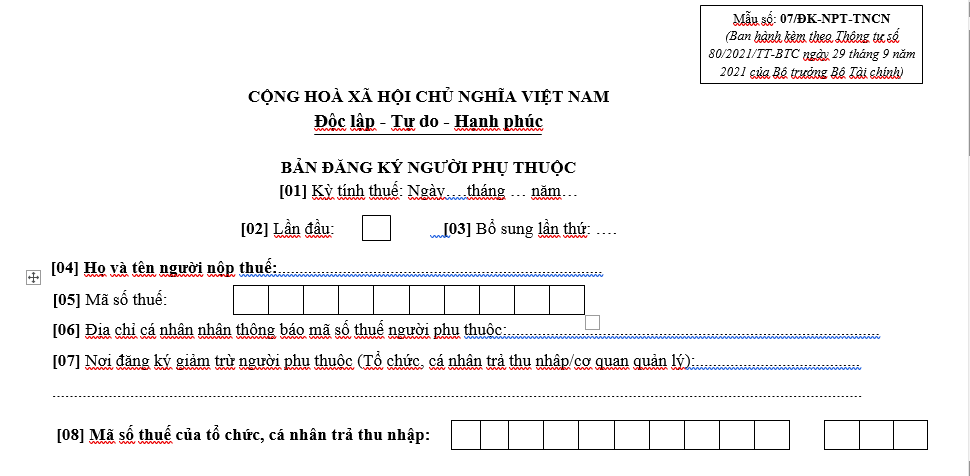

The dependant registration declaration form for personal exemptions applicable in 2025 is form number 07/DK-NPT-TNCN issued together with Circular 80/2021/TT-BTC.

Form 07/DK-NPT-TNCN, the dependant registration declaration, includes the following content:

Download Form 07/DK-NPT-TNCN for dependant registration

Some notes when filling out Form 07/DK-NPT-TNCN:

- Item [16]: indicates the starting point for dependant deduction. In the case where the taxpayer changes the organization paying income for dependant deduction or changes the taxpayer for dependant deduction, item [16] should record the starting point for dependant deduction at that organization or at that taxpayer. If a taxpayer registers for a dependant deduction for a period before the current year due to reassessing previous years, item [16] should state the starting point for the dependant deduction corresponding to the reassessed year preceding the current year.

- Item [17]: indicates the ending point for the dependant deduction. If the taxpayer has not determined the ending point for the dependant deduction, leave it blank. If the taxpayer changes the ending point for the dependant deduction (including cases where item [17] has been filled or left blank), the taxpayer must complete a supplemental Declaration of dependant Registration to update item [17] in accordance with the actual ending time of the dependant deduction.

How to download the 2025 dependant registration form for personal exemption in Vietnam? What documentation is required to prove dependant? (Image from the Internet)

What documentation is required to prove dependant for personal income taxpayers in Vietnam?

Based on point g, clause 1, Article 9 of Circular 111/2013/TT-BTC, amended by Article 1 of Circular 79/2022/TT-BTC, the documentation required to prove dependant for personal income taxpayers includes:

(1) For children:

- Children under 18 years old:

+ Photocopy of the Birth Certificate.

+ Photocopy of the Identity Card or Citizen Identification Card (if available).

- Children aged 18 years or older with disabilities, unable to work:

+ Photocopy of the Birth Certificate and photocopy of the Identity Card or Citizen Identification Card (if available).

+ Photocopy of the Disability Certificate as prescribed by law on persons with disabilities.

- Children attending educational levels guided in sub-point d.1.3 of point d, clause 1, Article 9 of Circular 111/2013/TT-BTC:

+ Photocopy of the Birth Certificate.

+ Photocopy of the Student Card or a declaration certified by the educational institution, or other documents proving enrollment in a university, college, professional secondary, high school, or vocational school.

- In cases of adopted children, illegitimate children, or stepchildren, in addition to the documents required for each case mentioned above, the documentation must include additional papers proving the relationship, such as:

+ Photocopy of the decision recognizing the adoption.

+ Decision recognizing the recognition of parent, child by a competent state agency.

(2) For spouse:

- Photocopy of the Identity Card or Citizen Identification Card.

- Photocopy of the Residency Information Certificate or Notice of Personal Identification Number and Information in the National Population Database or other documents issued by the Police authority (proving the spousal relationship) or a Photocopy of the Marriage Certificate.

- If the spouse is of working age, in addition to the documents mentioned above, the documentation must include additional documents proving the dependant's inability to work, such as:

+ Photocopy of the Disability Certificate as prescribed by law on persons with disabilities who are unable to work.

+ Photocopy of the medical record for individuals with diseases that incapacitate them (such as AIDS, cancer, chronic kidney failure, etc.).

(3) For biological parents, parents-in-law (or father-in-law, mother-in-law), stepfather, stepmother, legal adoptive father, legal adoptive mother:

- Photocopy of the Identity Card or Citizen Identification Card.

- Legal documents to identify the dependant's relationship with the taxpayer, such as a photocopy of the Residency Information Certificate or Notice of Personal Identification Number and Information in the National Population Database or other documents issued by the Police authority, birth certificate, and decision recognizing parent, child by a competent state agency.

- If in working age, in addition to the documents mentioned above, the documentation must include additional documents proving disability and inability to work, such as:

+ Photocopy of the Disability Certificate as prescribed by law on persons with disabilities who are unable to work.

+ Photocopy of the medical record for individuals with diseases that incapacitate them (such as AIDS, cancer, chronic kidney failure, etc.).

(4) For other individuals as guided in sub-point d.4 of point d, clause 1, Article 9 of Circular 111/2013/TT-BTC:

- Photocopy of the Identity Card or Citizen Identification Card or Birth Certificate.

- Legal documents to establish responsibility for care as per legal provisions, such as:

+ Photocopy of documents identifying the obligation of care as prescribed by law (if any).

+ Photocopy of the Residency Information Certificate or Notice of Personal Identification Number and Information in the National Population Database or other documents issued by the Police authority.

+ Taxpayer’s self-declaration according to the form issued together with Circular 80/2021/TT-BTC certified by the local People's Committee where the taxpayer resides about the dependant living with them.

+ Taxpayer’s self-declaration according to the form issued together with Circular 80/2021/TT-BTC certified by the local People's Committee where the dependant resides about the dependant currently residing at the location and having no one to support them (case of not living together).

- If the dependant is of working age, in addition to the documents mentioned above, the documentation must include additional documents proving their inability to work, such as:

+ Photocopy of the Disability Certificate as prescribed by law on persons with disabilities who are unable to work.

+ Photocopy of the medical record for individuals with diseases that incapacitate them (such as AIDS, cancer, chronic kidney failure, etc.).

(5) For resident individuals who are foreigners, if there is no documentation as guided for each specific case mentioned above, similar legal documents must be provided as evidence to prove dependant.

(6) For taxpayers working in economic organizations, administrative, or career agencies with parents, spouses, children, and other individuals eligible as dependants clearly declared in the taxpayer's dossier, the documentation for proving dependants is implemented according to sub-points g.1, g.2, g.3, g.4, g.5 of point g, clause 1, Article 9 of Circular 111/2013/TT-BTC or simply a dependant Registration Form according to the form issued with Circular 80/2021/TT-BTC certified by the Head of the unit on the left side of the declaration.

Can multiple personal income taxpayers register the same dependant in Vietnam?

Based on sub-point c.2.4 of point c, clause 1, Article 9 of Circular 111/2013/TT-BTC, which stipulates the principles of personal exemption as follows:

Deduction Amounts

- personal exemption

...

c) Principles for calculating personal exemption

...

c.2) personal exemption for dependants

...

c.2.4) Each dependant is only eligible for deduction once against one taxpayer in a tax year. In cases where multiple taxpayers share a dependant who needs support, the taxpayers must agree to register the personal exemption for one taxpayer.

...

Thus, each dependant is only eligible for deduction once against one personal income taxpayer. In cases where multiple taxpayers share a dependant that needs support, the taxpayers must agree among themselves to register the personal exemption for one taxpayer.