How to determine the place to submit PIT declaration dossiers in Vietnam?

How to determine the place to submit PIT declaration dossiers in Vietnam?

Based on Section 4 of Official Dispatch 883/TCT-DNNCN 2022 guiding the personal income tax finalization issued by the General Department of Taxation, the method to determine the place to submit PIT declaration dossier is as follows:

The place to submit PIT declaration dossier is implemented according to specific guidance at Clause 8, Article 11 of Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam. In cases where individuals declare and submit PIT declarations on the website https://canhan.gdt.gov.vn, the system has a function to assist in determining the tax office finalizing based on information related to the tax obligations arising in the year as declared by the individual.

The specific determination of the place to submit PIT declaration dossier is as follows:

- For organizations paying income, submit tax finalization declaration dossiers to the Tax Authority directly managing the income-paying organization.

- For individuals directly finalizing with the Tax Authority:

- Resident individuals with income from salary, and wages at one place and belonging to the self-declared tax category during the year shall submit tax finalization declaration dossiers to the tax authority where the individual directly declared tax during the year as stipulated at Point a, Clause 8, Article 11 of Decree 126/2020/ND-CP.

In the case of individuals with salary and wage income from two or more places, including cases of both directly declared income and income from organizations deducting tax, individuals shall submit tax finalization declaration dossiers to the tax office where the largest income source of the year is located.

In case the largest income source of the year cannot be determined, individuals can choose to submit the tax finalization dossier at the tax office managing the organization paying income or where the individual resides.

- Resident individuals with income from salaries, and wages subject to deduction at source by organizations from two or more places shall submit tax finalization declaration dossiers as follows:

+ Individuals who have calculated family deduction at any organization, and individuals paying income shall submit tax finalization declaration dossiers to the tax authority directly managing the organization or individual paying income.

In the case of individuals changing jobs and at the final income-paying organization that calculates family deduction, submit tax finalization declaration dossiers to the tax authority managing the final income-paying organization.

If the individual changes jobs and the final income-paying organization does not calculate family deduction, submit tax finalization declaration dossiers to the tax authority where the individual resides.

If the individual has not calculated family deduction at any income-paying organization or individual, submit the tax finalization declaration dossiers to the tax authority where the individual resides.

+ In the case of resident individuals not signing labor contracts, signing labor contracts for less than 03 months, or signing service contracts with income at one or more places subject to 10% deduction, submit tax finalization declaration dossiers to the tax authority where the individual resides.

+ Resident individuals in the year with income from salaries and wages at one or more places but at the time of finalization do not work at any organization paying income, the place to submit the tax finalization declaration dossiers is the tax authority where the individual resides.

- Resident individuals with income from salaries and wages subject to directly settling personal income tax with the tax authority with dossiers requesting tax reduction due to natural disasters, fires, accidents, serious illness shall submit tax finalization dossiers to the tax authority where the individual submits tax reduction dossiers.

The tax authority processing the tax reduction dossier is responsible for processing the tax finalization dossier according to regulations.

How to determine the place to submit PIT declaration dossiers in Vietnam? (Image from the Internet)

What is the deadline for PIT declaration dossier submission in Vietnam?

Based on Section 5 of Official Dispatch 883/TCT-DNNCN 2022 the provisions are as follows:

Based on regulations at Point a, Point b Clause 2 Article 44 of the Tax Administration Law No. 38/2019/QH14 of the National Assembly stipulating the deadline for declaring and PIT declaration dossier submission as follows:

- For income paying organizations: The deadline for submitting tax finalization declaration dossiers is no later than the end of the third month from the end of the calendar year.

- For individuals directly finalizing tax: The deadline for submitting tax finalization dossiers is no later than the end of the fourth month from the end of the calendar year. In cases where individuals incur personal income tax refunds but are late in submitting tax finalization declarations as prescribed, no administrative penalty is applied for late tax finalization declaration submission.

- In cases where the tax finalization dossier submission deadline coincides with a holiday as prescribed, the deadline for submitting the tax finalization dossier is the next working day after the holiday, according to the Civil Code.

VI. RESPONSIBILITY FOR RECEIVING AND PROCESSING PIT declaration dossier OF THE TAX AUTHORITY

- The tax authority is responsible for disseminating, guiding, and urging taxpayers to perform tax finalization, and paying taxes promptly to avoid taxpayers being subject to violation handling as prescribed by law.

- To promote individuals using the electronic tax declaration service (according to guidance in document No. 535/TCT-DNNCN dated March 3, 2021, of the General Department of Taxation) and electronic tax payment for individuals on mobile devices (according to guidance in document No. 4899/TCT-CNTT dated December 14, 2021, of the General Department of Taxation on the implementation of the Tax electronic application for mobile devices (eTax Mobile 1.0)), the General Department of Taxation requests the Tax Departments/Tax Offices to further enhance the granting of electronic tax transaction accounts for individuals to facilitate taxpayers in performing tax finalization and simultaneously disseminate to individuals the benefits of using electronic tax accounts issued by the tax authority, such as: individuals filing tax finalization, paying taxes electronically (via website https://canhan.gdt.gov.vn, the “Thuế điện tử” application on smart devices) will help make individual tax finalization declaration, tax payment more convenient, faster, promptly and more efficient without individuals having to submit tax finalization documentation papers to the tax authority.

- The tax authority disseminates and guides individuals to pay taxes by electronic methods on the Tax electronic application on mobile devices as guided in Appendix II of the Electronic Tax Payment Process for Individuals, issued together with document No. 4899/TCT-CNTT dated December 14, 2021, of the General Department of Taxation.

- The tax authority organizes the reception of PIT declaration dossier according to the principle of facilitating arrangements concerning location, personnel, and dossier reception time to ensure receiving all PIT declaration dossier within the prescribed deadline.

- The Tax Authority, after accepting PIT declaration dossier, will review and process the tax finalization declaration dossiers not yet accounted on the Tax sector’s IT system; process the dossiers according to the regulations, not return the tax finalization dossiers if individuals do not request an adjustment to the tax finalization authority.

The above is guidance from the General Department of Taxation on some contents of personal income tax finalization according to the current personal income tax law. During the implementation, in case of any issues, Tax Departments are requested to report to the General Department of Taxation for prompt guidance./.

Thus, it can be seen that the latest deadline for PIT declaration dossier submission is the last day of the third month from the end of the calendar year.

What is the PIT declaration form in Vietnam in 2024?

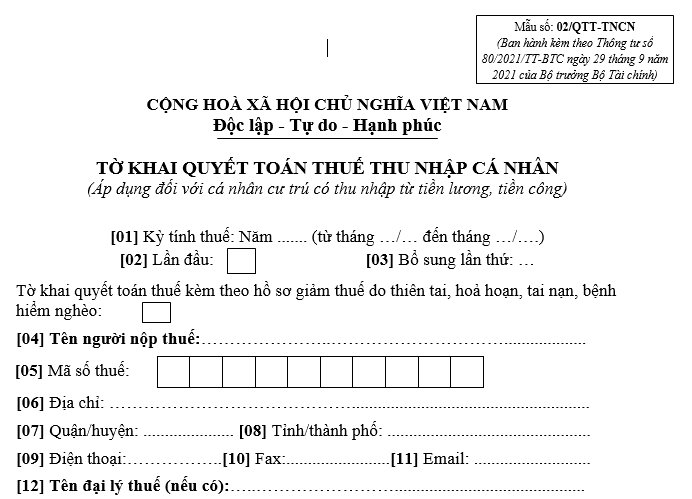

The PIT declaration Form applicable to individuals with income from salary, wages is Form 02/QTT-TNCN issued together with Circular 80/2021/TT-BTC, specifically:

>>> Download the PIT declaration Form applicable for individuals with income from salary, wages.