How to determine the Chapter for licensing fee payment in Vietnam?

How to determine the Chapter for licensing fee payment in Vietnam?

Pursuant to Clause 1, Article 2 of Circular 324/2016/TT-BTC, the Chapter is defined for classifying state budget revenue and expenditure based on the organizational system of agencies and organizations under a particular level of government (commonly referred to as the managing agency) that is organized to manage a separate budget.

Each budget level allocates a specific Chapter (Other Budget Relations) to reflect budget revenues and expenditures that are not part of the allocation for agencies and organizations.

The list of Chapter codes is detailed in Appendix I issued with Circular 324/2016/TT-BTC. The Finance Department provides guidance on accounting for Chapter codes within the local area to align with the organizational reality in the locality; and does not issue codes different from Circular 324/2016/TT-BTC.

In accordance with the provisions of Appendix I issued with Circular 324/2016/TT-BTC (amended by Circular 93/2019/TT-BTC), the 2025 licensing fee code is stipulated as follows:

(1) The Chapter code is digitized into 03 characters according to each management level:

| Management Level | Code |

| Central-level agencies | 001 - 399 |

| Provincial-level agencies | 400 - 599 |

| District-level agencies | 600 - 799 |

| Commune-level agencies | 800 - 989 |

Simply put, the licensing fee code is the business code classified by the tax management agency.

(2) The 2025 licensing fee codes are stipulated as follows:

| Chapter Code | Name | Management Level |

| 151 | Economic units with 100% foreign investment in Vietnam | Central |

| 152 | Units with foreign capital from 51% to less than 100% charter capital or have a majority of partners who are foreign individuals in a partnership company | Central |

| 153 | Vietnamese economic units with overseas investment | Central |

| 154 | Non-state mixed economy | Central |

| 158 | Mixed economic units with state capital over 50% to less than 100% charter capital | Central |

| 159 | Units with state capital up to 50% charter capital | Central |

| 160 | Other budget relations | Central |

| 161 | Main foreign contractors | Central |

| 162 | Sub-foreign contractors | Central |

| 551 | Units with 100% foreign investment in Vietnam | Provincial |

| 552 | Units with foreign capital from 51% to less than 100% charter capital or have a majority of partners who are foreign individuals in a partnership company | Provincial |

| 553 | Economic units with overseas investment | Provincial |

| 554 | Non-state mixed economy | Provincial |

| 555 | Private enterprises | Provincial |

| 556 | Cooperatives | Provincial |

| 557 | Households, individuals | Provincial |

| 558 | Mixed economic units with state capital over 50% to less than 100% charter capital | Provincial |

| 559 | Units with state capital up to 50% charter capital | Provincial |

| 560 | Other budget relations | Provincial |

| 561 | Main foreign contractors | Provincial |

| 562 | Sub-foreign contractors | Provincial |

| 563 | Local corporations management | Provincial |

| 564 | Units with state capital holding 100% charter capital (not belonging to managing agencies, Group Chapters, Corporations) | Provincial |

| 754 | Non-state mixed economy (limited liability company, joint-stock company) | District |

| 755 | Private enterprises | District |

| 756 | Cooperatives | District |

| 757 | Households, individuals | District |

| 758 | Mixed economic units with state capital over 50% to less than 100% charter capital | District |

| 759 | Units with state capital up to 50% charter capital | District |

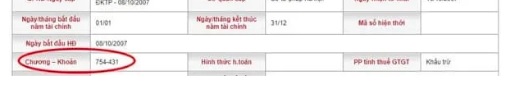

Typically, businesses will be managed by the Tax Department with licensing fee codes from 754 - 759.

How to determine the Chapter for licensing fee payment in Vietnam? (Image from the Internet)

How to look up the 2025 Chapter for licensing fee payment in Vietnam?

Below is the method to look up the 2025 Chapter for licensing fee payment:

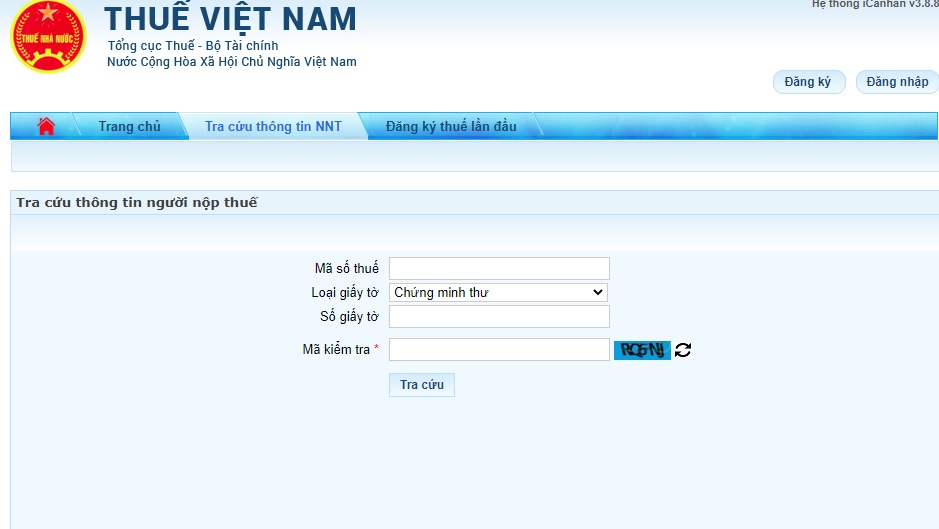

Step 1: Visit the website of the General Department of Taxation:

https://thuedientu.gdt.gov.vn

Step 2: Select the "Taxpayer Information" section >> Enter the enterprise's tax code >> Enter the verification code >> Click look up.

Step 3: Once the lookup is completed, the screen will display as shown below and includes the business code (the first three numbers of the “Chapter - Article”).

Which cases are exempt from the 2025 licensing fee in Vietnam?

According to Article 3 of Decree 139/2016/ND-CP (supplemented by Clause 1, Article 1 of Decree 22/2020/ND-CP), the cases exempt from the 2025 licensing fee include:

- Individuals, groups of individuals, households engaged in production and business activities with annual revenue of 100 million VND or less.

- Individuals, groups of individuals, households engaged in irregular production and business activities; without a fixed location according to guidance from the Ministry of Finance.

- Individuals, groups of individuals, households involved in salt production.

- Organizations, individuals, groups of individuals, households raising, catching aquatic and marine products, and fishery logistics services.

- Cultural commune postal points; press agencies (print newspapers, radio, television, electronic newspapers).

- Cooperatives, cooperative unions (including branches, representative offices, business locations) operating in the agricultural sector according to the law on agricultural cooperatives.

- People's credit funds; branches, representative offices, business locations of cooperatives, cooperative unions, and private enterprises doing business in mountainous areas. The mountainous areas are determined according to the regulations of the Ethnic Committee.

- Exemption from the licensing fee in the first year of establishment or commencement of production and business activities (from January 1 to December 31) for:

+ Newly established organizations (issued with a new tax code, new enterprise code).

+ Households, individuals, groups of individuals first commencing production, business activities.

+ During the licensing fee exemption period, if organizations, households, individuals, groups of individuals establish branches, representative offices, business locations, these entities are also exempted during the exemption period applicable to the organization, household, individual, group.

- Small and medium enterprises transitioning from business households are exempted from the licensing fee for 03 years from the date of initial enterprise registration.

+ During the exemption period, if small and medium enterprises establish branches, representative offices, business locations, these are also exempted during the exemption period applicable to the small and medium enterprises.

+ Branches, representative offices, business locations of small and medium enterprises (subject to licensing fee exemption as stipulated in Article 16 of the Law on Supporting Small and Medium Enterprises 2017) established before this Decree takes effect, the exemption time is calculated from the effective date of this Decree until the expiration of the exemption period for small and medium enterprises.

+ Small and medium enterprises transitioning from business households before this Decree takes effect implement licensing fee exemption as stipulated in Article 16 and Article 35 of the Law on Supporting Small and Medium Enterprises 2017.

- Public primary education institutions and public preschool education institutions.