How to declare personal income tax for employees working at representative offices in Vietnam?

How to declare personal income tax for employees working at representative offices in Vietnam?

According to Article 19 of Circular 80/2021/TT-BTC, the provisions are as follows:

Tax declaration, tax calculation, and allocation of personal income tax

1. Allocation cases:

a) Personal income tax withholding for income from salaries and wages paid at the headquarters for employees working at dependent units or business locations in other provinces.

b) Personal income tax withholding for winnings from computerized lottery winnings.

2. Allocation methods:

a) Allocation of personal income tax for income from salaries and wages:

Taxpayers shall separately determine the personal income tax that must be allocated for income from salaries and wages of individuals working in each province based on the actual taxes withheld for each individual. In cases where employees are transferred, rotated, or seconded, the personal income tax withheld arising shall be attributed to the province where the employee is working at the time the income is paid.

b) Allocation of personal income tax for winnings from computerized lottery winnings:

Taxpayers shall separately determine the personal income tax that must be paid for income from winnings of computerized lottery winners in each province where the individual registered to participate in the lottery draw via phone or internet distribution and the location where the computerized lottery ticket was issued via terminal distribution based on the actual taxes withheld for each individual.

3. Tax declaration, tax payment:

a) Personal income tax for income from salaries and wages:

a.1) Taxpayers paying salaries and wages to employees working at dependent units or business locations in provinces other than where the headquarters is located shall perform personal income tax withholding for income from salaries and wages according to regulations and submit tax declaration dossiers according to Form No. 05/KK-TNCN, appendix table determining the personal income tax amount payable to the localities enjoying the revenue source according to Form No. 05-1/PBT-KK-TNCN attached to Appendix II of this Circular to the directly supervisory tax authority; pay personal income tax on income from salaries and wages into the state budget for each province where the employees work as prescribed in Clause 4, Article 12 of this Circular. The personal income tax determined for each province shall be monthly or quarterly in correspondence with the personal income tax declaration period and shall not be re-determined when finalizing personal income tax.

a.2) Individuals with income from salaries and wages who are subject to direct tax declaration with the tax authority include: resident individuals with income from salaries and wages paid from abroad; non-resident individuals with income from salaries and wages arising in Vietnam but paid from abroad; individuals with income from salaries and wages paid by International organizations, Embassies, Consulates in Vietnam but have not had tax withheld; individuals receiving bonus shares from the paying entity.

b) Personal income tax for winnings from computerized lottery winnings:

The taxpayer being the organization paying income shall withhold personal income tax for income from winnings of computerized lottery winners, perform personal income tax declaration according to regulations, submit tax declaration dossiers according to Form No. 06/TNCN, appendix table determining the personal income tax amount payable to the localities enjoying the revenue source according to Form No. 05-1/PBT-KK-TNCN attached to Appendix II of this Circular to the directly supervisory tax authority; pay personal income tax on winnings into the state budget for each province where the individual registered to participate in the lottery draw via phone or internet distribution and the location where the computerized lottery ticket was issued via terminal distribution as prescribed in Clause 4, Article 12 of this Circular."

In cases where enterprises establish branches, representative offices, or business locations in provinces different from where the taxpayer is headquartered and the enterprise pays employees working at these branches, representative offices, or business locations collectively, the enterprise must:

- Withhold and declare PIT from salaries and wages centrally at the headquarters- Prepare a tax allocation table for the localities where employees are working- Submit tax declaration dossiers and allocation tables to the tax authority managing the headquarters directly.

Thus, it can be seen that enterprises can pay personal income tax for employees working at representative offices. At this time, the enterprise submits the tax declaration dossiers to the tax authority managing the enterprise directly and allocates the tax, pays money into the state budget for the place where employees work at the representative office.

How to declare personal income tax for employees working at representative offices in Vietnam? (Image from the Internet)

Vietnam: What documents do the personal income tax finalization dossiers for new enterprises include?

According to sub-item 1, Section 4 Official Dispatch 636/TCT-DNNCN of 2021, the personal income tax finalization dossiers for new enterprises include the following documents:

[1] Tax finalization declaration form No. 05/QTT-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC. (Download)

[2] Appendix detailing individuals subject to tax calculus according to the progressive tax schedule Form No. 05-1/BK-QTT-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC. (Download)

[3] Appendix detailing individuals subject to tax calculus according to full rate tax Form No. 05-2/BK-QTT-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC. (Download)

[4] Appendix detailing dependents for family circumstance deduction Form No. 05-3/BK-QTT-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC. (Download)

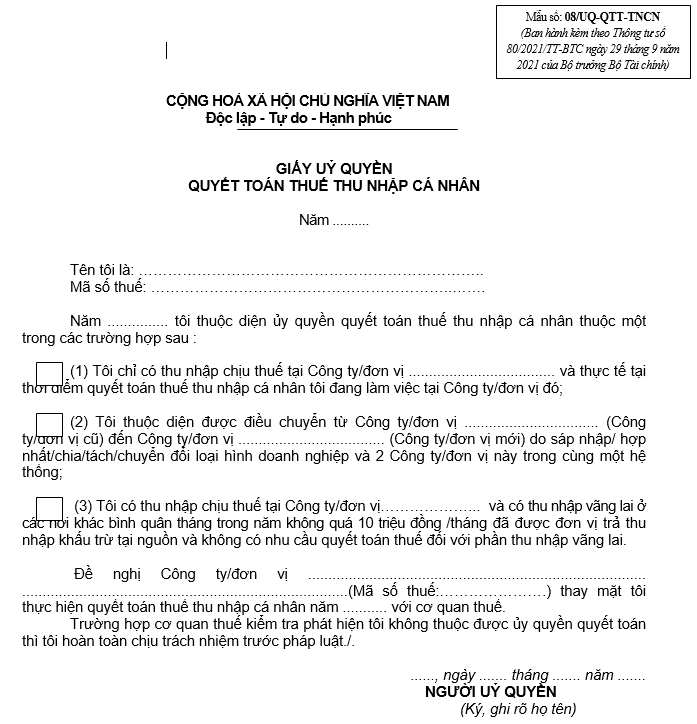

* Note: Individuals authorizing income-paying organizations to finalize tax on their behalf must

Individuals shall prepare a Personal Income Tax Finalization Authorization Letter for the 2023 tax period according to Form No. 08/UQ-QTT-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC. (Download)

What is the form of authorization for personal income tax finalization in Vietnam?

Currently, the form of authorization for personal income tax finalization 2024 is Form 08/UQ-QTT-TNCN, Appendix II, issued together with Circular 80/2021/TT-BTC. Form 08/UQ-QTT-TNCN is as follows:

Download Form 08/UQ-QTT-TNCN here