How to confirm the residence status of an individual in Vietnam?

How to confirm the residence status of an individual in Vietnam?

Based on subsection 2 of Section 2 of the Administrative Procedures issued together with Decision 2780/QD-BTC in 2023, the procedure for confirming the residence status of an individual in Vietnam is as follows:

- Procedure:

+ Step 1. Organizations or individuals requesting confirmation as a tax resident of Vietnam, as stipulated in the Tax Agreement, prepare the application dossier and submit it to the Tax Department where the taxpayer is registered.

+ Step 2. Tax authority reception:

++ In cases where the dossier is submitted directly at the tax authority or sent via postal service: the tax authority shall receive, process the dossier, and return the results as stipulated.

++ In cases where the dossier is submitted to the tax authority through electronic transactions, the reception, inspection, approval, and processing of the dossier will occur through the tax authority's electronic data processing system.

- Methods of submission:

+ Direct submission at the tax authority’s headquarters;

+ Submission via postal service;

+ Submission via electronic dossier through the tax authority’s electronic transaction portal.

How to confirm residence status of an individual in Vietnam? (Image from the Internet)

When do foreigners need to confirm the tax paid in Vietnam?

Based on Article 70 of Circular 80/2021/TT-BTC, it is stipulated as follows:

Confirmation of tax obligation fulfillment

...

2. Confirmation of tax paid in Vietnam for foreign residents:

In case a resident of a country that has signed a Tax Agreement with Vietnam must pay income tax in Vietnam as per the agreement and Vietnamese tax law, and wishes to confirm the tax paid in Vietnam for deduction from the tax payable in their country of residence, the following procedures must be followed:

a) If the taxpayer requests confirmation of tax paid in Vietnam, the application must be sent to the Tax Department of the province or city directly under the Central Government where the tax is registered. The dossier includes:

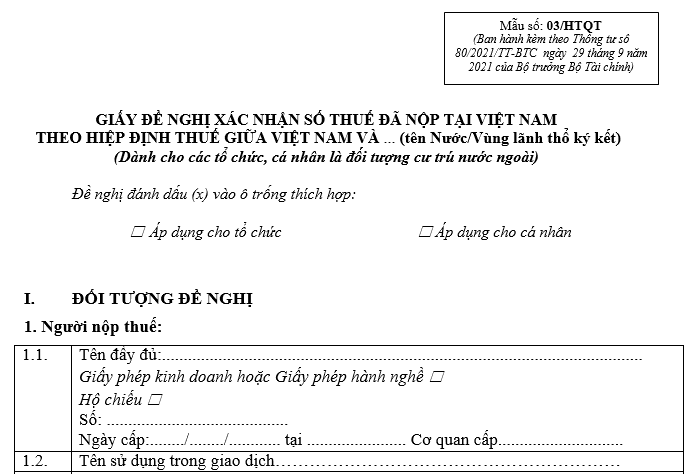

a.1) A request for confirmation of the tax paid in Vietnam according to the Tax Agreement, using Form 03/HTQT issued with Appendix I of this Circular, providing information on transactions related to taxable income and the tax arising therefrom within the scope of the Tax Agreement;

a.2) Original (or certified copy) of the Certificate of Residency from the country of residence, issued by the tax authority (stating the residence status during which tax period), legalized for consular purposes;

a.3) Power of attorney in cases where the taxpayer authorizes a legal representative to perform the procedures related to applying the Tax Agreement.

Within 07 working days from receipt of the dossier, the Tax Department where the entity is registered is responsible for issuing a certificate of the income tax paid in Vietnam using Form 04/HTQT or Form 05/HTQT issued with Appendix I of this Circular. Form 04/HTQT is used for confirmation of personal income tax and corporate income tax; Form 05/HTQT is used for confirmation of dividend income tax, loan interest tax, royalty, or technical service fee tax.

During the process of processing the dossier, if there is a lack of information requiring explanation or additional documents, the tax authority will issue a Notice of Explanation or Supplement of Information and Documents using Form 01/TB-BSTT-NNT issued with Decree 126/2020/ND-CP to the taxpayer to request explanation or supplement of information, documents.

Within 10 working days from the date the tax authority issues the Notice, the taxpayer is responsible for submitting a written explanation or supplementing the information, documents as requested by the tax authority.

...

Thus, foreigners who are citizens of a country that has signed a Tax Agreement with Vietnam and who are required to pay income tax in Vietnam according to the Agreement and Vietnamese tax law, and who wish to confirm the tax paid in Vietnam for deduction from the tax payable in their country of residence, need to carry out the procedure for confirming the fulfillment of tax obligations.

What is the form for requesting confirmation of tax paid in Vietnam for foreign residents?

The form for requesting confirmation of tax paid in Vietnam for foreign residents is Form 03/HTQT included in Appendix I, issued with Circular 80/2021/TT-BTC. To be specific:

Download Form 03/HTQT Request for Confirmation of Tax Paid in Vietnam for Foreign Residents: Here