What are the instructions for completing the taxpayer registration form made in Form 01-DK-TCT in Vietnam?

What is the taxpayer registration form - Form 01-DK-TCT in Vietnam about?

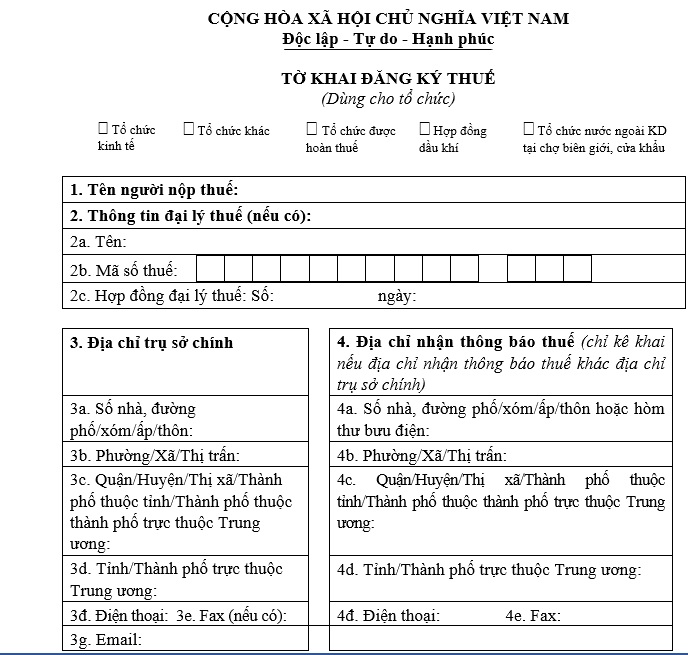

The taxpayer registration form - Form 01-DK-TCT issued along with Circular 105/2020/TT-BTC is as follows:

>> Download the taxpayer registration form - Form 01-DK-TCT: Download

The taxpayer registration form - Form 01-DK-TCT applies to organizations.

What is the taxpayer registration form - Form 01-DK-TCT in Vietnam about? (Image from the Internet)

What are the instructions for completing the taxpayer registration form made in Form 01-DK-TCT in Vietnam?

According to the Appendix issued along with Circular 105/2020/TT-BTC, the instructions for completing the taxpayer registration form made in Form 01-DK-TCT are as follows:

[1] Taxpayer's name: Clearly and fully write in capital letters the name of the organization according to the Establishment Decision or Establishment and Operation License or equivalent document issued by the competent authority (for Vietnamese organizations) or the Business Registration Certificate (for organizations from countries sharing a land border with Vietnam engaged in business activities at border markets, border gate markets, markets in economic zones at border gates in Vietnam).

[2] Tax agent information: Fully write the information of the tax agent if a tax agent has been contracted to handle taxpayer registration procedures on behalf of the taxpayer by the Tax Administration Law.

[3] Principal place of business address: Clearly write the house number, alley, lane, street/village/hamlet, commune/ward, district/town/provincial city, province/city of the taxpayer. If there is a telephone number, or fax number, write clearly with the area code - telephone/fax number according to the address information as follows:

- Address of the principal place of business of the organization.

- Address of business locations in border markets, border gate markets, and economic zone border markets for organizations from countries sharing a land border with Vietnam.

- Address where oil and gas exploration and exploitation activities take place, for petroleum contracts.

- The taxpayer must fully and accurately declare email information. This email address will be used as an electronic transaction account with the tax authority for electronic taxpayer registration records.

[4] Tax notice address: If the taxpayer is an organization with a different address for receiving tax notices from the main address listed in item 3 above, clearly state the tax notice receiving address so the tax authority can contact them.

[5] Establishment decision:

- For taxpayers who are organizations with an establishment decision: Clearly state the decision number, the issuance date of the decision, and the issuing authority.

- For petroleum contracts: Clearly state the contract number, and signing date, and leave the issuing authority field blank.

[6] Business registration certificate/Establishment and operation license or equivalent document issued by the competent authority: Clearly state the number, issuance date, and issuing authority for the Business Registration Certificate from the country sharing a border with Vietnam (for organizations from countries sharing a land border with Vietnam that engage in business activities at border markets, border gate markets, markets in economic zones at border gates in Vietnam), or the Establishment and Operation License or equivalent document issued by the competent authority (for Vietnamese organizations).

For the information "issuing authority" for the Business Registration Certificate, state the name of the country sharing a land border with Vietnam that issued it (Laos, Cambodia, China).

[7] Main business activities: Write according to the business activities on the Establishment and Operation License or equivalent document issued by the competent authority (for Vietnamese organizations) and the Business Registration Certificate (for organizations from countries sharing a land border with Vietnam that engage in business activities at border markets, border gate markets, economic zone border markets in Vietnam).

Note: Only list one primary business activity actually being carried out.

[8] Charter capital:

- For taxpayers who are a Limited Liability Company, Joint-Stock Company, Partnership Company: State according to the charter capital on the Establishment and Operation License or equivalent document issued by the competent authority, or the capital mentioned in the Establishment Decision (specify the currency, categorize the capital by ownership, and the proportion of each type of capital in the total capital).

- For taxpayers who are sole proprietorships: State according to the investment capital on the Establishment and Operation License or equivalent document issued by the competent authority (specify the currency).

- For organizations from countries sharing a land border with Vietnam and other organizations: If the Establishment Decision, Business Registration Certificate, etc., includes capital, state it. If not, leave this information blank.

[9] Date of commencement of activities: State the actual start date of operations if it differs from the tax identification number issuance date.

[10] Economic type: Mark an "X" in one of the corresponding boxes.

[11] Accounting method for business results: Mark an "X" in one of the two boxes, either independent or dependent. If selecting the “independent” box, also mark “with consolidated financial statements” if required to submit consolidated financial statements to the tax authority.

[12] Financial year: Clearly state the date, month of the starting fiscal period to the date, month of the ending fiscal period as per the calendar year or the taxpayer's financial year.

[13] Information about the supervising unit or direct management unit: Clearly state the name, tax identification number of the direct supervising unit managing the taxpayer organization.

[14] Information about the legal representative/owner of a sole proprietorship: Declare detailed information about the legal representative of the taxpayer organization (for economic organizations and other organizations except for sole proprietorships) or the information of the sole proprietorship owner.

[15] VAT calculation method: Mark an "X" in one of the boxes for this item.

[16] Information about related entities:

- If the taxpayer has subsidiary companies or member companies, mark an "X" in the “Has subsidiary companies, member companies” box, then declare in the "List of subsidiaries, member companies” form BK01-DK-TCT.

- If the taxpayer has dependent units, mark an "X" in the “Has dependent units” box, then declare in the "List of dependent units” form BK02-DK-TCT.

- If the taxpayer has business locations, and dependent warehouses without business functions, mark an "X" in the “Has business locations, dependent warehouses” box, then declare in the "List of business locations” form BK03-DK-TCT.

- If the taxpayer has foreign contractors or foreign subcontractors, mark an "X" in the “Has foreign contractors, foreign subcontractors” box, then declare in the "List of foreign contractors, foreign subcontractors” form BK04-DK-TCT.

- If the taxpayer has oil and gas contractors or investors, mark an "X" in the “Has oil and gas contractors, investors” box, then declare in the "List of oil and gas contractors, investors” form BK05-DK-TCT (for petroleum contracts).

[17] Other information: Clearly state the full name, personal tax identification number, contact phone number, email of the General Director or Director and Chief Accountant of the taxpayer.

[18] Status before the reorganization of economic organizations (if any): If the taxpayer is registering due to the reorganization of a previous economic organization, mark an "X" in one of the cases: merger, consolidation, division, or separation, and clearly state the previously issued tax identification numbers of the organizations being merged, consolidated, divided, separated.

[19] Signature of the taxpayer or the legal representative of the taxpayer: The taxpayer or the legal representative of the taxpayer must sign and clearly write their name in this section.

[20] Taxpayer's seal:

In cases where the taxpayer has a seal at the time of taxpayer registration, they must affix the seal in this section. In cases where the taxpayer does not have a seal at the time of taxpayer registration, affixing the seal on the tax declaration form is not yet required. When the taxpayer comes to receive the result, the seal must be added for the tax authority.

In cases where the taxpayer falls under the taxpayer registration regulations in point d, clause 2, Article 4 of Circular 105/2020/TT-BTC without a seal, affixing the seal in this section is not required.

[21] Tax agent staff: If the tax agent declares on behalf of the taxpayer, declare in this information.

What is the structure of the tax identification number in Vietnam?

Under Article 5 of Circular 105/2020/TT-BTC, the structure of the tax identification number is as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

Where:

- The first two digits N1N2 indicate the province that issues TINs

- Seven digits N3N4N5N6N7N8N9 are formed in a definite element in ascending order from 0000001 to 9999999.

- N10 is the check digit.

- Three digits N11N12N13 are formed in ascending order from 001 to 999.

- A dash (-) is used to separate the first 10-digit element and the last 3-digit element.

Furthermore, a business identification number, cooperatives identification number, and identification number of affiliated entity of enterprise or cooperative that is issued in accordance with the law on the registration of enterprises or cooperatives is also a taxpayer identification number.