How many tax identification numbers does each individual have in Vietnam?

What is a tax identification number in Vietnam?

According to Clause 5, Article 3 of the Tax Administration Law 2019, a tax identification number (TIN) is a string of 10 digits or 13 digits and other characters issued by the tax authority to taxpayers for tax management purposes.

Additionally, pursuant to Point a, Clause 2, Article 30 of the Tax Administration Law 2019, a 10-digit TIN is used for businesses, legal entities, representatives of households, household businesses, and other individuals.

Thus, a TIN is a string of 10 digits issued by the tax authority to taxpayers for tax management purposes.

How many TINs does each individual have in Vietnam? (Image from the internet)

How many TINs does each individual have in Vietnam?

According to Clause 3, Article 30 of the Tax Administration Law 2019, it is stipulated as follows:

Subjects of taxpayer registration and issuance of TINs

...

3. The issuance of TINs is regulated as follows:

a) Businesses, economic organizations, and other organizations are issued with one unique TIN to use throughout their operational process from taxpayer registration to the termination of the TIN’s validity. Taxpayers with branches, representative offices, and directly dependent units that perform tax obligations will be issued with dependent TINs. In cases where businesses, organizations, branches, representative offices, and dependent units perform taxpayer registration under the one-stop interlinked mechanism along with business registration, cooperative registration, and business registration, the code on the business registration certificate, cooperative registration certificate, and business registration certificate will simultaneously be the TIN;

b) Individuals are issued with one unique TIN to use for their entire lifetime. Dependents of the individual will be issued with a TIN for family deduction purposes for the individual taxpayer's personal income tax. The TIN issued for the dependent will also be the individual’s TIN if the dependent incurs obligations with the state budget;

c) Businesses, organizations, and individuals responsible for withholding and paying tax on behalf of others will be issued with a substitute TIN to declare and pay tax on behalf of the taxpayers;

d) A TIN issued cannot be reused for issuing to other taxpayers;

đ) The TIN of businesses, economic organizations, and other organizations will be maintained after any transformation, sale, transfer, donation, or inheritance;

e) The TIN issued to households, household businesses, and individual business owners is the TIN of the household representative or the business individual.

...

Thus, each individual is only issued with one unique TIN.

What are the uses of TINs in Vietnam?

According to Article 35 of the Tax Administration Law 2019, regulations on the use of the TIN are as follows:

- Taxpayers must record the issued TIN on invoices, documents, and materials when conducting business transactions; opening deposit accounts at commercial banks and other credit organizations; declaring taxes, paying taxes, exempting from taxes, reducing taxes, refunding taxes, non-collection of taxes, registering customs declarations, and performing other tax-related transactions for all obligations payable to the state budget, including cases where taxpayers conduct production or business activities in various locations.

- Taxpayers must provide the TIN to relevant agencies, organizations, or record the TIN on files when implementing administrative procedures under the one-stop interlinked mechanism with tax management agencies.

- Tax management agencies, State Treasury, commercial banks, and institutions authorized by tax agencies for tax collection use the taxpayer’s TIN for tax management and tax collection into the state budget.

- Commercial banks and other credit institutions must record the TIN on account opening files and transaction documents via the taxpayer’s account.

- Other organizations and individuals involved in tax management use the issued taxpayer's TIN when providing information related to tax obligations determination.

- When Vietnamese parties pay to organizations or individuals conducting cross-border business activities via a digital intermediary platform that does not have a physical presence in Vietnam, they must use the issued TIN for these organizations or individuals to withhold and pay the tax on their behalf.

- When a personal identification number is issued to all residents, it will be used in place of the TIN.

Guide to lookup TINs in Vietnam

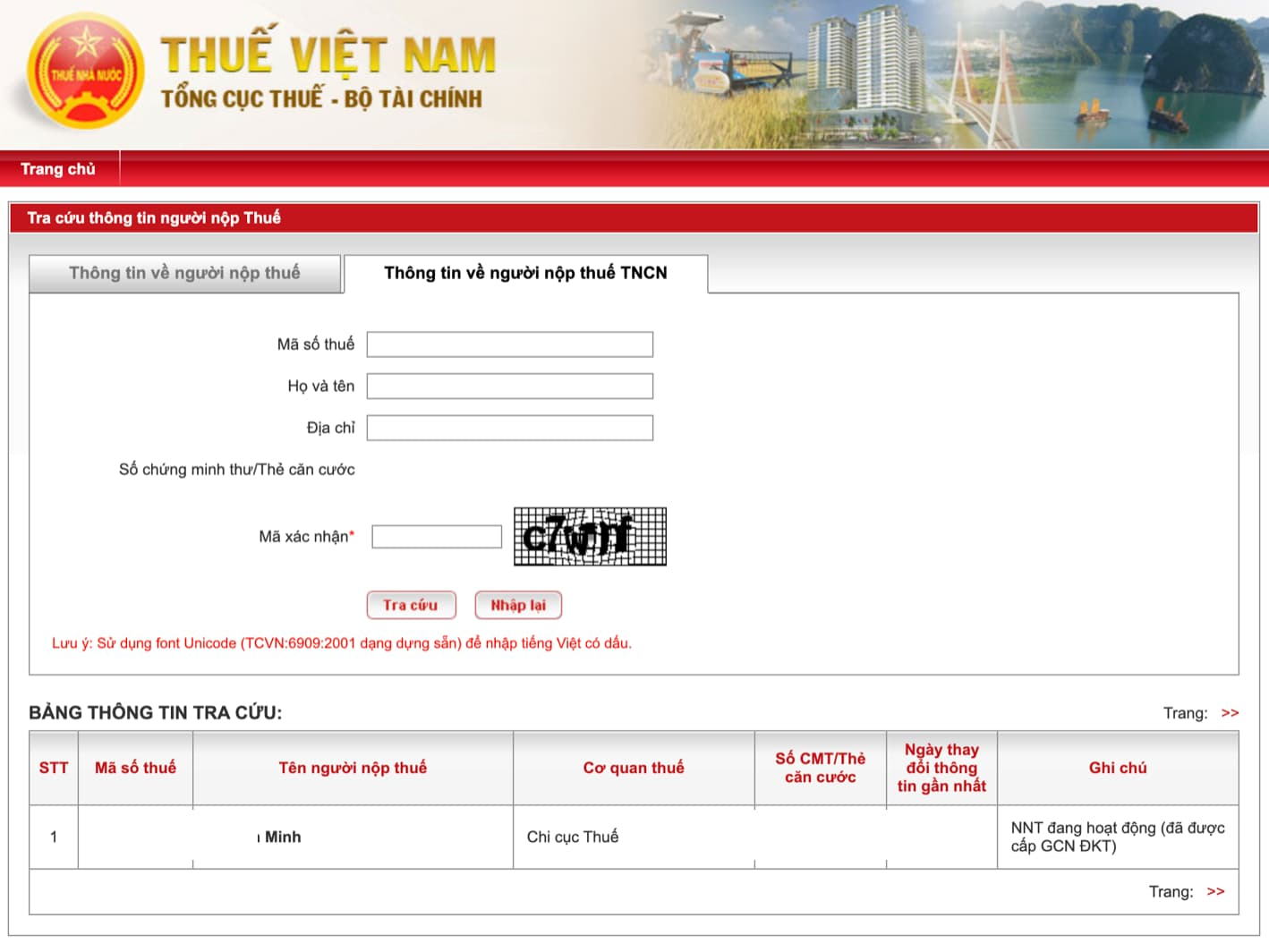

Below is a detailed guide for looking up TINs on the General Department of Taxation's electronic portal.

Step 1: Visit https://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

Step 2: Enter one of the following details:

- TIN

- Full name

- Address

- Identity card/Personal identification card number

Enter the verification code and search.

Step 3: Click on the taxpayer’s name to view details and verify the taxpayer’s information.