How many days are there in February 2025? What is the deadline for submitting the VAT declaration for February 2025 in Vietnam?

How many days are there in February 2025?

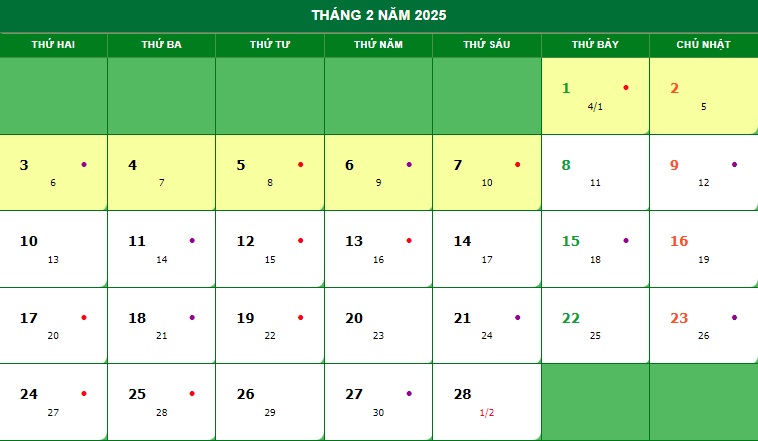

February 2025 has 28 days because the year 2025 is not a leap year. To be specific, as shown in the image below:

Lunar and Solar Calendar February 2025

Information for reference purposes only!

How many days are there in February 2025? What is the deadline for submitting the VAT declaration for February 2025 in Vietnam? (Image from Internet)

What is the deadline for submitting the VAT declaration for February 2025 in Vietnam?

According to Clause 1 Article 44 of the Law on Tax Administration 2019, the deadline for submitting tax declaration dossiers is stipulated as follows:

Deadline for submitting tax declaration dossiers

- The deadline for submitting tax declaration dossiers for taxes declared monthly or quarterly is regulated as follows:

a) No later than the 20th day of the month following the month in which the tax liability arises for cases of monthly declaration and payment;

b) No later than the last day of the first month of the following quarter for cases of quarterly declaration and payment.

...

Accordingly, the deadline for submitting the monthly VAT declaration is no later than the 20th day of the following month in which the tax liability arises.

Thus, the deadline for submitting the VAT declaration for February 2025 is Thursday, March 20, 2025.

When should the VAT declaration be submitted monthly in Vietnam?

According to Point a Clause 1 Article 8 of Decree 126/2020/ND-CP:

Types of taxes declared monthly, quarterly, annually, each time a tax liability arises and tax settlement declaration

- Taxes and other collections managed by the tax authorities are subject to monthly declarations, including:

a) Value-added tax, personal income tax. Taxpayers who meet the criteria specified in Article 9 of this Decree may choose to declare on a quarterly basis.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, excluding the resource tax specified at Point e of this Clause.

đ) Fees and charges belonging to the state budget (excluding fees and charges collected by the representative offices of the Socialist Republic of Vietnam abroad as regulated in Article 12 of this Decree; customs fees; transit goods, baggage, and vehicle fees).

...

Referring to the provision at Point a Clause 1 Article 9 of Decree 126/2020/ND-CP:

Criteria for quarterly declaration of VAT and personal income tax

- Criteria for quarterly tax declaration

a) Quarterly VAT declaration applies to:

a.1) Taxpayers subject to monthly VAT declaration as stipulated in Point a Clause 1 Article 8 of this Decree, if their total sales revenue and service provision revenue of the preceding year is 50 billion VND or less, they may declare VAT quarterly. Sales revenue and service provision revenue is determined as the total revenue on VAT declarations of the tax periods in the calendar year.

If taxpayers implement concentrated tax declaration at their headquarters for dependent units or business locations, the sales revenue and service provision revenue includes the revenue of dependent units and business locations.

a.2) Taxpayers newly commencing operations or businesses may choose to declare VAT quarterly. After completing 12 months of production and business, from the subsequent calendar year, the revenue level of the previous full calendar year will be used as the basis to declare VAT on a monthly or quarterly tax period.

...

Thus, generally, taxpayers must submit the VAT declaration monthly, unless they meet the criteria below, allowing them to choose to declare and submit VAT declarations quarterly:

- If the total sales revenue and service provision revenue of the previous year is 50 billion VND or less.

- In the case of new business activities. After completing 12 months of production and business, from the subsequent calendar year, the revenue level of the previous full calendar year will be used as the basis for VAT declaration on a monthly or quarterly tax period.

What are the penalties for late submission of the VAT declaration in Vietnam?

According to Article 13 of Decree 125/2020/ND-CP, penalties for late submission of the VAT declaration are stipulated as follows:

(1) A warning penalty applies for late submission of the VAT declaration from 01 to 05 days with mitigating circumstances.

(2) A monetary penalty from 2,000,000 VND to 5,000,000 VND applies for late submission of the VAT declaration from 01 to 30 days, excluding cases stipulated in clause 1 Article 13 of Decree 125/2020/ND-CP.

(3) A monetary penalty from 5,000,000 VND to 8,000,000 VND applies for late submission of the VAT declaration from 31 to 60 days.

(4) A monetary penalty from 8,000,000 VND to 15,000,000 VND applies for the following acts:

- Late submission of the VAT declaration from 61 to 90 days;

- Late submission of the VAT declaration from 91 days or more but with no tax payable;

- Non-submission of the VAT declaration but with no tax payable;

(5) A monetary penalty from 15,000,000 VND to 25,000,000 VND applies for late submission of the VAT declaration over 90 days from the deadline, with tax payable, provided the taxpayer has paid the full tax amount and late payment interest into the state budget before the tax authority announces a decision to inspect or audit the tax or before the tax authority draws up a record for late submission of the tax declaration dossier as stipulated in Clause 11 Article 143 of the Law on Tax Administration 2019.

If the penalty amount as per this clause exceeds the payable tax amount on the tax declaration dossier, the maximum penalty shall be equal to the payable tax amount but not less than the average of the fine frame stipulated in Clause 4 Article 13 of Decree 125/2020/ND-CP.

Additionally, individuals who engage in such violations must take corrective measures:

- Be required to pay enough late payment interest to the state budget for violations stipulated in Clauses 1, 2, 3, 4, and 5 Article 13 of Decree 125/2020/ND-CP, in the event that the taxpayer's delayed submission of the VAT declaration leads to late tax payment.

- Be required to submit outstanding tax declaration dossiers and supplementary attachments for violations listed in Points c, d Clause 4 Article 13 of Decree 125/2020/ND-CP.

Note: The aforementioned monetary penalties for late submission of the VAT declaration apply to violations committed by organizations. For individuals committing similar violations, the monetary penalty is half the penalty for organizations (according to Clause 5 Article 5 of Decree 125/2020/ND-CP).