How long does it take for the tax authority to respond when a taxpayer amends or supplements e-transaction information in Vietnam?

How long does it take for the tax authority to respond when a taxpayer amends or supplements e-transaction information in Vietnam?

Pursuant to Article 11 of Circular 19/2021/TT-BTC, regulations on registering for amendments or supplements in e-transaction information are as follows:

- Taxpayers who have been granted an e-tax transaction account as stipulated in Article 10 of Circular 19/2021/TT-BTC, if they change or supplement information registered for e-tax transactions with the tax authority, are responsible for promptly updating complete information as soon as changes occur.

Taxpayers must access the General Department of Taxation's e-portal to update, change, and supplement information registered for e-tax transactions with the tax authority (using form 02/DK-TDT (Download) issued with Circular 19/2021/TT-BTC), sign electronically, and submit to the tax authority.

No later than 15 minutes after receiving the taxpayer's change or supplementary information, the General Department of Taxation's portal sends a notification (using form 03/TB-TDT issued with Circular 19/2021/TT-BTC) regarding acceptance or non-acceptance of the registration change or supplement information to the taxpayer.

- Taxpayers already registered for transactions with the tax authority electronically via the e-portal of competent state authority should follow the regulations of the competent state authority when changing or supplementing registered information.

- Taxpayers granted an e-tax transaction account via T-VAN service providers as per Article 42 of Circular 19/2021/TT-BTC, if they change or supplement registered e-tax transaction information, shall comply with the regulations in Article 43 of the Circular.

- For amendments or supplements regarding transaction accounts at banks or intermediary payment service providers for e-tax payments, taxpayers should register with the bank or intermediary payment service provider where the taxpayer has an account according to Clause 5, Article 10 of Circular 19/2021/TT-BTC.

- Taxpayers registering to change the e-tax transaction method must comply with Clause 4, Article 4 of Circular 19/2021/TT-BTC and Article 11 of the Circular.

Thus, according to the regulation, after taxpayers change or supplement e-transaction information, the tax authority responds regarding acceptance or non-acceptance of the registration change or supplement information no later than 15 minutes after receiving such information.

How long does it take for the tax authority to respond when a taxpayer amends or supplements e-transaction information in Vietnam? (Image from the Internet)

If there are errors in the application for amendments to taxpayer registration information in Vietnam, must the taxpayer submit another application?

Based on Clause 3, Article 13 of Circular 19/2021/TT-BTC, regulations regarding the receipt of applications and returning results of e-taxpayer registration directly with the tax authority are as follows:

- Applications for amendments to taxpayer registration information that do not require result submission to the taxpayer:

+ Taxpayers rely on the regulations regarding applications, deadlines for submitting applications, and locations to submit applications in the Tax Administration Law 2019, Decree 126/2020/ND-CP, and Circular 105/2020/TT-BTC to prepare and send applications to the tax authority as stipulated in Point a, Clause 5, Article 4 of Circular 19/2021/TT-BTC.

+ The General Department of Taxation's portal receives, checks, and sends a receipt notification of e-taxpayer registration applications (using form 01-1/TB-TDT issued with Circular 19/2021/TT-BTC) to the taxpayer no later than 15 minutes after receiving the e-application from the taxpayer.

+ If the e-application is complete according to regulations, the tax authority updates the changed information within the time limit stipulated in Circular 105/2020/TT-BTC.

+ If the e-application is incomplete according to regulations, within 2 working days from the date stated on the notification of receipt of the e-taxpayer registration application, the tax authority sends a notice of non-acceptance of the application (using form 01-2/TB-TDT issued with Circular 19/2021/TT-BTC) to the taxpayer as per Clause 2, Article 5 of the Circular.

Taxpayers are responsible for sending another e-application via the e-portal they choose to replace the incorrect application previously sent to the tax authority.

Thus, it is evident that sending another application is the taxpayer's responsibility to replace the incorrect application previously sent to the tax authority.

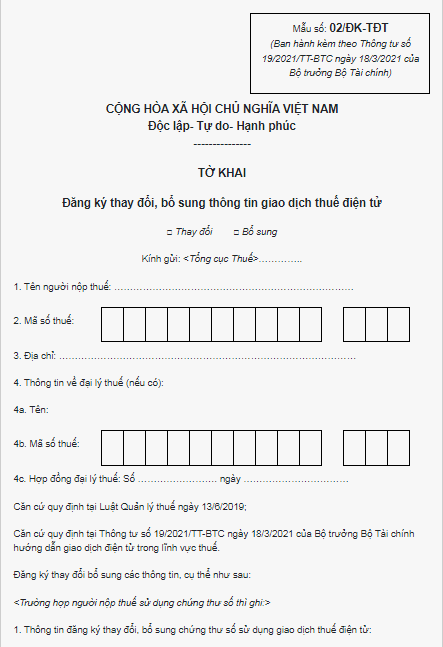

What is Form 02/DK-TDT for registering amendments and supplements to e-tax transaction information in Vietnam?

Based on the list of forms issued with Circular 19/2021/TT-BTC, the declaration form for registering amendments or supplements to e-tax transaction information will be Form 02/DK-TDT as follows:

*Note: When filling out Form 02/DK-TDT, the taxpayer is responsible for the legality, completeness, and accuracy of the registered information and commits to receiving and responding to information related to e-transactions with the tax authority;

Comply with decisions, notifications, and requests from the tax authority sent to the registered email address and the taxpayer’s e-transaction account on the General Department of Taxation's e-portal and manage, use the e-transaction account in the tax field granted by the tax authority according to legal regulations and guidance from the tax authority.

Download Form 02/DK-TDT declaration form for registering amendments and supplements to e-tax transaction information, latest version.