Guidance on the implementation of environmental protection tax declaration procedures for petroleum trading activities in Vietnam

What are procedures for environmental protection tax declaration for petroleum trading activities in Vietnam?

According to Subsection 21, Section 2, Administrative Procedures issued together with Decision 1462/QD-BTC in 2022, the procedures for declaring environmental protection tax for petroleum trading activities are as follows:

Step 1: Taxpayers prepare data, fill out the tax returns, and submit them to the tax authorities no later than the 20th of the month following the arising month. To be specific:

- Key traders directly importing, producing, blending petroleum submit tax declaration dossiers to the tax authorities directly managing the quantities of petroleum directly exported or sold by key traders, including exports for internal consumption, exports for exchanging other goods, exports for returning entrusted imports, sales to other organizations, or individuals not being dependent units or subsidiaries as stipulated in the Enterprise Law of key traders; excluding quantities of petroleum sold and entrusted imports for key traders.

- Subsidiaries as stipulated in the Enterprise Law of key traders or dependent units of subsidiaries, dependent units of key traders submit tax declaration dossiers to the tax authorities directly managing the quantities of petroleum exported or sold to organizations or individuals not being subsidiaries or dependent units as stipulated in the Enterprise Law of key traders and dependent units of subsidiaries.

+ Key traders or subsidiaries as stipulated in the Enterprise Law of key traders having dependent units operating in provinces or cities different from the place where the key traders or subsidiaries are headquartered, where the dependent units do not handle separate accounting for environmental protection tax declaration, then key traders or subsidiaries of key traders file environmental protection tax to the directly managing tax authorities; calculate tax and allocate tax liability to each locality where the dependent units are headquartered as prescribed by the Minister of Finance.

Step 2: Tax authorities receive:

- The tax authority receives the tax declaration dossier, and issues a notice of receipt of the tax declaration dossier; in case the dossier is illegal, incomplete, or not in the prescribed form, notify the taxpayer within 03 working days from the date of receipt of the dossier.

- In case of receiving dossiers via the online portal of the General Department of Taxation, the tax authorities shall receive, check, and handle the dossiers through the electronic data processing system of the tax authorities:

+ The online portal of the General Department of Taxation sends a receipt notification of the taxpayer's submission or a notice of reasons for not accepting the dossier to the taxpayer via the online portal chosen by the taxpayer for filing and submitting the dossier (the online portal of the General Department of Taxation/state agency with authority or a T-VAN service provider organization) no later than 15 minutes from the receipt of the taxpayer's electronic tax declaration dossier.

+ The tax authority issues a notice of acceptance/rejection of the tax declaration dossier to the online portal chosen by the taxpayer to file and submit the dossier no later than 01 working day from the date stated on the receipt notification of the tax declaration dossier.

Guidance on the implementation of environmental protection tax declaration procedures for petroleum trading activities in Vietnam (Image from the Internet)

What are methods for environmental protection tax declaration in Vietnam?

Based on Subsection 21, Section 2, Administrative Procedures issued together with Decision 1462/QD-BTC in 2022, taxpayers can declare environmental protection tax in the following three methods:

- Submit directly at the headquarters of the tax authorities.

- Send via the postal system.

- Send electronic dossiers to the tax authorities through electronic transactions (online portal of the General Department of Taxation/state agency with authority or a T-VAN service provider organization).

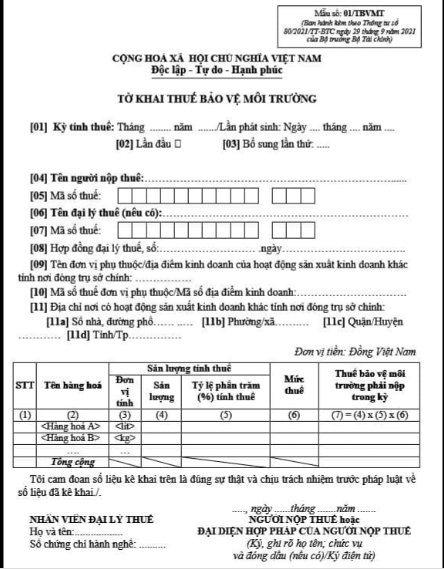

What is the latest environmental protection tax return form in Vietnam?

The latest environmental protection tax return form is Form 01/TBVMT issued together with Circular 80/2021/TT-BTC as follows:

>> Download the latest Environmental Protection Tax Return Form

>> Download the list of environmental protection activities eligible for incentives and support.