Guidance on filling out the appendix for VAT reduction in Vietnam under Resolution 142/2024/QH15 on the HTKK software

Guidance on filling out the appendix for VAT reduction in Vietnam under Resolution 142/2024/QH15

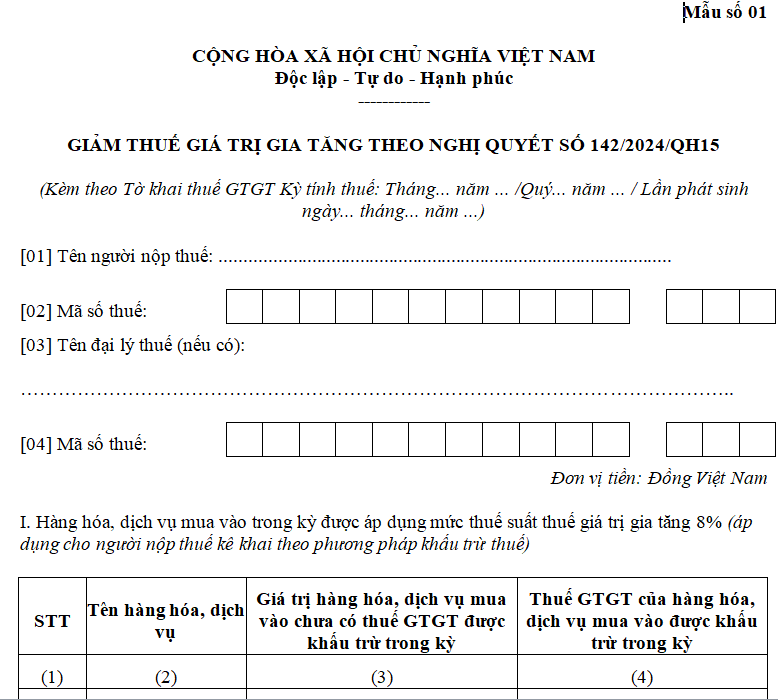

Currently, the VAT reduction appendix form under Resolution 142/2024/QH15 on the HTKK software version 5.2.3 consists of three sections:

Section 1: This section is for goods or services purchased with a tax rate of 8% (applicable for taxpayers declaring according to the tax credit method):

Name of goods, services (2): Enter the name of the goods or services purchased during the period eligible for a VAT rate of 8%.

Value of goods, services purchased without deductible VAT during the period (3): Enter the value of goods or services purchased excluding deductible VAT during the period.

Deductible VAT of goods, services purchased during the period (4): After entering the name of goods or services eligible for a tax reduction and the pre-tax price into columns (2) and (3), the HTKK software will automatically calculate the VAT amount with a rate of 8% in column (4).

Section 2: This section is for goods or services sold during the tax declaration period.

Name of goods, services (2): Enter the name of goods or services sold during the period with a VAT rate of 8%.

Value of goods, services without VAT (3): Enter the value of goods or services sold excluding VAT.

Statutory VAT rate (4): The tax rate of goods or services before applying the VAT reduction according to Resolution 142/2024/QH15 (10%).

VAT rate after reduction (5): The tax rate of goods or services after applying the VAT reduction according to Resolution 142/2024/QH15 (8%).

Reduced VAT of goods, services sold (6): After entering the name of goods or services eligible for a tax reduction and the pre-tax price into columns (2) and (3), the HTKK software will automatically calculate the reduced VAT amount in column (6).

Section 3: The VAT difference of goods and services sold and purchased during the period with a VAT rate of 8%: After completing the information in sections (I) and (II), the HTKK software will automatically calculate the VAT difference of goods and services sold and purchased during the period with a VAT rate of 8%.

Guidance on filling out the appendix for VAT reduction in Vietnam under Resolution 142/2024/QH15 on the HTKK software (Image from the Internet)

What are regulations on VAT reduction appendix form in Vietnam under Resolution 142/2024/QH15?

The VAT reduction appendix form under Resolution 142/2024/QH15 on the HTKK Software is the VAT Reduction Appendix as specified in Appendix IV issued with Decree 72/2024/ND-CP:

Download the VAT Reduction Appendix Form Under Resolution 142/2024/QH15

What goods and services are not eligible for VAT reduction in Vietnam in 2024?

Under Article 1 of Decree 72/2024/ND-CP, VAT reduction is implemented for groups of goods and services currently subjected to a 10% tax rate, excluding the following groups of goods and services:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and products from pre-cast metals, mining products (excluding coal mining), coke, refined petroleum, chemical products.

Details in Appendix I issued with Decree 72/2024/ND-CP

- Goods and services subjected to special consumption tax.

Details in Appendix II issued with Decree 72/2024/ND-CP

- Information technology services as per information technology legislation.

Details in Appendix III issued with Decree 72/2024/ND-CP

- VAT reduction for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP will be uniformly applied at stages of importation, production, processing, commercial trading. For coal mining sold (including cases where mined coal is sold after screening and classification through a closed process), it is eligible for VAT reduction. Coal products listed in Appendix I issued with Decree 72/2024/ND-CP at other stages, except mining and selling, are not eligible for VAT reduction.

Economic corporations conducting processes in a closed cycle before sale are also eligible for VAT reduction for coal mining and sales.

In cases where goods and services stated in Appendices I, II, and III issued with Decree 72/2024/ND-CP are either not subject to VAT or are subject to a 5% VAT according to the Value Added Tax Law, they must comply with the provisions of the Value Added Tax Law and are not eligible for VAT reduction.