Form No. 05-1/BK-QTT-TNCN on detailed list of individuals subject to tax calculation by partially progressive tariff in Vietnam

Form No. 05-1/BK-QTT-TNCN on detailed list of individuals subject to tax calculation by partially progressive tariff in Vietnam

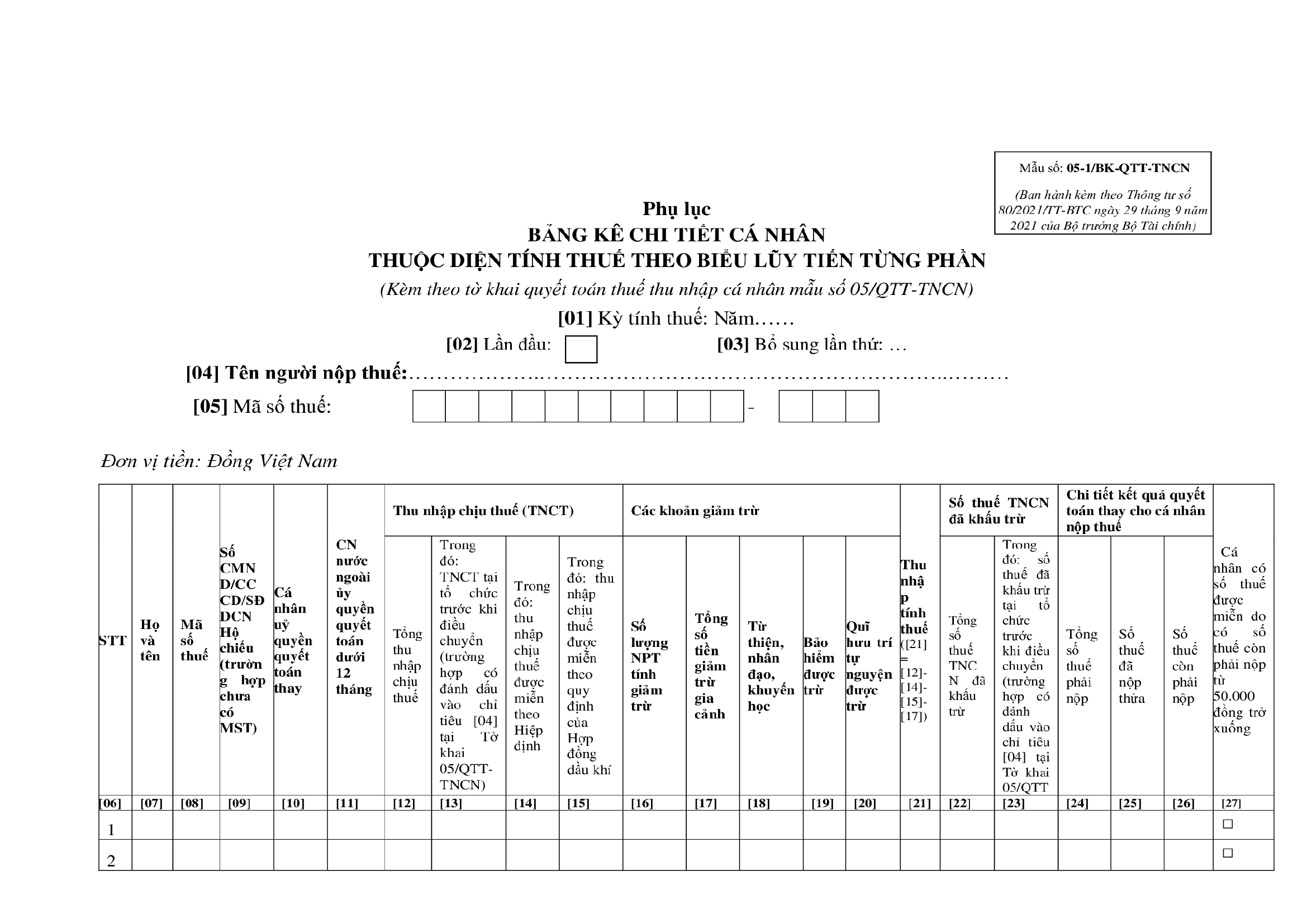

The appendix detailing individuals subject to tax calculation by partially progressive tariff, applicable to organizations and individuals that pay taxable income from salaries and wages, is implemented according to Form No. 05-1/BK-QTT-TNCN issued in conjunction with Circular 80/2021/TT-BTC as follows:

Download Form No. 05-1/BK-QTT-TNCN: Here

Note:

- Accurately enter the income amount and personal exemption for each individual.

- If authorized, select 'authorized' for the system to calculate the tax due for each individual.

- Accurately enter the deducted amounts per individual (regardless of whether already paid/not paid into the budget) for the system to calculate the surplus or deficiency for each individual.

Form No. 05-1/BK-QTT-TNCN detail list of individuals subject to tax calculation by partially progressive tariff (Image from the Internet)

Vietnam: What does the personal income tax finalization for income payers include?

Based on the tax declaration dossier list issued in conjunction with Decree 126/2020/ND-CP and the declaration forms issued in conjunction with Circular 80/2021/TT-BTC, the personal income tax finalization for income payers includes:

- Personal income tax finalization declaration Form 05/QTT-TNCN issued in conjunction with Appendix 2 Circular 80/2021/TT-BTC.

- Appendix detailing individuals subject to tax calculation by Partially Progressive Tariff Form No. 05-1/BK-QTT-TNCN issued in conjunction with Appendix 2 Circular 80/2021/TT-BTC.

- Appendix detailing individuals subject to tax calculation by full tax rate Form 05-2/BK-QTT-TNCN issued in conjunction with Appendix 2 Circular 80/2021/TT-BTC.

- Appendix detailing dependents for personal exemption Form 05-3/BK-QTT-TNCN issued in conjunction with Appendix 2 Circular 80/2021/TT-BTC.

Can a person who has stopped working at the time of personal income tax finalization authorize tax finalization in Vietnam?

According to subsection d.2, point d, clause 6, Article 8 of Decree 126/2020/ND-CP, resident individuals with income from salaries and wages can authorize personal income tax finalization to the income payers under the following conditions:

Taxes declared monthly, quarterly, annually, separately, and annual tax finalization

...

6. Taxes and revenues to be finalized annually, and to be finalized upon dissolution, bankruptcy, cessation of operations, termination of contracts, or reorganization of the enterprise. In the case of enterprise transformation (excluding state enterprise equitization) where the transforming enterprise inherits all tax obligations of the transformed enterprise, no finalization is required up to the decision date on enterprise transformation; the enterprise finalizes taxes at the year-end. To be specific: as follows:

...

d) Personal income tax for organizations and individuals paying taxable income from salaries and wages; individuals with income from salaries and wages authorizing tax finalization to income-paying organizations and individuals; individuals with income from salaries and wages directly settling tax with tax authorities. To be specific: as follows:

...

d.2) Resident individuals with income from salaries and wages authorizing tax finalization to income-paying organizations and individuals. To be specific:

Individuals with income from salaries and wages who sign labor contracts of 3 months or more at one place and are actually working there at the time the income payers finalizes taxes, even if they do not work for the full 12 months of the year. If an individual is transferred from the old organization to the new organization as per point d.1 of this clause, they can authorize tax finalization to the new organization.

Individuals with income from salaries and wages who sign labor contracts of 3 months or more at one place and are actually working there at the time the income payers finalizes taxes, even if they do not work for the full 12 months of the year; simultaneously having casual income at other places averaging no more than 10 million VND per month in a year, and have had personal income tax withheld at the rate of 10%, provided they do not require tax finalization for this portion of income.

...

Thus, at the time of authorizing tax finalization, the individual must be working at that enterprise; if no longer working, authorization is not permitted.

In addition, in subsection 1, Section 1 of Official Dispatch 883/TCT-DNNCN of 2022, the General Department of Taxation of Vietnam also guides that resident individuals with income from salaries and wages from two or more places that do not meet the conditions for authorized finalization must directly file personal income tax finalization with the tax authorities if additional tax is payable or if there is overpaid tax requested for refund or carryover to the next tax declaration period.