Form No. 01/TB-BSTT-NNT Notification on Explanation, Supplement, Provision of Information and Documents in Vietnam

Form 01/TB-BSTT-NNT Notification on Explanation, Supplementation, and Provision of Documents in Vietnam

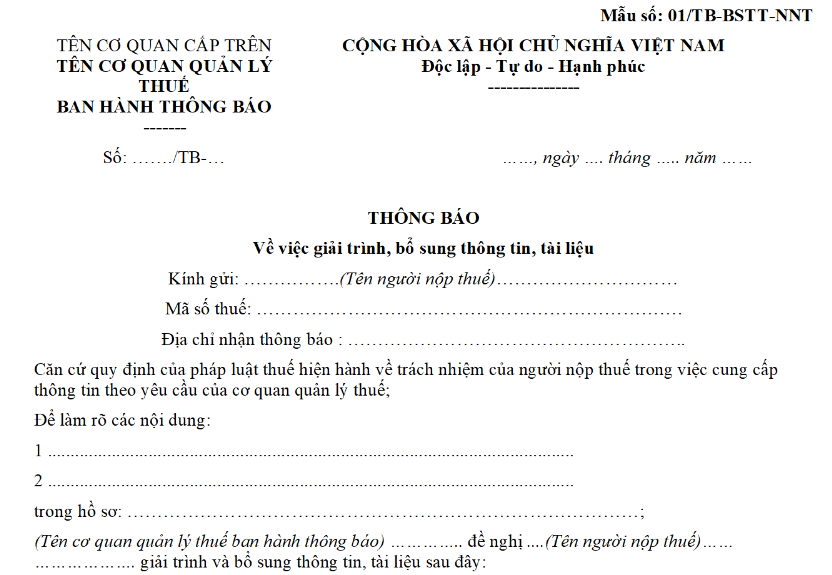

Form 01/TB-BSTT-NNT Appendix 2 issued together with Circular 105/2020/TT-BTC is the form that the tax authority must notify in writing requesting the taxpayer to explain or supplement the dossier, as follows:

>>> Download Form 01/TB-BSTT-NNT Notification on Explanation, Supplementation, and Provision of Documents.

Form 01/TB-BSTT-NNT Notification on Explanation, Supplementation, and Provision of Documents in Vietnam (Image from the Internet)

When must taxpayers register with business registration and notify changes in taxpayer registration information in Vietnam?

Based on Article 36 Law on Tax Administration 2019 stipulates as follows:

Notification of changes in taxpayer registration information

1. Taxpayers registering with business registration, cooperative registration, or business households registration, when there are changes in taxpayer registration information, shall notify such changes together with changes in business registration content, cooperative registration, or business households registration according to law.

In case the taxpayer changes the address of the headquarters leading to changes in the tax authority management, the taxpayer must carry out tax procedures with the directly managing tax authority as prescribed by this Law before registering changes in information with the business registration authority, cooperative registration, or business households registration authority.

2. Taxpayers registering directly with the tax authority, when there are changes in taxpayer registration information, shall notify the directly managing tax authority within 10 working days from the date the information changes.

3. In case individuals authorize organizations or individuals paying income to register changes in taxpayer registration information for individuals and their dependents, they must notify the organizations or individuals paying income no later than 10 working days from the date the information changes; organizations or individuals paying income are responsible for notifying the tax authority no later than 10 working days from the date of receiving the authorization from the individual.

Thus, according to the above provisions, taxpayers registering with business registration must notify changes in taxpayer registration information when there are changes in taxpayer registration information together with changes in business registration content, cooperative registration, or business households registration according to the law.

Where and how to submit dossiers of change in taxpayer registration information in Vietnam?

Based on Article 10, Section 2, Chapter 2 of Circular 105/2020/TT-BTC as follows:

The place to submit and dossiers of change in taxpayer registration information shall be implemented according to the provisions of Article 36 of the Law on Tax Administration 2019 and the following regulations:

[1] Change in taxpayer registration information but does not change the directly managing tax authority

- Taxpayers under the provisions of Points a, b, c, d, dd, e, h, i, n of Clause 2, Article 4 of Circular 105/2020/TT-BTC shall submit dossiers to the directly managing tax authority as follows:

+ Dossiers of change in taxpayer registration information of taxpayers under the provisions of Points a, b, c, dd, h, n Clause 2, Article 4 of Circular 105/2020/TT-BTC, include:

++ Declaration form for adjustment, supplementation of taxpayer registration information form 08-MST (download) issued together with Circular 105/2020/TT-BTC;

++ A copy of the license for establishment and operation, or the certificate of registration of the dependent unit's operation, or the establishment decision, or an equivalent license issued by a competent authority if the information on these documents changes.

- Dossiers of change in taxpayer registration information of taxpayers under the provisions of Point d Clause 2, Article 4 of Circular 105/2020/TT-BTC, include: Declaration form for adjustment, supplementation of taxpayer registration information form 08-MST (download) issued together with Circular 105/2020/TT-BTC.

- Dossiers of change in taxpayer registration information of foreign suppliers under the provisions of Point e Clause 2, Article 4 of Circular 105/2020/TT-BTC shall be implemented in accordance with the provisions of the Ministry of Finance's Circular guiding the implementation of a number of articles of the Law on Tax Administration.

- Dossiers of change in taxpayer registration information of business households, and individual businesses under the provisions of Point i Clause 2, Article 4 of Circular 105/2020/TT-BTC, include:

+ Declaration form for adjustment, supplementation of taxpayer registration information form 08-MST

(download) issued together with Circular 105/2020/TT-BTC or Tax declaration dossier as per the law on tax administration;

+ A copy of the business household registration certificate if the information on the business household registration certificate changes;

+ A copy of the valid citizen identity card or valid identity card for individuals who are Vietnamese nationals; a valid passport for individuals who are foreign nationals and Vietnamese nationals living abroad if the information on these documents changes.

- Taxpayers who are contractors or investors participating in oil and gas contracts under the provisions of Point h, Article 4 of Circular 105/2020/TT-BTC when transferring capital contributions in economic organizations or transferring part of the benefits of participating in oil and gas contracts, shall submit dossiers of change in taxpayer registration information at the Tax Department where the operator's headquarters is located.

Dossiers of change in taxpayer registration information include: Declaration form for adjustment, supplementation of taxpayer registration information form 08-MST (download) issued together with Circular 105/2020/TT-BTC.