Form 30/DK-TCT: What is the application form for relocation to the tax authority in charge of the new location in Vietnam?

What is the application form for relocation to the tax authority in charge of the new location in Vietnam based on form 30/DK-TCT?

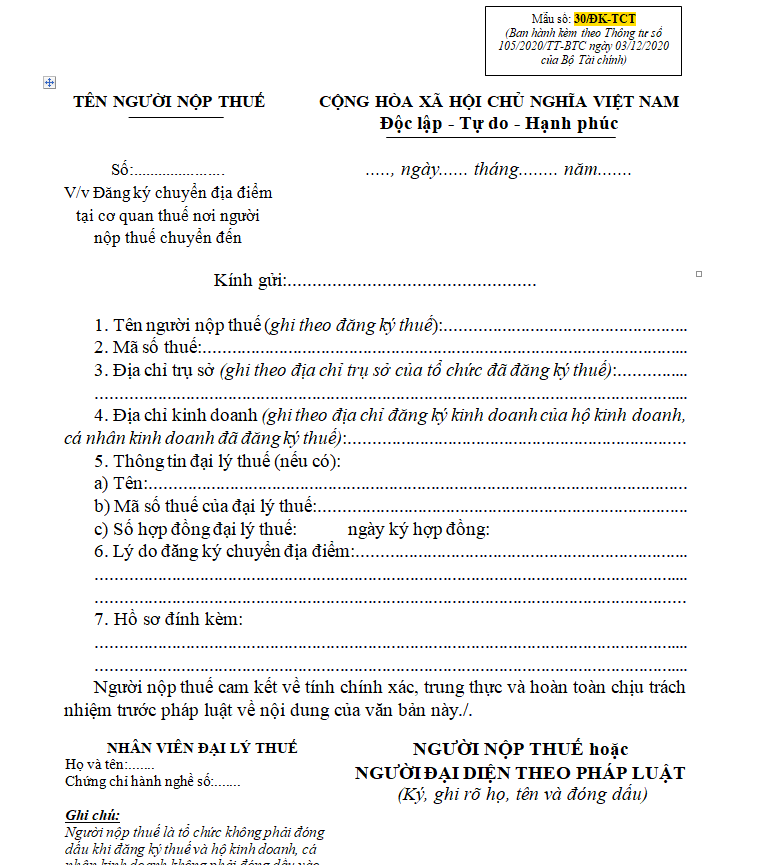

Pursuant to Appendix 1 on the list of taxpayer identification status issued with Circular 105/2020/TT-BTC, the application form for relocation to the tax authority in charge of the new location will follow form 30/DK-TCT as follows:

Download application form for relocation to the tax authority in charge of the new location according to form 30/DK-TCT.

Form 30/DK-TCT: What is the application form for relocation to the tax authority in charge of the new location in Vietnam? (Image from the Internet)

What is the receipt procedure of a application for cancellation of relocation form in Vietnam?

According to sub-section 1, Section 1 of the administrative procedures issued with Decision 2589/QD-BTC of 2021, the receipt of a application for cancellation of relocation form is handled as follows:

- For paper taxpayer registration applications:

+ In case the application is submitted directly to the tax authority: The tax officer receives and stamps the application with the receipt stamp, clearly stating the date of receipt and the number of documents according to the checklist of the taxpayer registration application submitted directly to the tax authority. The tax officer issues a receipt slip with the date for result retrieval and the timeline for processing the received application;

+ In case the taxpayer registration application is sent via postal service: The tax officer stamps it with the receipt stamp, notes the date of receipt on the application, and records the tax authority's dispatch number;

The tax officer checks the taxpayer registration application. If the application is incomplete, requiring explanations or additional information and documents, the tax authority will notify the taxpayer using form 01/TB-BSTT-NNT in Appendix 2 issued with Decree 126/2020/ND-CP within 02 (two) working days from the date of receiving the application.

- For electronic taxpayer registration applications:

The tax authority receives applications through the electronic portal of the General Department of Taxation, examines and processes the application via the electronic data processing system of the tax authority:

+ Receiving applications: The electronic portal of the General Department of Taxation sends a notification that the taxpayer has submitted an application through the electronic portal chosen by the taxpayer (the electronic portal of the General Department of Taxation/the electronic portal of the competent state agency or the T-VAN service provider) within 15 minutes upon receipt of the taxpayer registration application;

+ Checking and processing applications: The tax authority checks and processes the taxpayer's application following the legal provisions on taxpayer registration and sends the resolution results through the electronic portal chosen by the taxpayer;

+ If the application is complete and in accordance with procedures and requires results: The tax authority sends the resolution results to the electronic portal chosen by the taxpayer as per the timeline specified in Circular 105/2020/TT-BTC.

If the application is incomplete or not in accordance with procedures, the tax authority sends a notification of rejection to the electronic portal selected by the taxpayer within 02 (two) working days from the date on the receipt notification.

Is it necessary to submit the application for canceling the relocation directly to the tax authority in Vietnam?

According to sub-section 1, Section 1 of the administrative procedures issued with Decision 2589/QD-BTC of 2021, it is regulated as follows:

New administrative procedures:

1. Registering to cancel the relocation at the tax authority at the old location.

...

- Mode of execution:

+ Submit directly at the headquarters of the tax authority;

+ Or send through the postal system;

+ Or by electronic means through the electronic portal of the General Department of Taxation/the electronic portal of a competent state agency including the National Public Service Portal, the Ministry-level or Provincial Public Service Portal per regulations on the execution of a single-window, interconnected single-window mechanism in administrative procedure resolution and connected with the electronic portal of the General Department of Taxation/the T-VAN service provider's portal as per Circular No. 19/2021/TT-BTC dated March 18, 2021, of the Ministry of Finance guiding electronic transactions in the taxation sector.

- Components and quantity of the application:

+ Application components, include:

Document for registration to cancel the relocation according to form 31/DK-TCT issued with Circular No. 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance.

+ Quantity of application: 01 (set).

...

It is not mandatory to submit the registration application for canceling the relocation to the tax authority at the original location directly at the tax authority.

Taxpayers can submit the application via postal services or by electronic means through the electronic portal of the General Department of Taxation/the electronic portal of a competent state agency including the National Public Service Portal, the Ministry-level or Provincial Public Service Portal per regulations on the execution of a single-window, interconnected single-window mechanism in administrative procedure resolution and connected with the electronic portal of the General Department of Taxation/the T-VAN service provider's portal.