Form 04/TB-TDT on Notification on the of acceptance of e-tax payment registration through commercial banks in Vietnam

Form 04/TB-TDT on Notification on the of acceptance of e-tax payment registration through commercial banks in Vietnam

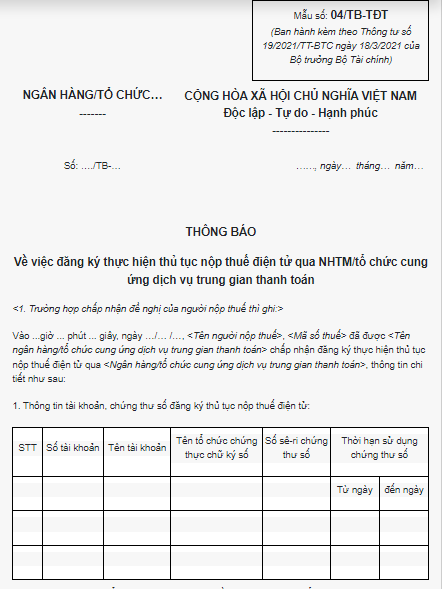

Based on the form catalog issued together with Circular 19/2021/TT-BTC, when notifying about the of acceptance of e-tax payment registration through commercial banks, the following Form 04/TB-TDT shall be used:

>>> Download Form 04/TB-TDT on Notification on the of acceptance of e-tax payment registration through commercial banks.

Form 04/TB-TDT on Notification on the of acceptance of e-tax payment registration through commercial banks in Vietnam (Image from the Internet)

What are the 5 methods that taxpayers can choose to conduct e-tax transactions?

Based on Clause 2, Article 4 of Circular 19/2021/TT-BTC, the 5 methods that taxpayers can choose to conduct e-tax transactions include:

[1] The e-portal of the General Department of Taxation.

[2] The National Public Service Portal, or the e-portal of the Ministry of Finance connected with the e-portal of the General Department of Taxation.

[3] The e-portal of other competent state agencies (excluding Point b of this Clause) connected with the e-portal of the General Department of Taxation.

[4] Organizations providing T-VAN services approved by the General Department of Taxation to connect with the e-portal of the General Department of Taxation.

[5] e-payment services of banks or intermediary payment service providers to implement e-tax payment.

How to register one of the 5 methods for conducting e-tax transactions in Vietnam?

Based on Clause 3, Article 4 of Circular 19/2021/TT-BTC, selecting one of the 5 methods for conducting e-tax transactions should be registered as follows:

- Taxpayers conducting e-tax transactions through the e-portal of the General Department of Taxation must register to conduct e-tax transactions per regulations in Article 10 of Circular 19/2021/TT-BTC.

- Taxpayers conducting e-tax transactions through the National Public Service Portal or the e-portal of the Ministry of Finance connected with the e-portal of the General Department of Taxation must register according to the guidance of the system's managing agency.

- Taxpayers conducting e-tax transactions through the e-portal of other competent state agencies connected with the e-portal of the General Department of Taxation must register according to the guidance of the competent state agency.

- Taxpayers conducting e-tax transactions through organizations providing T-VAN services approved by the General Department of Taxation to connect with the e-portal of the General Department of Taxation must register to conduct e-tax transactions per regulations in Article 42 of Circular 19/2021/TT-BTC.

During the same period, taxpayers may only choose to register and implement one of the administrative tax procedures stipulated at Point a, Clause 1, Article 1 of Circular 19/2021/TT-BTC via the e-portal of the General Department of Taxation, the National Public Service Portal, the e-portal of the Ministry of Finance, or a T-VAN service provider (excluding cases specified in Article 9 of Circular 19/2021/TT-BTC).

- Taxpayers choosing e-tax payment through the e-payment services of banks or intermediary payment service providers must register according to the guidance of the bank or intermediary payment service provider.

- Taxpayers who have registered for e-transactions with the tax authorities must conduct tax transactions within the scope specified in Clause 1, Article 1 of Circular 19/2021/TT-BTC electronically, except in cases specified in Article 9 of Circular 19/2021/TT-BTC.

Moreover, if taxpayers wish to switch between these 5 methods, they can change per Clause 3, Article 4 of Circular 19/2021/TT-BTC as follows:

- Taxpayers who have registered to use e-tax transaction methods according to Point b, Clause 3, Article 4 of Circular 19/2021/TT-BTC may conduct e-tax transactions according to the methods stipulated at Point a, Clause 2, Article 4 of Circular 19/2021/TT-BTC without having to register as per Point a, Clause 3, Article 4 of Circular 19/2021/TT-BTC.

- Taxpayers who have registered to use e-tax transaction methods according to Point d, Clause 3 of this Article, when switching to e-tax transaction methods per Points a, b, Clause 2, Article 4 of Circular 19/2021/TT-BTC, must register to stop using the e-tax transaction methods as per Point d, Clause 3, Article 4 of Circular 19/2021/TT-BTC and register to use e-tax transaction methods as per Points a, b, Clause 3, Article 4 of Circular 19/2021/TT-BTC.

- Taxpayers who have registered to use e-tax transaction methods according to Points c, d, Clause 3, Article 4 of Circular 19/2021/TT-BTC, when switching to e-tax transaction methods per Points a, b, Clause 2, Article 4 of Circular 19/2021/TT-BTC must register to use e-tax transaction methods as per Points a, b, Clause 3, Article 4 of Circular 19/2021/TT-BTC.