Form 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam?

Form 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam

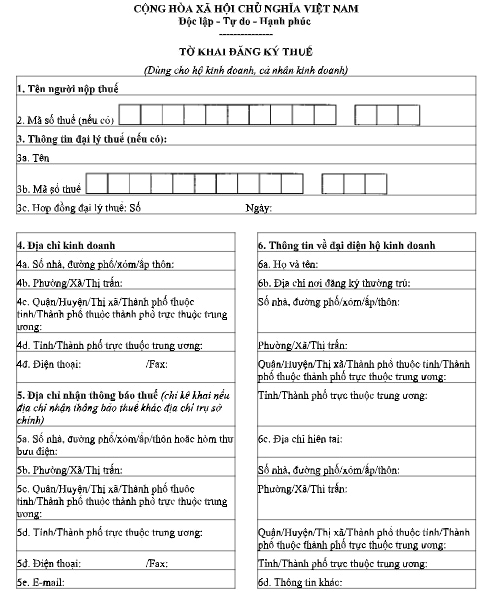

Pursuant to Circular 105/2020/TT-BTC regulating the application form for tax registration for individual businesses and household businesses is form 03-DK-TCT as follows:

Download form 03-DK-TCT: Here

Form 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam (Image from Internet)

Instructions on filling Form 03-DK-TCT - Application form for tax registration in Vietnam

The declaration form 03-DK-TCT issued with Circular 105/2020/TT-BTC provides guidance on how to fill in form 03-DK-TCT as follows:

(1) Name of the taxpayer: Clearly and fully write in capital letters the name of the household business, individual business. In case of having a Business Registration Certificate, it must be written exactly as the household business name on the Business Registration Certificate.

(2) Tax Identification Number (TIN): Enter the 10-digit TIN of the representative of the household business, individual business in the case of taxpayer registration for a newly established business location, or the assigned TIN of the business location in case of re-activation of a business location that has ceased operations.

(3) Tax Agent Information: Fully record the information of the tax agent if the tax agent signs a contract with the taxpayer to perform the taxpayer registration procedures on behalf of the taxpayer as per the Law on Tax Administration.

(4) Business Address:

(4.1) For household businesses, individual businesses with regular business activities and fixed business locations; individuals leasing properties, the business address or the address where the individual leases the property must be clearly recorded, including house number, street/hamlet/village, ward/commune/commune-level town, district/district-level town/provincial city, province/city. If there’s a phone or fax number, specify the area code - phone/fax number. In case there is a Business Registration Certificate, the business address should match the address on the certificate.

(4.2) For household businesses, individual businesses with regular business activities but no fixed business location, clearly state the permanent address of the representative of the household business or the current address if the representative does not live at the permanent address.

(5) Address for receiving tax notifications: If the business's address for receiving notifications from the tax authority differs from the main office address, clearly state the tax notification address for the tax authority to contact.

(6) Information about the representative of the household business: Fully record the information of the representative of the household business (Full name, permanent address, current address). If there is a phone or fax number, specify the area code - phone/fax number.

(7) Business Registration Certificate/Household Business Registration Certificate:

- For Vietnamese household businesses, individual businesses, and individual businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones, clearly state the number, issuance date, and issuing authority of the Business Registration Certificate (if any).

- For household businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones, clearly state the number, issuance date of the Business Registration Certificate. Information regarding the "issuing authority" of the Business Registration Certificate: state the name of the country sharing a land border with Vietnam that issued the certificate (Laos, Cambodia, China).

(8) Information about the representative's documents: Clearly state the number, issuance date, and authority of one of the representative's documents: ID card; Citizen ÍD Card; passport; other certified documents issued by a competent authority. Regarding “place of issue,” only the city or province name should be noted.

(9) Business Capital: Record according to the "business capital" information on the Household Business Registration Certificate or Business Registration Certificate. If there is no such certificate or no business capital information on the certificate, record the actual capital being used in business.

(10) Main Business Field: Record according to the business field on the Household Business Registration Certificate or Business Registration Certificate. The taxpayer should only record 1 main business field currently being operated.

(11) Start Date of Operations: Clearly state the date the household, group of individuals, or individual business started production and business activities.

(12) Taxpayer Registration Status:

For new taxpayer registration or newly established business locations requiring a tax code from the tax authority, mark an X in the “New Issuance” box.

If after a period of non-operation the household, individual business has converted the representative's tax code to the individual's tax code, start operating again, mark an X in the “Reactivation” box and note the assigned tax code in the “Tax Identification Number” box of the declaration form.

(13) Information about related units: If the household business, individual business includes additional stores, branches, or dependent warehouses, mark an X in the “Has dependent stores, branches” box and declare in the Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01.

(14) Section for the representative of the household business, individual business to sign and clearly state their name: The representative must sign and clearly state their name in this section.

(15) Tax Agent Employee: If the tax agent completes the declaration on behalf of the taxpayer, complete this information.

Taxpayer registration application for household businesses and individual businesses in Vietnam

Pursuant to Clause 8, Article 7 of Circular 105/2020/TT-BTC, taxpayer registration applications for household businesses, individual businesses should be submitted to the local Tax Department, where the business location is situated. The taxpayer registration application for household businesses, individual businesses includes:

- Application form for tax registration form number 03-DK-TCT issued with this Circular or the tax declaration dossier of the household business, individual business as per the law on tax administration;

- Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01 issued with this Circular (if any);

- A copy of the Household Business Registration Certificate (if any);

- A copy of the Citizen ÍD Card or valid ID card for Vietnamese citizens; a copy of the valid passport for foreign citizens or Vietnamese citizens living abroad.

Additionally, the Taxpayer registration application for household businesses, individual businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones includes:

- Application form for tax registration form number 03-DK-TCT issued with Circular 105/2020/TT-BTC;

- Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01 issued with Circular 105/2020/TT-BTC (if any);

- A copy of the required documents as per regulations.