Form 03/DK-T-VAN: What is the registration form for unsubscribing T-VAN services in Vietnam?

Form 03/DK-T-VAN: What is the registration form for unsubscribing T-VAN services in Vietnam?

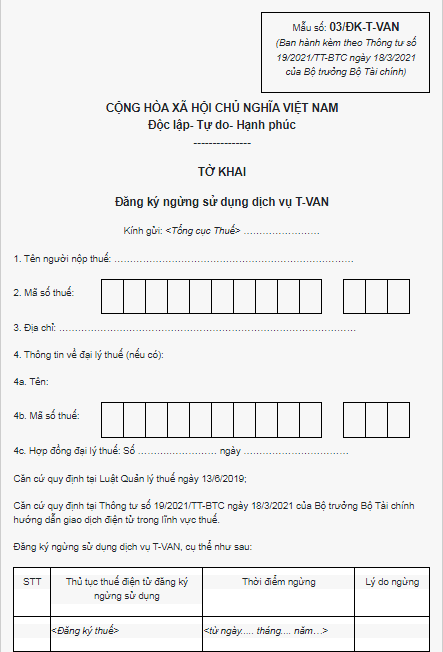

Based on the list of forms issued together with Circular 19/2021/TT-BTC, the registration form for unsubscribing T-VAN services is Form 03/DK-T-VAN, as follows:

Download Form 03/DK-T-VAN: The latest registration form for unsubscribing T-VAN services.

Form 03/DK-T-VAN: Registration form for unsubscribing T-VAN services in Vietnam(Image from the Internet)

What is T-VAN service registration in Vietnam?

Based on the provision in Clause 7, Article 3 of Circular 19/2021/TT-BTC, it can be understood that:

First, T-VAN service is an abbreviation for organizations providing value-added services for electronic transactions in the field of taxation.

T-VAN service is understood as an intermediary as prescribed in the Law on Electronic Transactions and accepted by the General Department of Taxation to connect with the General Department of Taxation's electronic information portal to provide representation services (partially or fully) for taxpayers to perform the sending, receiving, storing, and recovering of electronic documents; support the creation, processing of electronic documents; confirm the performance of electronic transactions between taxpayers and tax authorities.

From that, it can be inferred that T-VAN service registration is the registration to use T-VAN Service to help taxpayers have tools and means to deploy taxpayer registration, tax declaration, tax payment, tax refund, and receive other documents and texts that taxpayers send to tax authorities by electronic means.

What are the procedures for registration of T-VAN service and unsubscribing T-VAN services in Vietnam?

Based on Article 42 of Circular 19/2021/TT-BTC, the procedures for registering to use the T-VAN service are as follows:

Step 1. Taxpayers are allowed to use T-VAN services in performing tax administrative procedures electronically.

Step 2. Procedures for registering electronic transactions through T-VAN service providers:

- Taxpayers prepare a registration form for using T-VAN service (according to Form 01/DK-T-VAN (Download) issued together with Circular 19/2021/TT-BTC) and send it to the General Department of Taxation's electronic information portal via a T-VAN service provider.

- Within 15 minutes from receiving the registration dossier for using T-VAN service, the General Department of Taxation's electronic information portal sends a notice (according to Form 03/TB-TDT (Download) issued together with this Circular) on accepting or not accepting the registration for using T-VAN services via the information exchange system of the T-VAN service provider to the taxpayer.

+ In case of acceptance, the General Department of Taxation's electronic information portal sends a notification about the account on the General Department of Taxation's electronic information portal via the information exchange system of the T-VAN service provider to the taxpayer. The taxpayer is responsible for changing the initial password and updating it at least once every 03 (three) months to ensure safety and security.

+ In case of non-acceptance, the taxpayer, based on the notice of non-acceptance of using T-VAN services from the tax authority, completes the registration information, digitally signs and sends it to the General Department of Taxation's electronic information portal via the T-VAN service provider, or contacts the tax authority for guidance and support.

Step 3. Procedures for registering for electronic tax payment:

In the case of registering for electronic tax payment, after completing the registration at the General Department of Taxation's electronic information portal via the T-VAN service provider, the taxpayer registers for electronic tax payment with the bank or intermediary payment service provider as specified in Clause 5, Article 10 of this Circular.

Step 4. Taxpayers performing electronic transactions with tax authorities via T-VAN service providers may use the electronic tax transaction account granted by the tax authority to perform electronic tax transactions and lookup all relevant information on the General Department of Taxation's electronic information portal.

Step 5. Electronic documents of the taxpayer sent through the T-VAN service provider to the tax authority must have the digital signature of the taxpayer and the T-VAN service provider.

In addition, if the taxpayer wants to stop using it, they will have to register to stop using the T-VAN service (according to Article 44 of Circular 19/2021/TT-BTC) as follows:

- In case of unsubscribing T-VAN services, the taxpayer registers (according to Form 03/DK-T-VAN (Download) issued together with this Circular) and sends it to the General Department of Taxation's electronic information portal via the T-VAN service provider.

- Within 15 minutes from receiving the registration dossier for unsubscribing T-VAN services, the General Department of Taxation's electronic information portal sends a notice (according to Form 03/TB-TDT (Download) issued together with this Circular) confirming the cessation of using T-VAN service to the taxpayer via the T-VAN service provider.

- From the time of registering to stop using the T-VAN service, the taxpayer can register for transactions with the tax authority by electronic means via the General Department of Taxation's electronic information portal or register through another T-VAN service provider.