What is the excise tax declaration form - Form 02/TTDB applicable to facilities producing and blending biological gasoline in Vietnam?

Are biological gasoline subject to excise tax in Vietnam?

Under sub-clause 1.3 of Clause 1 QCVN 03:2014/BCT, biological gasoline is understood as a mixture of unleaded gasoline and fuel ethanol.

According to Clause 1, Article 2 of the Law on Excise Tax 2008 (amended by Clause 1, Article 1 of the Law on Amendments to Law on Excise Tax), goods subject to excise tax include:

Taxable objects

1. Goods:

a/ Cigarettes, cigars and other tobacco preparations used for smoking, inhaling, chewing, sniffing or keeping in mouth;

b/ Liquor;

c/ Beer;

d/ Under-24 seat cars, including cars for both passenger and cargo transportation with two or more rows of seats and fixed partitions between passenger holds and cargo holds;

e/ Two- and three-wheeled motorcycles of a cylinder capacity of over 125 cm3;

f/ Aircraft and yachts;

g/ Gasoline;

h/ Air-conditioners of 90,000 BTU or less;

i/ Playing cards;

j/ Votive gilt papers and votive objects.

...

Thus, biological gasoline is subject to excise tax.

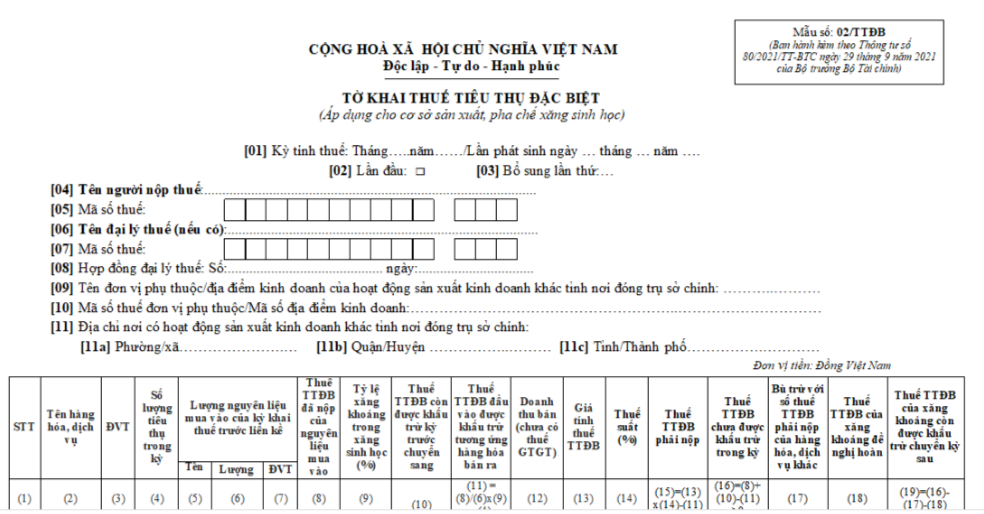

What is the excise tax declaration form - Form 02/TTDB applicable to facilities producing and blending biological gasoline in Vietnam? (Image from Internet)

What is the excise tax declaration form - Form 02/TTDB applicable to facilities producing and blending biological gasoline in Vietnam?

The excise tax declaration form applicable to facilities producing and blending biological gasoline is prescribed as Form 02/TTDB issued together with Circular 80/2021/TT-BTC as follows:

Download the excise tax declaration form - Form 02/TTDB applicable to facilities producing and blending biological gasoline in Vietnam: Here

What is the excise tax rate for biological gasoline in Vietnam in 2024?

The excise tax rates during 2024 are specified in Article 7 of the Law on Excise Tax 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13, and Article 8 of the Law Amending the Law on Public Investment, the Law on Public-Private Partnership Investment, the Law on Investment, the Law on Housing, the Law on Procurement, the Law on Electricity, the Law on Enterprises, the Law on excise tax, and the Law on Civil Judgment Enforcement 2022 as follows:

| No. | Goods, Services | Tax Rate (%) |

| I | Goods | |

| 1 | Cigarettes, cigars, and other preparations from tobacco plants | 75 |

| 2 | Alcohol | |

| a) Alcohol of 20 degrees and above | 65 | |

| b) Alcohol below 20 degrees | 35 | |

| 3 | Beer | 65 |

| 4 | Cars under 24 seats | |

| a) Passenger cars of 9 seats or less, except for those stipulated in Points 4đ, 4e, and 4g of the Tax Schedule prescribed in Article 7 of the excise tax Law 2008 (amended 2014, 2016) | ||

| - With cylinder capacity of 1,500 cm3 or below | 35 | |

| - With cylinder capacity over 1,500 cm3 to 2,000 cm3 | 40 | |

| - With cylinder capacity over 2,000 cm3 to 2,500 cm3 | 50 | |

| - With cylinder capacity over 2,500 cm3 to 3,000 cm3 | 60 | |

| - With cylinder capacity over 3,000 cm3 to 4,000 cm3 | 90 | |

| - With cylinder capacity over 4,000 cm3 to 5,000 cm3 | 110 | |

| - With cylinder capacity over 5,000 cm3 to 6,000 cm3 | 130 | |

| - With cylinder capacity over 6,000 cm3 | 150 | |

| b) Passenger cars from 10 to under 16 seats, except for those stipulated in Points 4đ, 4e, and 4g of the Tax Schedule prescribed in Article 7 of the Excise Tax Law 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 15 | |

| c) Passenger cars from 16 to under 24 seats, except for those stipulated in Points 4đ, 4e, and 4g of the Tax Schedule prescribed in Article 7 of the Excise Tax Law 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 10 | |

| d) Passenger cars carrying both people and goods, except for those stipulated in Points 4đ, 4e, and 4g of the Tax Schedule prescribed in Article 7 of the Excise Tax Law 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 15 | |

| - With cylinder capacity of 2,500 cm3 or below | 15 | |

| - With cylinder capacity over 2,500 cm3 to 3,000 cm3 | 20 | |

| - With cylinder capacity over 3,000 cm3 | 25 | |

| dd) Cars powered by gasoline in combination with electric energy or bioenergy, in which the gasoline proportion used does not exceed 70% of the total energy used | Equal to 70% of the tax rate applicable to the same type of car as specified in Points 4a, 4b, 4c, and 4d of the Tax Schedule prescribed in Article 7 of the Excise Tax Law 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | |

| e) Cars powered by bioenergy | Equal to 50% of the tax rate applicable to the same type of car as specified in Points 4a, 4b, 4c, and 4d of the Tax Schedule prescribed in Article 7 of the Excise Tax Law 2008 amended by Clause 4 Article 1 of the Law on Amendments to Law on Excise Tax 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | |

| g) Electric cars | ||

| (1) Battery-powered electric cars | ||

| - Passenger cars of 9 seats or less | ||

| + From March 1, 2022, to February 28, 2027 | 3 | |

| - Passenger cars from 10 to under 16 seats | ||

| + From March 1, 2022, to February 28, 2027 | 2 | |

| + From March 1, 2027 | 7 | |

| - Passenger cars from 16 to under 24 seats | ||

| + From March 1, 2022, to February 28, 2027 | 1 | |

| + From March 1, 2027 | 4 | |

| - Designed for both passenger and goods transport | ||

| + From March 1, 2022, to February 28, 2027 | 2 | |

| + From March 1, 2027 | 7 | |

| (2) Other electric cars | ||

| - Passenger cars of 9 seats or less | 15 | |

| - Passenger cars from 10 to under 16 seats | 10 | |

| - Passenger cars from 16 to under 24 seats | 5 | |

| - Designed for both passenger and goods transport | 10 | |

| h) Motorhomes regardless of cylinder capacity | 75 | |

| 5 | Two-wheeled motorbikes and three-wheeled motorbikes with a cylinder capacity of over 125cm3 | 20 |

| 6 | Aircraft | 30 |

| 7 | Yachts | 30 |

| 8 | All types of gasoline | |

| a) Gasoline | 10 | |

| b) E5 Gasoline | 8 | |

| c) E10 Gasoline | 7 | |

| 9 | Air conditioners with a capacity of 90,000 BTU or below | 10 |

| 10 | Playing cards | 40 |

| 11 | Worship pasteboard items, ceremonial objects | 70 |

| II | Services | |

| 1 | Business operations of discotheques | 40 |

| 2 | Business operations of massage, karaoke | 30 |

| 3 | Business operations of casinos, electronic gaming services with prizes | 35 |

| 4 | Betting business operations | 30 |

| 5 | Business operations of golf | 20 |

| 6 | Lottery business operations | 15 |

Therefore, the excise tax rate for biological gasoline in 2024 is 7%, 8%, 10%.