What is the newest application form for changes and additions to information about T-VAN services - Form 02/DK-T-VAN in Vietnam?

What is the newest application form for changes and additions to information about T-VAN services - Form 02/DK-T-VAN in Vietnam?

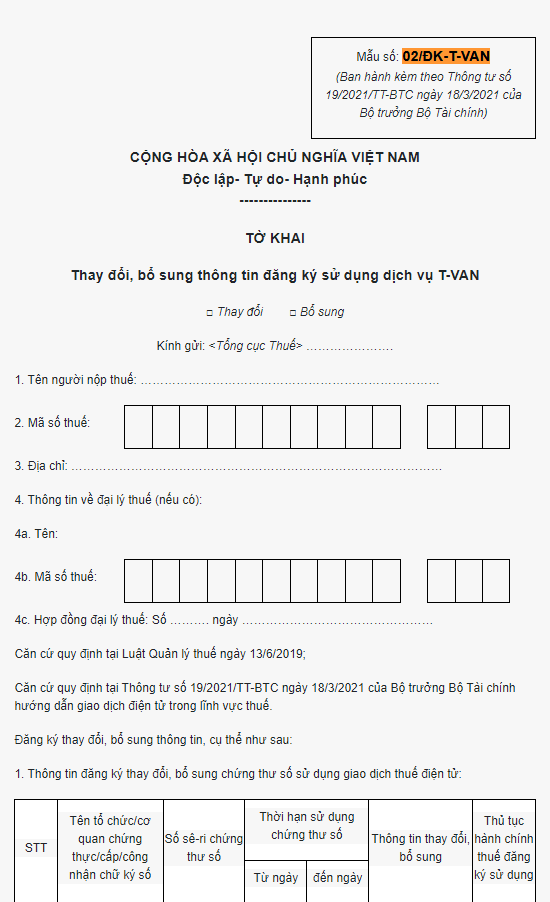

According to the list of forms/templates issued together with Circular 19/2021/TT-BTC, the newest application form for changes and additions to information about T-VAN services is as follows:

>>> Download the newest application form for changes and additions to information about T-VAN services - Form 02/DK-T-VAN.

What is the newest application form for changes and additions to information about T-VAN services - Form 02/DK-T-VAN in Vietnam? (Image from Internet)

What are the regulations on registration of changes and additions to information about T-VAN services in Vietnam?

According to Article 43 of Circular 19/2021/TT-BTC, the registration of changes and additions to information about T-VAN services in Vietnam is specified as follows:

- In the case of a change or addition to the information on the T-VAN service registration form, the taxpayer shall complete the Form No. 02/ĐK-T-VAN Download and send it to the GDT’s web portal through the T-VAN service provider.

Within 15 minutes from the receipt of the application form, the GDT’s web portal shall send a notification (Form No. 03/TB-TĐT enclosed herewith) of acceptance or non-acceptance of the application form to the taxpayer through the T-VAN service provider.

In the case of a change or addition to the information on the account serving e-tax payment, the taxpayer shall comply with the regulations set forth in Clause 5 Article 10 of Circular 19/2021/TT-BTC.

- In the case of change of the T-VAN service provider, the taxpayer shall follow the unsubscribing procedures in Article 44 and apply again in accordance with Article 42 of Circular 19/2021/TT-BTC.

What is the relationship between T-VAN service providers and taxpayers in Vietnam?

According to Article 45 of Circular 19/2021/TT-BTC, the relationship between T-VAN service providers and taxpayers is as follows:

- The T-VAN service provider shall:

+ Publish the operating method and service quality on its website.

+ Provide transmission services and complete the format of e-documents to facilitate exchange of information between taxpayers and tax authorities.

+ Transmit and receive e-documents punctually and completely under agreements with other parties.

+ Retain result of every transmission and receipt; retain e-documents before transactions are successfully done.

+ Ensure connection, security, integration of information, and provide other utilities for other participants in the exchange of e-documents.

+ Give taxpayers and tax authorities ten days' notice of the date of a system outage for maintenance days and take measures for protecting taxpayers’ interests.

+ Send e-tax dossiers of taxpayers to tax authorities and transfer results of processing of e-tax dossiers by tax authorities to taxpayers on schedule as prescribed in Circular 19/2021/TT-BTC, in the case of sending dossiers against regulations resulting late submission of dossiers, be responsible to taxpayers as prescribed by law.

+ Provide compensation for taxpayers under regulations of law and civil contracts between 2 parties in case the taxpayer suffers any damage through the T-VAN service provider's fault.

- The taxpayer shall:

+ Adhere to terms and conditions of the contract with the T-VAN service provider.

+ Enable the T-VAN service provider to implement system safety and security measures.

+ Take legal responsibility for their e-tax dossiers.