Form 01/KHBS: Supplementary tax declaration form

Viietnam: What is the latest supplementary tax declaration form in 2023? Where to download the Form No. 01/KHBS?

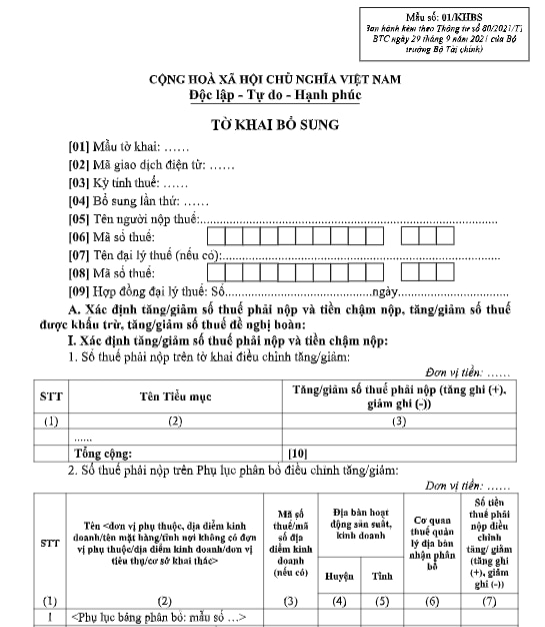

The supplementary tax declaration form is Form No. 01/KHBS issued along with Circular 80/2021/TT-BTC, as follows:

Download the supplementary declaration form here

What does the 01/KHBS supplementary tax declaration form look like? (Image from the Internet)

What does a supplementary tax declaration dossier include?

According to sub-item 11 of Section 2 of the administrative procedures issued along with Decision 1462/QD-BTC in 2022 and clause 4 of Article 47 of the Law on Tax Administration 2019, the supplementary tax declaration dossier includes:

- The supplementary declaration form No. 01/KHBS (except in cases where the supplementary declaration does not change tax obligations);

- The explanatory report for supplementary declaration form No. 01-1/KHBS;

- The tax declaration dossier of the tax period containing errors that has been supplemented.

What are subjects required to supplement the tax declaration in Vietnam?

According to Article 47 of the Law on Tax Administration 2019, subjects required to supplement the tax declaration are as follows:

- Taxpayers who discover that the tax declaration submitted to the tax authorities has errors are allowed to supplement the tax declaration within 10 years from the deadline for submitting the tax declaration of the tax period containing errors, but before the tax authority or the competent authority announces the inspection or audit decision.

When the tax authority or the competent authority has announced the tax inspection or audit decision at the taxpayer’s headquarters, the taxpayer is still allowed to supplement the tax declaration. The tax authority will impose administrative penalties for tax management violations stipulated in Articles 142 and 143 of the Law on Tax Administration 2019.

After the tax authority or competent authority has issued conclusions or decisions on tax handling post-inspection or post-audit at the taxpayer's headquarters, the taxpayer is permitted to supplement the tax declaration in cases where it leads to an increase in the payable tax amount, a decrease in the deductible tax amount, or a decrease in the exempted or refunded tax amount, and will be sanctioned for tax management administrative violations as per Articles 142 and 143 of the Law on Tax Administration 2019.

If the taxpayer discovers errors in the tax declaration that result in a reduction of the payable tax amount or an increase in the deductible tax amount, exempted, or refunded tax amount, it shall follow the provisions regarding the resolution of tax complaints.

How to supplement the tax declaration containing errors in Vietnam?

According to clause 4 of Article 7 of Decree 126/2020/ND-CP, taxpayers are allowed to submit supplementary tax declarations for each tax declaration containing errors.

The supplementary declaration is conducted as follows:

- If the supplementary declaration does not change the tax obligations, only the Explanatory Report for Supplementary Declaration and related documents must be submitted, and the Supplementary Declaration Form is not required.

- If the annual tax finalization declaration has not been submitted, the taxpayer shall supplement the monthly or quarterly tax declaration that has errors and concurrently aggregate the supplemented figures into the annual tax finalization declaration.

- If the annual tax finalization declaration has been submitted, only the annual tax finalization declaration will be supplemented. For supplementary declarations of the annual finalization of personal income tax for organizations or individuals paying income from salaries or wages, supplementary declarations of the corresponding monthly or quarterly declarations containing errors must be concurrently submitted.

- If the taxpayer’s supplementary declaration results in an increased payable tax amount or a reduction of the refunded tax amount from the state budget, the taxpayer must pay the additional payable tax amount or the over-refunded tax amount and the late payment interest into the state budget (if any).

In cases where the supplementary declaration only increases or decreases the VAT amount that can be carried forward to the next period, it must be declared in the current tax period. Taxpayers are only allowed to increase the VAT amount proposed for refund in the supplementary declaration if the declaration for the next tax period has not been submitted and the refund request has not been filed.

What are the regulations on receiving tax declaration dossiers for tax authorities in Vietnam?

According to Article 48 of the Law on Tax Administration 2019, the responsibilities of the tax authorities in receiving tax declaration dossiers are as follows:

Responsibilities of the Tax Authorities in Receiving Tax Declaration Dossiers

1. The tax authorities receives tax declaration dossiers from taxpayers through the following methods:

a) Directly receiving at the tax authorities;

b) Receiving via postal service;

c) Receiving electronically through the tax authorities's e-portal.

2. The tax authorities shall notify the receipt of the tax declaration dossier to the taxpayer; in case the dossier is illegal, incomplete, or not in the prescribed format, the tax authorities shall notify the taxpayer within 03 working days from the date of receiving the dossier.

Thus, the tax authorities receives tax declaration dossiers from taxpayers through the following three methods:

- Direct receipt at the tax authorities;

- Receipt via postal service;

- Receipt electronically through the tax authorities's e-portal.