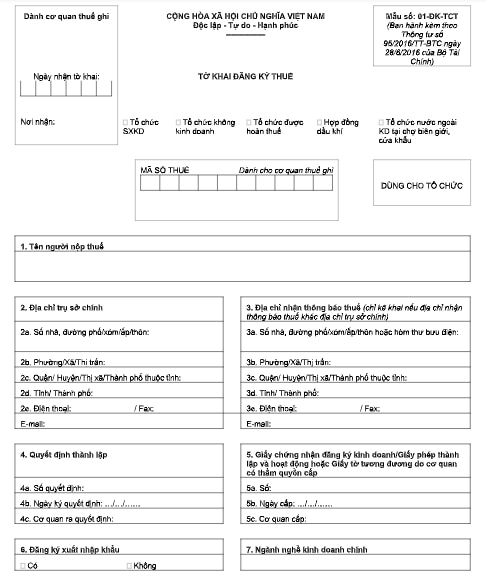

Form 01-DK-TCT - Application form for tax registration in Vietnam according to Circular 105

Form 01-DK-TCT - Application form for tax registration in Vietnam according to Circular 105

Form number 01-DK-TCT Application form for tax registration for organizations is implemented according to the issuance attached to Circular 105/2020/TT-BTC, as follows:

Download the Application form for tax registration form 01-DK-TCT: Here

Form 01-DK-TCT Application form for tax registration in Vietnam according to Circular 105 (Image from the Internet)

When is the initial taxpayer registration deadline in Vietnam?

According to Article 33 of the Law on Tax Administration 2019, the initial taxpayer registration deadline is specified as follows:

- Taxpayers registering along with enterprise registration, cooperative registration, business registration must register as per the enterprise registration, cooperative registration, business registration deadlines provided by law.

- Taxpayers registering directly with tax authorities must do so within 10 working days from the following dates:

+ Issuance of the business registration certificate, establishment and operation license, investment registration certificate, or establishment decision;

+ Commencement of business activities for organizations not subject to business registration or business households, individuals subject to business registration but have not yet been issued a business registration certificate;

+ Arising obligation to withhold and pay tax on behalf; organizations paying on behalf of individuals under business cooperation contracts;

+ Signing of contracts for contractors, subcontractors to declare and pay tax directly with tax authorities; signing of oil and gas agreements;

+ Arising personal income tax obligations;

+ Arising tax refund request;

+ Arising other obligations to the state budget.

- Organizations and individuals paying income are responsible for registering on behalf of individuals receiving income within 10 working days from the date of arising tax obligation if the individual does not have a tax identification number; registering on behalf of the dependents of taxpayers within 10 working days from the date the taxpayer registers for family deductibles as per the law if the dependents do not have a tax identification number.

What documents does the initial tax registration iclude in Vietnam?

According to Article 31 of the Law on Tax Administration 2019, the initial taxpayer registration application includes:

- Taxpayers registering along with enterprise registration, cooperative registration, business registration must provide the enterprise registration, cooperative registration, business registration application as per the law.

- Organizations registering directly with the tax authorities must provide:

+ Application form for tax registration;

+ Copies of the establishment and operation license, establishment decision, investment registration certificate, or other equivalent effective documents issued by the competent authority;

+ Other relevant documents.

- Business households and individuals registering directly with tax authorities must provide:

+ Application form for tax registration or tax declaration;

+ Copies of ID card, citizen identification card, or passport;

+ Other relevant documents.

- Information linkage between state management agencies and tax authorities for receiving taxpayer registration files and issuing tax identification numbers through a one-stop-shop electronic portal is implemented as per the relevant laws.

Where is the location for submitting the initial taxpayer registration application in Vietnam?

The location for submitting the initial taxpayer registration application is stipulated in Article 32 of the Law on Tax Administration 2019 as follows:

- Taxpayers registering along with enterprise registration, cooperative registration, business registration submit at the locations specified for enterprise registration, cooperative registration, business registration as per the law.

- Taxpayers registering directly with tax authorities submit as follows:

+ Organizations, business households, and individuals submit at the tax authorities where the organization, business household, and individual are headquartered;

+ Organizations and individuals responsible for withholding and paying taxes on behalf submit at the tax authorities directly managing them;

+ Households and individuals not conducting business submit at the tax authorities where taxable income, permanent residence, temporary residence, or state budget obligations arise.

- Individuals authorizing organizations and individuals paying income to register on behalf must submit through the income-payers. These organizations are responsible for compiling and submitting the taxpayer registration applications on behalf of individuals to the tax authorities managing the income-payers.