Extension of the Deadline for Personal Income Tax Payment for Individuals Engaged in Creative, Artistic, and Entertainment Activities in 2024.

Are individuals engaged in creative, artistic, and entertainment activities eligible for the extension of the 2024 personal income tax payment deadline?

According to Article 3 of Decree 64/2024/ND-CP, individuals engaged in business activities in the following economic sectors are eligible for the extension of the 2024 personal income tax payment deadline:

Eligible entities for the extension

1. Enterprises, organizations, households, household businesses, and individuals engaged in production activities in the following economic sectors:

a) Agriculture, forestry, and fisheries;

b) Food production and processing; textiles; clothing production; leather and related products production; wood processing and manufacturing of products from wood, bamboo, and rattan (except for beds, cabinets, tables, and chairs); production of products from straw and plaiting materials; paper production and products from paper; rubber and plastic product manufacturing; production of non-metallic mineral products; metal production; mechanical processing; metal treatment and coating; production of electronic products, computers, and optical products; automobile and other motor vehicle manufacturing; production of beds, cabinets, tables, and chairs;

...

2. Enterprises, organizations, households, household businesses, and individuals engaged in business activities in the following economic sectors:

a) Transportation and storage; accommodation and food services; education and training; healthcare and social assistance activities; real estate business;

b) Labor and employment services; activities of travel agents, tour operation, and related support services, including advertising and organizing tours;

c) Creative, artistic, and entertainment activities; activities of libraries, archives, museums, and other cultural activities; sports, entertainment, and recreational activities; film projection activities;

d) Broadcasting and television activities; computer programming, consultancy, and other activities related to computers; information service activities;

đ) Support services for mining activities.

...

individuals engaged in creative, artistic, and entertainment activities are eligible for the extension of the 2024 personal income tax payment deadline.

Are individuals engaged in creative, artistic, and entertainment activities eligible for the extension of the 2024 personal income tax payment deadline? (Image from the Internet)

What is the deadline for the extension of the 2024 personal income tax payment for business individuals?

According to Article 4 of Decree 64/2024/ND-CP:

Extension of tax payment and land rent payment deadlines

- For value-added tax (excluding value-added tax at the import stage)

...

- For value-added tax and personal income tax for household businesses and business individuals

The payment deadline for value-added tax and personal income tax on the tax amount arising in 2024, for household businesses and business individuals operating in the economic sectors and fields specified in Clauses 1, 2, and 3 of Article 3 of this Decree, is extended. Household businesses and business individuals must complete the tax payments specified in this Clause no later than December 30, 2024.

4. For land rent

The deadline for payment of 50% of the land rent payable in 2024 (the amount payable for the second period of 2024) for enterprises, organizations, households, and individuals specified in Article 3 of this Decree, which are directly leased land by the State in accordance with Decisions or Contracts from competent state agencies under the form of annual land rent payments, is extended by 02 months from October 31, 2024.

This regulation applies even to enterprises, organizations, households, and individuals with multiple Decisions and Contracts for direct land leasing from the state, as well as diverse manufacturing and business activities, including economic sectors and fields specified in Clauses 1, 2, and 3 of Article 3 of this Decree.

5. In cases where enterprises, organizations, household businesses, and business individuals are engaged in manufacturing and business activities across various economic sectors, including those specified in Clauses 1, 2, and 3 of Article 3 of this Decree: enterprises and organizations shall be granted an extension for the entire payable value-added tax and corporate income tax amount; household businesses and business individuals shall be granted an extension for the entire payable value-added tax and personal income tax amount as guided in this Decree.

...

** the deadline for the extension of the 2024 personal income tax payment for business individuals is December 30, 2024.**

Note: The extension of the personal income tax payment deadline applies to the tax amount arising in 2024.

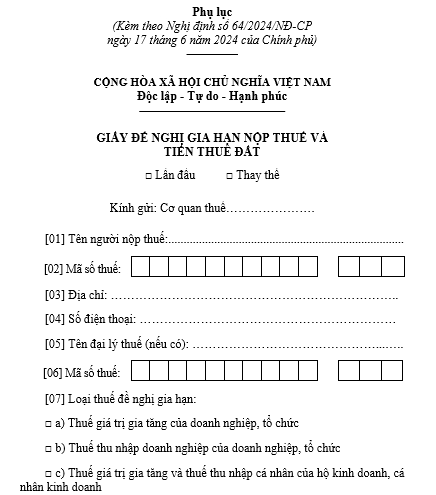

What is the form for the application for the tax payment extension in 2024?

The form for the application for the tax payment extension in 2024 is provided in the Appendix issued with Decree 64/2024/ND-CP:

>> Download the form for the 2024 tax payment extension: Download