Which goods serving social welfare works are subject to export and import duties in Vietnam?

Which goods serving social welfare works are subject to export and import duties in Vietnam?

Under Clause 1, Article 28 of Decree 134/2016/ND-CP, amended by Clause 9, Article 1 of Decree 18/2021/ND-CP, the following goods serving social welfare works are subject to export and import duties in Vietnam:

- Goods that cannot be domestically manufactured and have to be imported to be used for a project which is part of a social welfare program of the Government are exempt from import duties;

- Goods that cannot be domestically manufactured and are imported to serve recovery from disasters or epidemics are exempt from import duties;

- Agarwood derived from planted aquilaria trees and python skin obtained through breeding are exempt from export duties;

- Unprocessed agricultural products on the List in Appendix VIII hereof that are invested in, grown by Vietnamese enterprises, households, household businesses and individuals in provinces of Cambodia that border to Vietnam and imported through border checkpoints of within customs areas as materials for production in Vietnam are exempt from import duties.

Unprocessed agricultural products that are purchased or invested in provinces of Cambodia that do not border Vietnam are not exempt from import duties as prescribed in this Point.

- Exports and imports in other special cases where the Prime Minister decides to grant exemption of export and import duties on a case-by-case basis and at the request of the Ministry of Finance.

Which goods serving social welfare works are subject to export and import duties in Vietnam? (Image from the Internet)

What are the required documents and procedures for exemption of duties on goods serving social welfare works before carrying out customs procedures in Vietnam?

* Application for exemption of duties on goods serving social welfare works before carrying out customs procedures

Under Clause 4, Article 28 of Decree 134/2016/ND-CP, the application for exemption of duties on goods serving social welfare works before carrying out customs procedures includes:

- A written request for duty exemption prepared by the People’s Committee of the province, a Ministry or an equivalent authority;

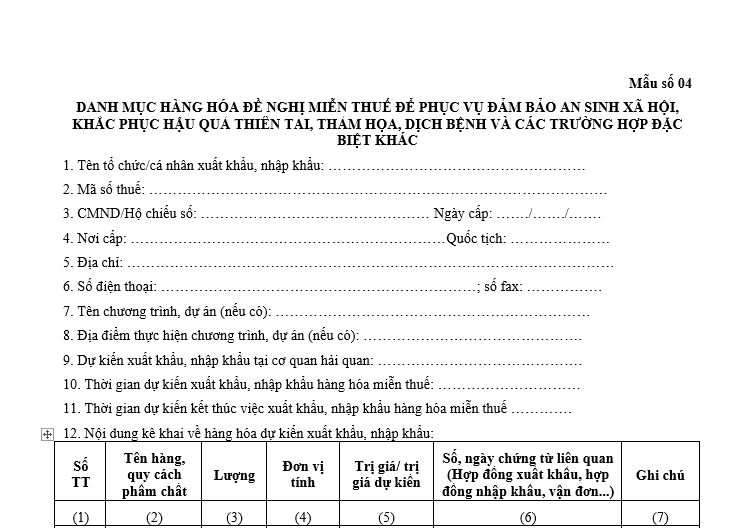

- A list of imports serving social welfare works according to Form 04 in Appendix VII attached to Decree 134/2016/ND-CP.

* Procedures for exemption of duties on goods serving social welfare works

Under Article 28 of Decree 134/2016/ND-CP (supplemented by Clause 9, Article 1 of Decree 18/2021/ND-CP):

Exemption of duties on goods exported or imported for social welfare, recovery from a disaster, epidemic or other special incidents

...

7. Procedures for exemption of duties on goods exported or imported for social welfare, recovery from disasters, epidemics and other special incidents:

The taxpayer shall submit the application specified in Clause 3, Clause 4, Clause 5 of this Article to the Ministry of Finance. Within 30 days from the receipt of the satisfactory application, the Ministry of Finance shall verify it and submit a report together with the list of goods to the Prime Minister for consideration. In other cases where comments of other ministries and authorities are necessary, the time limit for verifying the application may be extended but must not last longer than 40 days. Within 15 days from the receipt of the verification report from the Ministry of Finance, the Prime Minister shall issue an decision on exemption of export/import duties (Form No. 23 in Appendix VII hereof) or send a written rejection to the applicant.

The customs authority where export/import procedures are followed shall fulfill the Prime Minister’s decision.

...

Thus, the procedures for exemption of duties on goods serving social welfare works are as follows:

Step 1: The taxpayer submits an application for duty exemption to the Ministry of Finance.

Step 2: Within 30 days from the receipt of the satisfactory application, the Ministry of Finance shall verify it and submit a report together with the list of goods to the Prime Minister for consideration, along with the list of goods proposed for duty exemption.

In other cases where comments of other ministries and authorities are necessary, the time limit for verifying the application may be extended but must not last longer than 40 days.

Step 3: Within 15 days from the receipt of the verification report from the Ministry of Finance, the Prime Minister shall issue an decision on exemption of export/import duties (Form No. 23 in Appendix VII hereof) or send a written rejection to the applicant.

Under the Prime Minister's duty exemption decision, the customs authority at the location where goods are exported or imported processes the export and import duty exemption.

Where to download the List template of goods imported to serve social welfare works in Vietnam?

The List template of goods imported to serve social welfare works in Vietnam is Form 04 in Appendix 7 attached to Decree 134/2016/ND-CP.

Download the List template of goods imported to serve social welfare works in Vietnam: Here