Download the template of the balance sheet in the annual financial statements in Vietnam

Download the template of the balance sheet in the annual financial statements in Vietnam

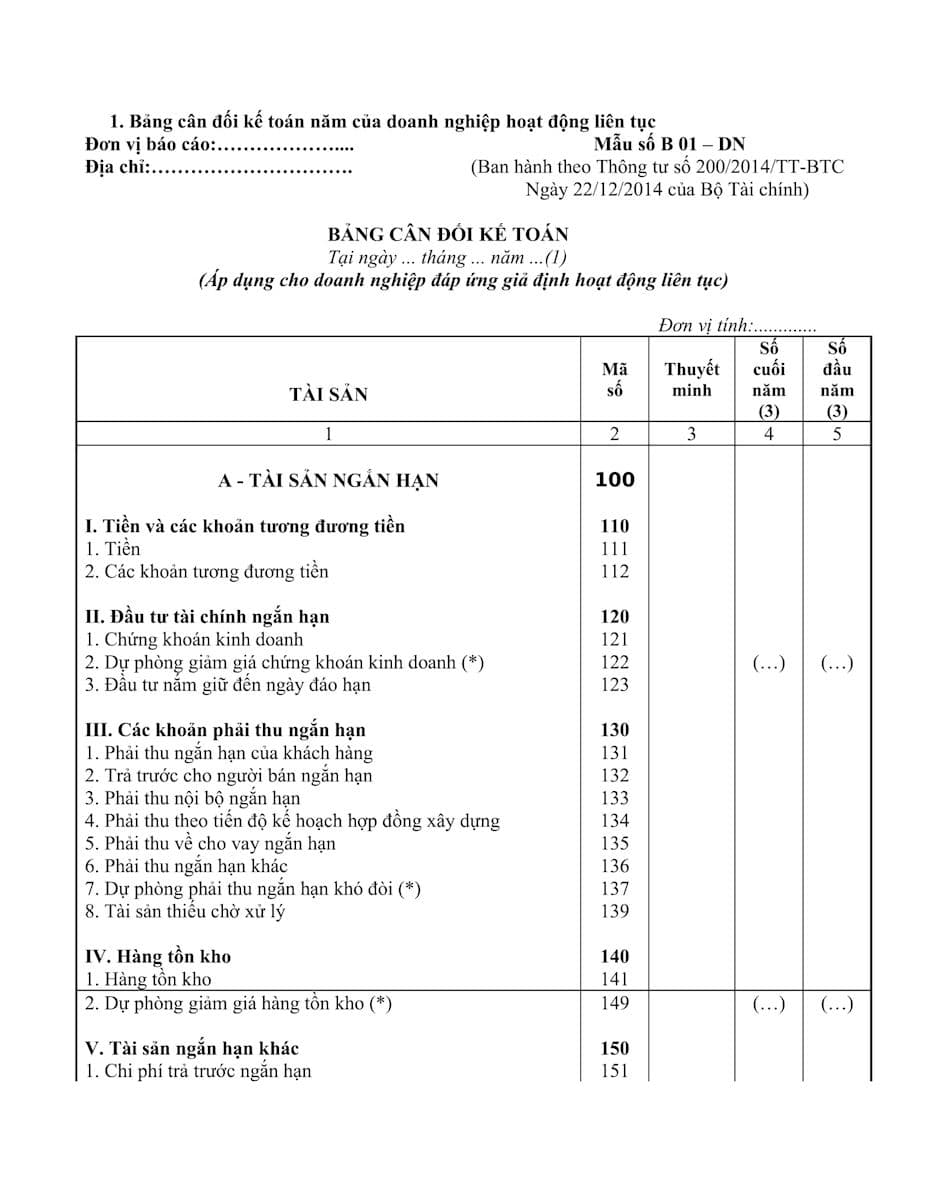

- Template of the balance sheet in the annual financial statements for enterprises assuming continuous operation: Form No. B 01 – DN issued with Circular 200/2014/TT-BTC.

Download the Template of the balance sheet in the annual financial statements for enterprises assuming continuous operation: here

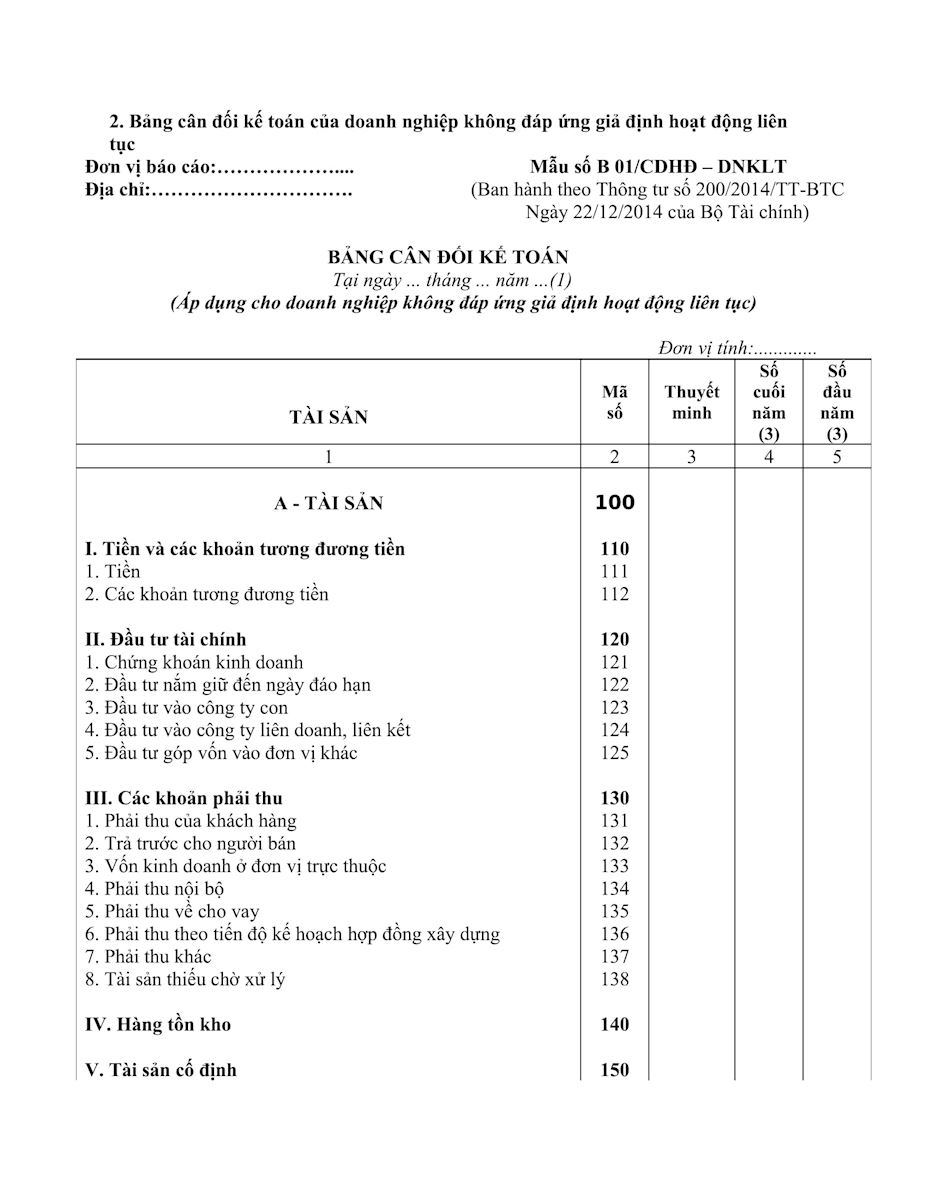

- Template of the balance sheet in the annual financial statements for enterprises faliing to meet the assumption of continuous operation: Form No. B 01/CDHD – DNKLT issued with Circular 200/2014/TT-BTC. To be specific:

Download the Template of the balance sheet in the annual financial statements for enterprises faliing to meet the assumption of continuous operation: here

Download the template of the balance sheet in the annual financial statements in Vietnam

Vietnam: What are principles for enterprises meeting assumption of continuous operation when preparing balance sheet B 01 – DN?

Based on Point 1.2 Clause 1 Article 112 Circular 200/2014/TT-BTC, enterprises assuming continuous operation when preparing their balance sheet must ensure the following principles:

(1) According to the accounting standard "Presentation of Financial Statements", when preparing and presenting the balance sheet, general principles on preparation and presentation must be complied with. Additionally, in the balance sheet, assets and liabilities must be presented separately as current and non-current depending on the normal business cycle of the enterprise. To be specific:

+ For enterprises with a normal business cycle of within 12 months, assets and liabilities are classified as current and non-current according to the following principles:

++ Assets and liabilities expected to be recovered or settled within no more than 12 months from the reporting date are classified as current;

++ Assets and liabilities expected to be recovered or settled after 12 months from the reporting date are classified as non-current.

+ For enterprises with a normal business cycle longer than 12 months, assets and liabilities are classified as current and non-current based on the following conditions:

++ Assets and liabilities expected to be recovered or settled within one normal business cycle are classified as current;

++ Assets and liabilities expected to be recovered or settled beyond one normal business cycle are classified as non-current.

In this case, the enterprise must clearly explain the characteristics used to define the normal business cycle, the average duration of the normal business cycle, and evidence of production and business cycles of the enterprise as well as those of the industry the enterprise operates in.

+ For enterprises where the nature of operations does not allow for differentiation between current and non-current based on business cycles, assets and liabilities are presented in order of decreasing liquidity.

(2) When preparing a consolidated balance sheet between superior and subordinate units lacking legal personality, the superior unit must eliminate all balances arising from internal transactions, such as receivables, payables, internal loans... between superior and subordinate units, and among subordinate units themselves.

The technique of eliminating internal items when consolidating reports between superior and subordinate units follows a similar process to that of financial statement consolidation.

(3) Items with no data are exempted from being presented on the balance sheet. Enterprises may rearrange the numbering of items following a continuous order within each section.

Vietnam: What provisions must enterprises faliing to meet the assumption of continuous operation ensure when preparing balance sheet B 01/CDHD – DNKLT?

Based on Clause 2 Article 112 Circular 200/2014/TT-BTC, the preparation of the balance sheet for enterprises faliing to meet the assumption of continuous operation is regulated as follows:

(1) The presentation of items on the balance sheet for enterprises faliing to meet the assumption of continuous operation is carried out similarly to that for enterprises in operation, except for a few adjustments:

- No distinction between current and non-current: Items are prepared without considering whether the remaining term from the report date is more than 12 months or no more than 12 months, or longer than one normal business cycle or within one normal business cycle;

- No provision indicators are presented since all assets and liabilities have been re-evaluated to their realizable net value, recoverable value, or fair value;

(2) Certain indicators have preparation methods different from the balance sheet of enterprises in continuous operation as follows:

- Indicator "Trading Securities" (Code 121)

This item reflects the book value of trading securities after re-evaluation. Enterprises are not required to present the item "Provision for Trading Securities Devaluation" as the provision is directly deducted from the book value of the trading securities.

- Indicators related to investments in subsidiaries, joint ventures, associates, and investments in other entities reflect the book value after re-evaluation of these investments. Enterprises are not required to present the item "Provision for Long-term Financial Investments" as the provision is directly deducted from the book value of the investments.

- Indicators related to receivables reflect the book value after re-evaluation of the receivables. Enterprises are not required to present the item "Provision for Doubtful Debts" as the provision is directly deducted from the book value of the receivables.

- Indicator "Inventories" Code 140:

This item reflects the book value of inventories after re-evaluation. The data for this item includes ongoing production, business expenses, and equipment, materials, and spare parts classified as non-current on the balance sheet of enterprises in continuous operation. Enterprises are not required to present the item "Provision for Inventory Devaluation" as the provision is directly deducted from the book value of the inventories.

- Indicators related to tangible fixed assets, intangible fixed assets, finance lease assets, and investment properties reflect the book value after re-evaluation of these assets. Enterprises are not required to present the item "Initial Cost" as the book value is the re-evaluated value, nor present the item "Cumulative Depreciation" as the depreciation amount is directly deducted from the book value of the asset.

(3) Other indicators are prepared by combining the content and data of corresponding items in the long-term and short-term sections of enterprises in continuous operation.