Vietnam: Download the fixed asset depreciation calculation and allocation table according to Circular 200

What is depreciation of fixed assets in Vietnam?

Pursuant to Clause 9, Article 2 of Circular 45/2013/TT-BTC, the concept of depreciation of fixed assets is defined as follows:

Depreciation of Fixed Assets is the process of calculating and systematically allocating the original cost of fixed assets into production and business expenses during the depreciation period of the fixed assets.

Vietnam: Downloading the fixed asset depreciation calculation and allocation table according to Circular 200

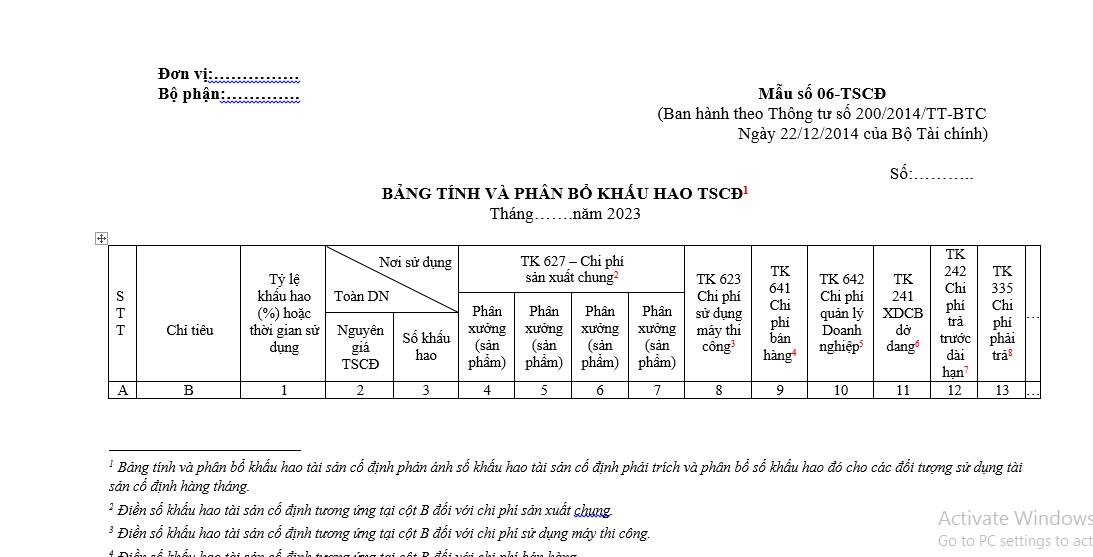

Currently, the Fixed Asset Depreciation Calculation and Allocation Table is applied according to Form 06-TSCĐ issued with Circular 200/2014/TT-BTC.

Form 06-TSCĐ of the Fixed Asset Depreciation Calculation and Allocation Table is as follows:

Form 06-TSCĐ of the Fixed Asset Depreciation Calculation and Allocation Table...Download

Below is how to fill in Form 06-TSCĐ of the Fixed Asset Depreciation Calculation and Allocation Table:

(1) The Fixed Asset Depreciation Calculation and Allocation Table reflects the depreciation amount of fixed assets that need to be allocated to the entities using fixed assets monthly.

(2) Enter the corresponding fixed asset depreciation amount in column B for general production costs.

(3) Enter the corresponding fixed asset depreciation amount in column B for construction machine usage costs.

(4) Enter the corresponding fixed asset depreciation amount in column B for sales costs.

(5) Enter the corresponding fixed asset depreciation amount in column B for enterprise management costs.

(6) Enter the corresponding fixed asset depreciation amount in column B for unfinished basic construction.

(7) Enter the corresponding fixed asset depreciation amount in column B for long-term prepaid expenses.

(8) Enter the corresponding fixed asset depreciation amount in column B for payable expenses.

(9) Enter the increased depreciation amount of fixed assets in the month.

Depreciation calculated in the previous month is obtained from the fixed asset depreciation calculation and allocation table of the previous month.

(10) The increased or decreased depreciation amount for this month is detailed for each relevant fixed asset in connection with the increase or decrease according to current policies on fixed asset depreciation.

(11) The depreciation amount to be calculated this month is computed as (=) depreciation calculated last month plus (+) the increased depreciation, minus (-) the decreased depreciation in the month.

Note: The depreciation amount to be allocated this month on the Fixed Asset Depreciation Allocation Table is used to record in related vouchers, logs - documents, and accounting books (credit account column 214), and is also used to calculate the actual cost of completed products and services.

Download the fixed asset depreciation calculation and allocation table according to Circular 200 (Image from the Internet)

What is the principles of fixed asset depreciation in Vietnam?

Pursuant to Article 9 of Circular 45/2013/TT-BTC (as supplemented by Clause 4, Article 1 of Circular 147/2016/TT-BTC and corrected by Article 1 of Decision 1173/QD-BTC of 2013), the principles of fixed asset depreciation are regulated as follows:

(1) All current fixed assets (TSCĐ) of the enterprise must be depreciated, except for the following TSCĐ:

- TSCĐ that have been fully depreciated but are still used in production and business activities.

- TSCĐ that have not been completely depreciated but are lost.

- Other TSCĐ managed by the enterprise but not owned by the enterprise (except for leased financial TSCĐ).

- TSCĐ not managed, monitored, or accounted for in the enterprise's accounting books.

- TSCĐ used in welfare activities serving the employees of the enterprise (except for TSCĐ serving employees working at the enterprise such as break rooms, canteens, changing rooms, restrooms, clean water tanks, parking lots, medical rooms or stations for healthcare services, employee transport vehicles, training facilities, and housing for employees invested by the enterprise).

- TSCĐ from non-refundable aid after being handed over by competent authorities to the enterprise to serve scientific research.

- Intangible TSCĐ as the long-term land use rights with land levy or receiving the legal transfer of long-term land use rights.

- Category 6 fixed assets, as specified, are not depreciated but detail records of annual depreciation of each asset must be opened, and the sources of capital forming the asset are not reduced.

(2) Depreciation costs for fixed assets are counted as reasonable expenses when calculating corporate income tax in accordance with legal documents on corporate income tax.

(3) In cases where TSCĐ used in welfare activities for employees of the enterprise as provided in (1) participate in production and business activities, the enterprise is to base on the time and nature of the usage of these fixed assets to calculate and allocate depreciation into the business expenses of the enterprise and notify the tax authority directly managing it for tracking and management.

(4) TSCĐ that have not been fully depreciated, if lost or damaged and unable to be repaired, the enterprise determines the cause, the compensation responsibility of individuals or groups responsible. The difference between the asset's remaining value and compensation from individuals, groups, insurance, and recovered value (if any), is used from the Financial Reserve Fund to compensate.

In cases where the Financial Reserve Fund is not sufficient for compensation, the deficit is considered reasonable expenses of the enterprise when determining corporate income tax.

(5) Enterprises leasing fixed operating TSCĐ must depreciate these leased TSCĐ.

(6) Enterprises leasing TSCĐ in the form of financial leasing (referred to as leased financial TSCĐ) must depreciate these leased TSCĐ as if they are owned by the enterprise as per current regulations. However, if at the start of the leasing, the enterprise leasing the financial TSCĐ commits not to purchase the leased asset in the lease contract, depreciation should be aligned with the lease term in the contract.

(7) When re-evaluating fully depreciated TSCĐ for capital contribution, transfer upon separation, merger, or acquisition, the value of these TSCĐ must be assessed by professional valuation organizations but not lower than 20% of the original asset cost.

The depreciation start time for these assets is the time when the enterprise officially receives the handover and puts the asset into use, with a depreciation period of 3 to 5 years. The specific period is decided by the enterprise but must be notified to the tax authority before implementation.

For enterprises undertaking equitization, the depreciation start time of these TSCĐ is the time the enterprise is issued a Certificate of Business Registration converting into a joint-stock company.

(8) For enterprises wholly owned by the state determining enterprise value for equitization using the discounted cash flow (DCF) method, the increased state capital difference between real value and the accounting book value is not recognized as intangible TSCĐ, but amortized gradually into business production expenses over a maximum of 10 years.

The amortization start time is when the enterprise officially converts into a joint-stock company (with a business registration certificate).

(9) The commencement or cessation of TSCĐ depreciation is effected from the day (considering the day of the month) the TSCĐ increases or decreases. Enterprises must account for the increase or decrease in TSCĐ according to current enterprise accounting policies.

(10) For basic construction projects completed and put into use, if an enterprise has accounted for the increase of TSCĐ at temporary prices due to pending settlement, any discrepancy between the temporary price and settlement value requires an adjustment of the original TSCĐ cost per the approved settlement value by competent authorities.

Enterprises should not adjust the depreciation costs already allocated from when the TSCĐ project was completed, handed over, and put into use until the settlement is approved. Post-settlement depreciation is calculated based on the asset's approved settlement value minus (-) the depreciation already allocated until settlement approval, divided (:) by the remaining depreciation period as specified.

(11) For TSCĐ that enterprises are currently monitoring, managing, and depreciating under Circular 203/2009/TT-BTC which now do not meet the original fixed asset cost standards as defined in Article 2 Circular 45/2013/TT-BTC, their remaining value should be allocated into the business production expenses over a period not exceeding 3 years from the effective date of Circular 45/2013/TT-BTC.