Download retail invoice template in Vietnam

Download retail invoice template in Vietnam

Currently, the law does not specifically regulate the sample retail sales invoice in Excel file format.

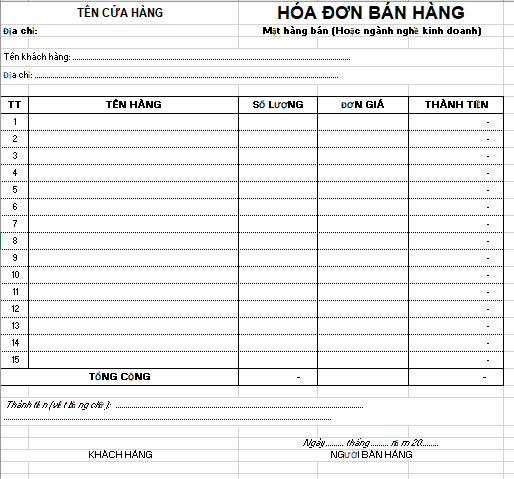

Therefore, individuals or organizations who are sellers can refer to the sample Excel file of the retail sales invoice below:

Download the retail invoice template here.

Download retail invoice template in Vietnam (Image from Internet)

What are procedures for preservation and storage of invoices and records in Vietnam?

Based on Article 6 of Decree 123/2020/ND-CP as follows:

Preservation and Storage of Invoices and records

1. Invoices and records shall be preserved and stored in a manner that ensures:

a) Safety, security, integrity, completeness, and no alteration or distortion during the storage period;

b) Storage for the correct and sufficient duration as prescribed by accounting law.

2. Electronic invoices and records are preserved and stored using electronic means. Agencies, organizations, and individuals have the right to select and apply methods for preserving and storing electronic invoices and records in a manner suitable to their operational characteristics and technological capability. Electronic invoices and records must be readily printable or searchable upon request.

3. Invoices printed by tax authorities, self-printed records must be stored and preserved in accordance with the following requirements:

a) Unissued invoices and records shall be stored and preserved in warehouses following record storage and preservation policies with value;

b) Issued invoices and records in accounting units shall be stored in accordance with the regulations for storing and preserving accounting records;

c) Issued invoices and records in organizations, households, and individuals not being accounting units shall be stored and preserved as personal assets of those organizations, households, or individuals.

Accordingly, the preservation and storage of invoices and records are carried out as follows:

- Invoices and records are preserved and stored ensuring:

+ Safety, security, integrity, completeness, and no alteration or distortion during the storage period;

+ Stored for the correct and sufficient duration as prescribed by accounting law.

- Electronic invoices and records are preserved and stored using electronic means. Agencies, organizations, and individuals have the right to select and apply methods for preserving and storing electronic invoices and records in a manner suitable to their operational characteristics and technological capability. Electronic invoices and records must be readily printable or searchable upon request.

- Invoices printed by tax authorities, self-printed records must be stored and preserved according to the following requirements:

+ Unissued invoices and records shall be stored and preserved in warehouses according to record storage and preservation policies with value.

+ Issued invoices and records in accounting units shall be stored according to the regulations for storing and preserving accounting records.

+ Issued invoices and records in organizations, households, and individuals not being accounting units shall be stored and preserved as personal assets of those organizations, households, or individuals.

Which organizations and individuals shall use sales invoices in Vietnam?

Based on Clause 2, Article 8 of Decree 123/2020/ND-CP as follows:

Types of Invoices

The invoices prescribed in this Decree include the following types:

1. VAT invoices are designated for organizations declaring VAT according to the credit method for activities such as:

a) Selling goods, providing services domestically;

b) International transportation activities;

c) Exporting into tax-free zones and cases considered as exports;

d) Exporting goods, providing services abroad.

2. Sales invoices are designated for organizations and individuals as follows:

a) Organizations and individuals declaring and calculating VAT according to the direct method for activities such as:

- Selling goods, providing services domestically;

- International transportation activities;

- Exporting into tax-free zones and cases considered as exports;

- Exporting goods, providing services abroad.

b) Organizations and individuals in the tax-free zones selling goods, providing services into the domestic market and when selling goods, supplying services among organizations and individuals within the tax-free zones, exporting goods, providing services abroad, the invoice must clearly indicate “For organizations and individuals in the tax-free zones.”

...

Sales invoices are designated for organizations and individuals as follows:

- Organizations and individuals declaring and calculating VAT according to the direct method for activities such as:

+ Selling goods, providing services domestically;

+ International transportation activities;

+ Exporting into tax-free zones and cases considered as exports;

+ Exporting goods, providing services abroad.

- Organizations and individuals in the tax-free zones when selling goods, providing services into the domestic market and when selling goods, supplying services among organizations and individuals within the tax-free zones, exporting goods, providing services abroad, the invoice must clearly state “For organizations and individuals in the tax-free zones."