Does the tax authority in Vietnam reactivate the TIN for the taxpayer immediately?

What are the procedures for TIN reactivation in Vietnam?

Based on the provisions in Clause 1, Article 19 of Circular 105/2020/TT-BTC regarding the handling of dossiers for TIN reactivation and returning results, the processing of dossiers by the tax authority is specifically regulated as follows:

For the taxpayer’s dossier: The tax authority receives, processes the dossier for reactivating the TIN, and returns the results to the taxpayer in accordance with Article 40, Article 41 of the Law on Tax Administration 2019 and Clause 4, Article 6 of Decree 126/2020/ND-CP as follows:

- Within 03 (three) working days from the date of receiving a complete dossier requesting the TIN reactivation of the taxpayer, for cases specified at point a, Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority shall:

+ Issue a Notification on reactivating the TIN using Form No. 19/TB-ĐKT Download, a Notification on TIN reactivation for the governing unit using Form No. 37/TB-ĐKT Download (if applicable) attached to this Circular to be sent to the taxpayer and the dependent unit (if the reactivated TIN is for the governing unit).

+ Re-issue the taxpayer registration Certificate or the TIN notification to the taxpayer if the original has been submitted to the tax authority according to the dossier for termination of the TIN.

+ Update the TIN status for the taxpayer on the taxpayer registration application system on the same working day or at the latest by the start of the next working day from the date of issuing the Notification on the TIN reactivation.

- Within 10 (ten) working days from the date of receiving the complete dossier requesting the TIN reactivation of the taxpayer for cases specified at point b, Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority shall list the missing tax declaration dossiers, the situation of invoice usage, the tax amounts, and other payable amounts to the state budget that must be paid or are still due, executing penalties for violations of tax laws and invoices up to the time the taxpayer submits the dossier requesting the TIN reactivation according to regulations, and also perform actual verification at the business location of the taxpayer and compile a Record of Verification on the operation status of the taxpayer at the registered address using Form No. 15/BB-BKD Download issued attached to this Circular according to the dossier requesting the TIN reactivation of the taxpayer (the taxpayer must sign to confirm the Record).

Within 03 (three) working days from the date the taxpayer fully complies with the administrative violations on tax and invoices, fully pays the tax amounts, and other amounts to the state budget that must be paid or are still due (excluding certain cases where tax debts and other amounts to the state budget do not need to be settled as stipulated in Clause 4, Article 6 of Decree 126/2020/ND-CP, the tax authority shall:

+ Issue a Notification on TIN reactivation for the taxpayer using Form No. 19/TB-ĐKT Download, a Notification on TIN reactivation for the governing unit using Form No. 37/TB-ĐKT Download (if applicable) along with this Circular, to be sent to the taxpayer and the dependent unit (if the reactivated TIN is for the governing unit).

+ Re-issue the taxpayer registration Certificate or the TIN notification to the taxpayer if the original has been submitted to the tax authority according to the dossier for termination of the TIN.

+ Update the TIN status of the taxpayer on the taxpayer registration application system on the same working day or at the latest by the start of the next working day from the date of issuing the Notification on the TIN reactivation.

The tax authority publicizes the Notification on the TIN reactivation on the General Department of Tax's electronic portal as prescribed in Article 22 of Circular 105/2020/TT-BTC. State management agencies in the locality (including: Customs authorities, business registration agencies (except in cases where integrated business and taxpayer registration is completed), Prosecutor's Office, police agencies, market management agencies, authorization-granting and operational agencies) and other organizations and individuals have the responsibility to search for information and the status of the taxpayer's TIN publicized by the tax authority to perform state management tasks and other contents.

- Within 10 (ten) working days from the date of receiving the complete dossier requesting the TIN reactivation of the taxpayer for cases specified at points c, d, Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority shall list the missing tax declaration dossiers, the situation of invoice usage, and the tax amounts and other payable amounts to the state budget that must be paid or are still due, and execute penalties for violations of tax laws and invoices up to the time the taxpayer submits the dossier requesting the TIN reactivation according to regulations.

Within 03 (three) working days from the date the taxpayer fully complies with the administrative violations on tax and invoices, fully pays the tax amounts and other amounts to the state budget that must be paid or are still due (excluding certain cases where tax debts and other amounts to the state budget do not need to be settled as stipulated in Clause 4, Article 6 of Decree 126/2020/ND-CP, the tax authority shall:

- Issue a Notification on TIN reactivation for the taxpayer using Form No. 19/TB-ĐKT, a Notification on TIN reactivation for the governing unit using Form No. 37/TB-ĐKT (if applicable) along with this Circular, to be sent to the taxpayer, and the dependent unit (if the reactivated TIN is for the governing unit).

+ Re-issue the taxpayer registration Certificate or the TIN notification to the taxpayer if the original has been submitted to the tax authority according to the dossier for termination of the TIN.

+ Update the TIN status for the taxpayer on the taxpayer registration application system on the same working day or at the latest by the start of the next working day from the date of issuing the Notification on the TIN reactivation.

- In cases where the taxpayer submits a dossier requesting the TIN reactivation that is incomplete or does not fall under categories eligible for reactivation as defined in Clause 1, Article 18 Circular 105/2020/TT-BTC, the tax authority shall issue a Notification on the non-TIN reactivation using Form No. 38/TB-ĐKT Download issued along with this Circular, to be sent to the taxpayer.

Does the tax authority need to reactivate the TIN for the taxpayer immediately? (Image from the Internet)

Does the tax authority in Vietnam reactivate the TIN for the taxpayer immediately?

Based on the provisions in Clause 3, Article 19 of Circular 105/2020/TT-BTC, when the tax authority receives transactions for reactivating the legal status of enterprises, cooperatives, branches, representative offices, and business locations from the business registration authority, the cooperative registration authority according to the legal provisions on business registration, cooperative registration on the taxpayer registration application system, the tax authority shall reactivate the TIN for the taxpayer on the day of receiving the transaction.

Accordingly, in line with the regulations, the TIN reactivation for the taxpayer must be executed on the day of receiving the transaction without delay as per the current legal provisions.

Where to download the 2024 Notification form for TIN reactivation in Vietnam?

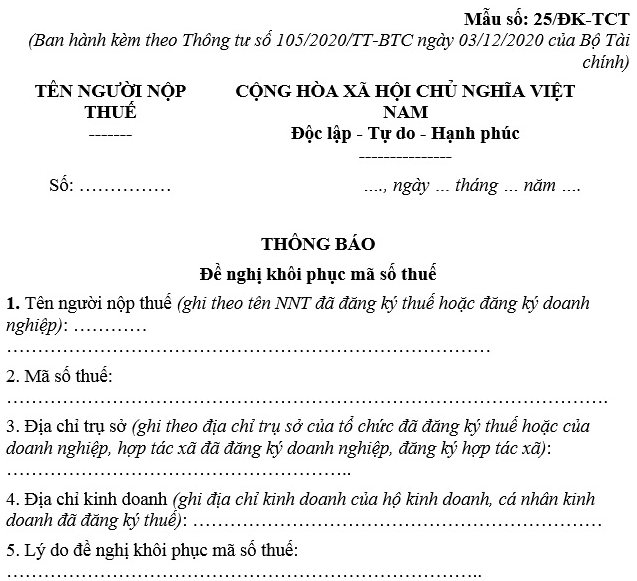

According to Appendix 2 issued with Circular 105/2020/TT-BTC, there is a provision for the notification form requesting the TIN reactivation Form No. 25/ĐK-TCT 2024 as follows:

Form No. 25/ĐK-TCT 2024 notification form for TIN reactivation as follows:

Download the Notification Form for requesting the reactivation of TIN Form No. 25/ĐK-TCT 2024.