Does the shutdown lead to the TIN deactivation for the business in Vietnam?

Is the shutdown associated with the TIN deactivation in Vietnam?

Pursuant to Article 39 of the Law on Tax Administration 2019, the regulations are set forth as follows:

TIN deactivation

1. Taxpayers registering with enterprise registration, cooperative registration, or business registration will have their TINs revoked in the following cases:

a) Shutdown or dissolution, bankruptcy;

b) deactivation of the certificate of enterprise registration, certificate of cooperative registration, or certificate of business registration;

c) Division, merger, or consolidation.

2. Taxpayers registering directly with the tax authorities will have their TINs revoked in the following cases:

a) Shutdown without further tax obligations for non-business organizations;

b) Deactivation of the business registration certificate or equivalent license;

c) Division, merger, or consolidation;

d) Receiving notice from the tax authorities that the taxpayer is not operating at the registered address;

e) Individuals who have died, disappeared, or lost civil capacity as prescribed by law;

f) Foreign contractors upon completion of contracts;

g) Contractors, investors participating in petroleum contracts upon completion or transferring all interests in petroleum contracts.

...

Thus, when an enterprise terminates its activities, its TIN will be revoked.

Does the shutdown lead to the TIN deactivation for the business in Vietnam? (Image from the Internet)

What are principles for the TIN deactivation in Vietnam?

Pursuant to Clause 3, Article 39 of the Law on Tax Administration 2019, the principles for the TIN deactivation are stipulated as follows:

- The TIN cannot be used in economic transactions from the date the tax authorities announce its deactivation;

- The TIN of an organization whose validity has been revoked cannot be reused, except for cases provided for in Article 40 of the Law on Tax Administration 2019;

- When the TIN of a business household or individual business is revoked, the TIN of the household representative is not revoked and can be used to fulfill other tax obligations of that individual;

- When an enterprise, economic organization, or other organization or individual revokes their TIN, the substitute TIN must also be revoked;

- When a tax-paying entity which is the parent entity revokes its TIN, the dependent entities must also have their TINs revoked.

Where to submit the application for TIN deactivation in Vietnam?

According to the Appendix issued with Decision 2589/QD-BTC of 2021, the agencies to carry out procedures for the TIN deactivation are as follows:

- TIN deactivation for contractors, investors participating in petroleum contracts, and foreign contractors: Tax Department

- TIN deactivation for economic organizations and other organizations (excluding dependent units): Tax Department/Tax Sub-department

- TIN deactivation for enterprises and cooperatives that are divided, merged, or consolidated; and termination of dependent units of enterprises and cooperatives: Tax Department/Tax Sub-department

- TIN deactivation in the case of division, merger, or consolidation of organizations - For the divided organization, merged organization, and consolidated organization: Tax Department/Tax Sub-department

- TIN deactivation for changes in the operational model of economic organizations and other organizations (Transforming a dependent unit into an independent unit or vice versa) - For the unit before transformation: Tax Department/Tax Sub-department

- TIN deactivation for changes in the operational model of economic organizations and other organizations (transforming an independent unit into a dependent unit of another parent entity) - For the unit before transformation: Tax Department/Tax Sub-department

- TIN deactivation for changes in the operational model of economic organizations and other organizations (Transforming a dependent unit of one parent entity into a dependent unit of another parent entity) - For the unit before transformation: Tax Department/Tax Sub-department

- TIN deactivation of business households and individual businesses: Tax Sub-department.

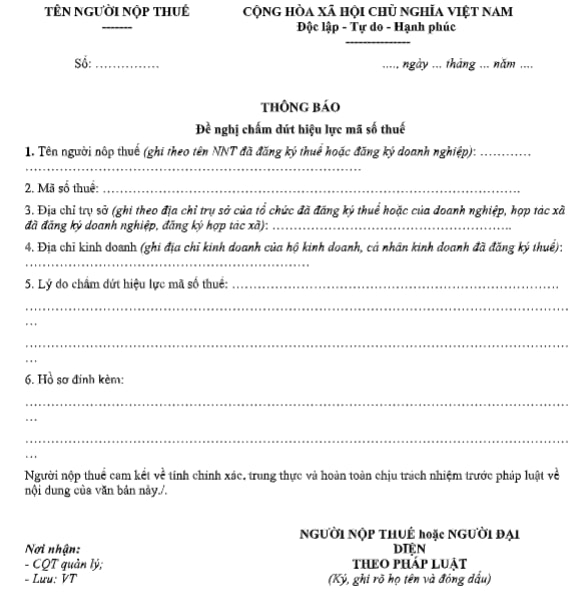

What is the application form for TIN deactivation in Vietnam?

The application for TIN deactivation is stipulated in form Number 24/DK-TCT, issued with Circular 105/2020/TT-BTC, as set out in Article 38 and Article 39 of the Law on Tax Administration 2019.

Download form 24/DK-TCT, a application for TIN deactivation: Here