Does a cooperative in Vietnam use a TIN with 10 or 13 digits?

Does a cooperative in Vietnam use a TIN with 10 or 13 digits?

Pursuant to Article 5 of Circular 105/2020/TT-BTC which stipulates the structure of TINs as follows:

Structure of TINs

1. Structure of the TIN

N1N2 N3N4N5N6N7N8N9 N10 - N11N12N13

Where:

- The first two digits N1N2 represent the tax region code.

- The seven digits N3N4N5N6N7N8N9 are established according to a specified structure, sequentially increasing from 0000001 to 9999999.

- The digit N10 is a check digit.

- The three digits N11N12N13 are serial numbers from 001 to 999.

- The hyphen (-) is a character separating the first 10 digits from the last 3 digits.

2. The business identification number, cooperative identification number, and identification number of the dependent unit of enterprises or cooperatives, as per the law on business registration and cooperative registration, are the TINs.

3. Classification of TIN Structure

a) A 10-digit TIN is used for enterprises, cooperatives, organizations with legal status or organizations without legal status but directly arising tax obligations; representatives of households, business households, and other individuals (hereinafter referred to as independent units).

b) A 13-digit TIN, with a hyphen (-) used to separate the first 10 digits from the last 3, is used for dependent units and other entities.

...

The 10-digit TIN is used for cooperatives, organizations with legal status, or organizations without legal status but directly incurring tax obligations.

Therefore, according to the aforementioned regulations, cooperatives will use a 10-digit TIN.

Does a cooperative in Vietnam use a TIN with 10 or 13 digits? (Image from the Internet)

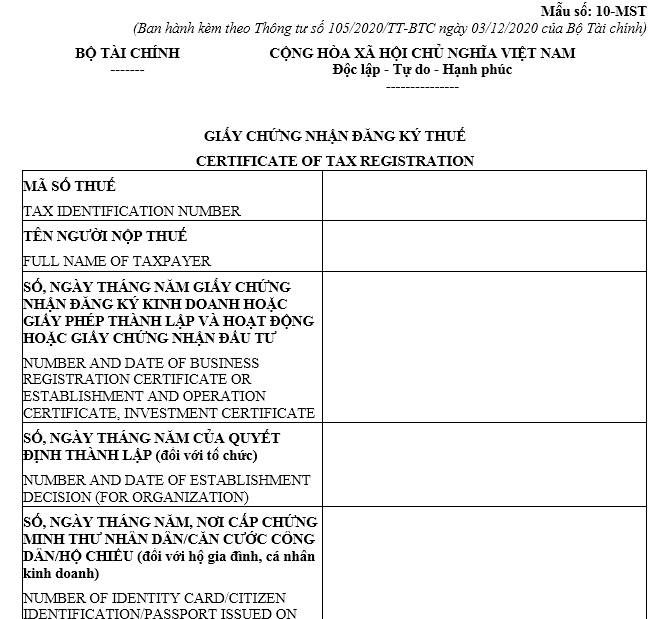

What is the Form 10-MST - Form for the certificate of tax registration in Vietnam?

Pursuant to Article 8 of Circular 105/2020/TT-BTC which provides regulations as follows:

Issuance of certificate of tax registration and Tax Identification Notification

The certificate of tax registration and Tax Identification Notification are issued to taxpayers according to Clauses 1 and 2 of Article 34 of the Law on Tax Administration and the following regulations:

1. certificate of tax registration for organizations, business households, and individual businesses

The "certificate of tax registration" form number 10-MST attached to this Circular is issued by the tax authority to organizations, business households, and individual businesses not falling within the provisions of Clauses 2, 3, and 4 of this Article.

2. certificate of tax registration for individuals

a) The "certificate of tax registration for individuals" form number 12-MST attached to this Circular is issued by the tax authority to individuals who submit their taxpayer registration forms directly to the tax authority as specified in Points b.1, b.2, b.4, b.5 of Clause 9, Article 7 of this Circular.

b) The "Individual Tax Identification Notification" form number 14-MST attached to this Circular is notified by the tax authority to the income-paying agency to carry out taxpayer registration in accordance with Point a of Clause 9, Article 7 of this Circular.

The income-paying agency has the responsibility to notify the individual’s TIN or the reason for not issuing a TIN so that individuals can adjust and supplement their information. The income-paying agency resubmits the taxpayer registration application to the tax authority to obtain a TIN for individuals as prescribed.

c) If an individual authorizes taxpayer registration to the income-paying agency or registers through tax declaration files as prescribed in Points a and b.3, Clause 9, Article 7 of this Circular, a proposal document to issue the “certificate of tax registration for individuals” form 32/ĐK-TCT attached to this Circular is sent to the tax authority that issued the TIN. The tax authority will issue the "certificate of tax registration for individuals," except as specified in Point b, Clause 4 of this Article.

3. Notification of dependent’s TIN

a) The "Dependent’s Tax Identification Notification" form number 21-MST attached to this Circular is issued by the tax authority to individuals directly registering taxpayers for dependents pursuant to Point b, Clause 10, Article 7 of this Circular.

b) The "Authorization Notification of Dependent’s Tax Identification for Taxpayer Registration to the Income-Paying Agency" form number 22-MST attached to this Circular is notified by the tax authority to the income-paying agency to carry out taxpayer registration for dependents in accordance with Point a, Clause 10, Article 7 of this Circular.

The income-paying agency is responsible for notifying the dependent’s TIN or the reason for not issuing a TIN so that dependents can adjust and supplement their information. The income-paying agency resubmits the taxpayer registration application to the tax authority to obtain a TIN for dependents as prescribed.

4. Tax Identification Notification

The "Tax Identification Notification" form number 11-MST attached to this Circular is issued by the tax authority to organizations and individuals as follows:

a) Organizations and individuals register taxpayers for withholding tax and substitute tax payments as regulated in Clause 6, Article 7 of this Circular.

b) Individuals register taxpayers through tax declaration files as specified in Point b.3, Clause 9, Article 7 of this Circular. If the tax authority calculates the tax and issues a Payment Notice in accordance with the tax management law, the issued TIN is recorded in the Payment Notice.

5. The tax authority processes the initial taxpayer registration dossier and returns the results as the certificate of tax registration and Tax Identification Notification to the taxpayer no later than 03 (three) working days from the date the tax authority receives the complete dossier from the taxpayer.

Thus, the sample for the certificate of tax registration Form 10-MST is as follows:

>>> Download the certificate of tax registration Form 10-MST.

What are regulations on the use of the 10-Digit TIN in Vietnam?

The use of TINs in general and the 10-digit TIN specifically is enforced under Article 35 of the Law on Tax Administration 2019. Specifically:

- Taxpayers must record the issued TIN on invoices, documents, and materials when:

+ Engaging in business transactions;

+ Opening deposit accounts at commercial banks or other credit institutions;

+ Declaring taxes, paying taxes, applying for tax exemptions, reductions, refunds, non-collections, and registering customs declarations;

+ Conducting other tax-related transactions concerning all obligations to the state budget, even if taxpayers are operating production or businesses in multiple regions.

- Taxpayers must provide the TIN to relevant agencies or organizations or record the TIN on documents when processing administrative procedures through integrated portal mechanisms with tax management agencies.

- Tax managing agencies, the State Treasury, commercial banks collaborating on state budget collections, and organizations authorized by tax agencies to collect taxes, use the taxpayer's TIN in tax management and to collect taxes into the state budget.

- Commercial banks or other credit institutions must record the TIN in account opening documents and transaction papers through the taxpayer's account.

- Other organizations or individuals engaged in tax management must use the taxpayer's issued TIN when providing information related to determining tax obligations.

- When Vietnamese entities pay to foreign organizations or individuals engaging in cross-border business activities on a digital intermediary platform without a presence in Vietnam, the already-issued TIN must be used for withholding and substitute tax payments.

- When the personal identification number is issued to all residents, the personal identification number will be used instead of the TIN.