Do enterprises receiving compensation pay VAT in Vietnam?

Do enterprises receiving compensation pay VAT in Vietnam?

Based on Clause 1, Article 5 of Circular 219/2013/TT-BTC, regulations on cases of exemption declaring and paying VAT are specified as follows:

Cases of exemption declaring and paying VAT

1. Organizations and individuals receiving compensation payments in cash (including compensation for land and assets on land when land is repossessed by a decision of a competent State agency), bonuses, support funds, emissions rights transfers, and other financial receipts.

Business establishments receiving compensation, bonuses, support funds, emission rights transfers, and other financial receipts must issue receipts according to regulations. For business establishments making payments, the purpose of the payment is the basis for issuing payment receipts.

In cases where compensation is made in goods or services, the compensating entity must issue invoices and declare, calculate, and pay VAT as for selling goods and services; the entity receiving compensation declares and deducts according to regulations.

In cases where a business establishment receives money from an organization or individual to perform services for that organization or individual such as repair, warranty, promotion, advertising, they must declare, and pay taxes according to regulations.

Example 10: P&C Co., Ltd. receives interest from purchasing bonds and dividends from purchasing shares of other enterprises. P&C Co., Ltd. does not have to declare or pay VAT on the interest from purchasing bonds and received dividends.

Example 11: Enterprise A receives a compensation of 50 million VND for contract cancellation from Enterprise B, Enterprise A must issue a receipt and does not have to declare or pay VAT on the above amount.

Example 12: Enterprise X purchases goods from Enterprise Y, Enterprise X has advanced an amount to Enterprise Y and is paid interest on the advance amount by Enterprise Y. Enterprise X does not have to declare or pay VAT on the received interest.

Example 13: Enterprise X sells goods to Enterprise Z, the total payment price is 440 million VND. According to the contract, Enterprise Z pays late over 3 months with an interest rate of 1%/month/total price of the contract. After 3 months, Enterprise X receives a total contract payment of 440 million VND and late payment interest of 13.2 million VND (440 million VND x 1% x 3 months) from Enterprise Z. Enterprise X does not have to declare or pay VAT on the 13.2 million VND.

Example 14: Insurance Enterprise A and Company B sign an insurance contract with monetary insurance. When a risk covered by the insurance occurs, insurer A compensates Company B in cash as per the insurance laws. Company B does not have to declare or pay VAT on the received insurance compensation.

Example 15: ABC Milk Joint Stock Company allocates money to distributors (legal entities, business individuals) for promotional programs (according to commercial promotion laws), marketing, and product display for the Company. When the distributors receive this money to perform services for the Company, if the distributor is a VAT taxpayer under the deduction method, they issue a VAT invoice and calculate VAT at the rate of 10%. If the distributor is a VAT taxpayer under the direct method, they use a sales invoice and determine the payable tax amount as a percentage (%) of revenue as prescribed.

...

When the enterprise receives the compensation payment, they must issue a receipt according to regulations.

In cases where compensation is made in goods or services, the compensating firm must issue an invoice and declare, calculate, and pay VAT as for selling goods or services; the entity receiving compensation declares and deducts according to regulations.

Therefore, enterprises receiving compensation payments do not need to pay VAT.

Example 11: Enterprise A receives a compensation of 50 million VND for contract cancellation from Enterprise B, they issue a receipt and do not have to declare or pay VAT for this amount.

Do enterprises receiving compensation pay VAT in Vietnam? (Image from the Internet)

When is the time to determine VAT on goods in Vietnam?

Article 5 of Decree 209/2013/ND-CP regulates the timing of determining value-added tax as follows:

Time to determine value-added tax

1. The time to determine value-added tax for goods is when the ownership or usage rights of goods are transferred to the buyer, regardless of whether the payment has been received.

2. The time to determine value-added tax for services is when the service provision is completed or when the service provision invoice is issued, regardless of whether payment has been received.

3. The Ministry of Finance provides specific guidance on the time of value-added tax determination for some specific cases.

Therefore, the time of determining VAT on goods is when the ownership or usage rights of goods are transferred to the buyer, regardless of whether the payment has been received.

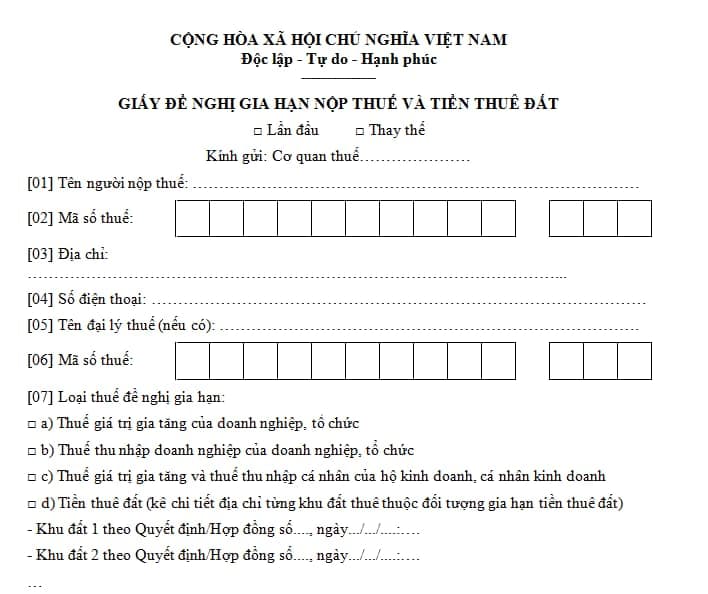

What is the application form for deadline extension of VAT payment in Vietnam?

In the Appendix issued with Decree 64/2024/ND-CP, the application form for deadline extension of VAT payment is specified as follows:

Download the application form for deadline extension of VAT payment 2024.