Can the VNeID account be used to log in to the GDT’s web portal at thuedientu.gdt.gov.vn?

Can the VNeID account be used to log in to the GDT’s web portal at thuedientu.gdt.gov.vn?

Based on point b, clause 1, Article 10 of Circular 19/2021/TT-BTC (as supplemented by clause 1, Article 1 of Circular 46/2024/TT-BTC and rectified by Section 2 of Official Dispatch 9166/BTC-TCT of 2024), regulations regarding the registration for e-tax transactions are as follows:

Registration for e-tax transactions

1. Register for an e-tax transaction account with the tax authority via the General Department of Taxation's e-portal

....

b) Procedure for registering and obtaining an e-tax transaction account with the tax authority via the General Department of Taxation’s e-portal.

b.3. For taxpayers who are individuals and have registered and activated a level 2 e-identification account following the regulations in clause 2, Article 10, clause 2, Article 11, and Article 14 of Decree No. 69/2024/ND-CP dated June 25, 2024, by the Government of Vietnam on e-identification and authentication; moreover, if the e-identification, authentication system, and the General Department of Taxation's e-portal are connected and operational, the taxpayer as an individual may use the e-identification account as a substitute for presenting a citizen identification card.

...

Taxpayers who have registered and activated a level 2 e-identification account may use the VNeID account as a substitute for presenting an ID/CCCD/Passport to proceed with registering and obtaining an e-tax transaction account with the tax authority.

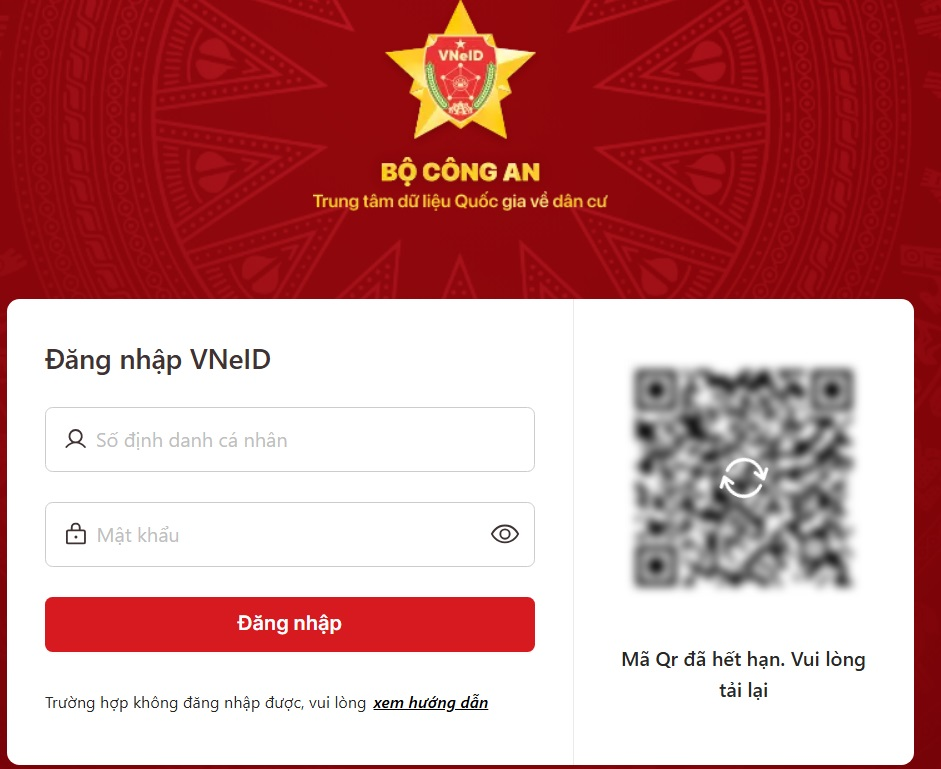

Can the VNeID account be used to log in to the GDT’s web portal at thuedientu.gdt.gov.vn? (Image from the Internet)

How to log in to thuedientu.gdt.gov.vn using a VNeID account?

Step 1: Visit https://thuedientu.gdt.gov.vn and select the personal section.

Step 2: Click the login box at the top right corner.

Step 3: Choose to log in using an e-identification account.

Step 4: Log in using personal account credentials or scan the QR code with the VNeID application to log in.

How many levels of identification does the VNeID account have?

According to clause 1, Article 20 of Decree 69/2024/ND-CP, the e-identification and authentication system provides four levels of authentication for e-identification accounts or VNeID accounts including:

- Level 01: Authentication of the e-identification account is based on one authentication factor as specified in clause 7, Article 3 of Decree 69/2024/ND-CP and corresponding authentication means specified in clause 8, Article 3 of Decree 69/2024/ND-CP, excluding biometric information.

- Level 02: Authentication of the e-identification account is based on two different authentication factors as specified in clause 7, Article 3 of Decree 69/2024/ND-CP and the corresponding authentication means specified in clause 8, Article 3 of Decree 69/2024/ND-CP, excluding biometric information.

- Level 03: Authentication of the e-identification account is based on two or more different authentication factors as specified in clause 7, Article 3 of Decree 69/2024/ND-CP, and the corresponding authentication means specified in clause 8, Article 3 of Decree 69/2024/ND-CP, including one biometric information.

- Level 04: Authentication of the e-identification account is based on authentication factors that include at least one biometric factor (facial image, fingerprint, voice, iris), at least one factor owned by the e-identity possessors (ID card, digital device, software), and one factor known by the e-identity possessors (password; secret code; two-dimensional barcode).

Note:

For other e-transaction accounts created by agencies, organizations, or individuals themselves, reference clause 1, Article 20 of Decree 69/2024/ND-CP to classify and identify relevant to each business process or procedure of those agencies, organizations, individuals, or follow specific industry regulations and guidance from competent state management authorities in each domain.

Is registration necessary when conducting e-tax transactions in Vietnam?

According to clause 3, Article 4 of Circular 19/2021/TT-BTC, there are regulations on registering to use e-tax transaction methods. It clearly states that if one wishes to conduct e-tax transactions, they must register following the guidance of the responsible parties, according to the specific regulations as follows:

- Taxpayers conducting e-tax transactions through the General Department of Taxation’s e-portal must register to conduct e-tax transactions in accordance with the provisions in Article 10 of Circular 19/2021/TT-BTC.

- Taxpayers conducting e-tax transactions through the national public service portal, the Ministry of Finance’s e-portal connected with the General Department of Taxation’s e-portal must register according to the guidance of the system's governing agency.

- Taxpayers conducting e-tax transactions through other competent state agency e-portals connected with the General Department of Taxation’s e-portal must register according to the guidance of the competent state agency.

- Taxpayers conducting e-tax transactions through T-VAN service providers, accepted by the General Department of Taxation, connected with the General Department of Taxation’s e-portal, must register to conduct e-tax transactions according to the provisions in Article 42 of Circular 19/2021/TT-BTC.

- Taxpayers wishing to choose e-tax payment through banks or intermediary payment service providers must register following the guidance of the bank or intermediary payment service provider.