Are thermal power plants required to pay environmental protection fees for emissions in Vietnam?

Are thermal power plants required to pay environmental protection fees for emissions in Vietnam?

Based on Article 3 of Decree 153/2024/ND-CP, the regulation is as follows:

Subjects liable for fees and fee payers

1. The subjects liable for environmental protection fees for emissions according to the provisions of this Decree are dust, industrial emissions discharged into the environment that must be treated from projects, production facilities, business, and service facilities required to have an environmental permit according to the law on environmental protection, which includes licensing for emissions discharge (hereinafter collectively referred to as emission discharging facilities).

Emission discharging facilities according to the provisions of this Decree include:

a) Iron, steel, metallurgy production facilities (excluding rolling, drawing, casting from raw billets);

b) Basic inorganic chemical production facilities (excluding industrial gases), inorganic fertilizers and nitrogen compounds production facilities (excluding blending, bottling, packaging), chemical pesticide production facilities (excluding blending, bottling);

c) Oil refining, petrochemical facilities;

d) Recycling, treating domestic solid waste, common industrial solid waste, hazardous waste facilities; using imported scrap from abroad as production materials;

dd) Coke production, coal gas production facilities;

e) Thermal power plants;

g) Cement production facilities;

h) Other production, business, and service facilities that emit industrial dust, emissions not included in points a, b, c, d, đ, e, and g of this clause.

2. The fee payers for environmental protection regarding emissions as stipulated in this Decree are the emission discharging facilities defined in clause 1 of this Article.

Thus, it can be seen that thermal power plants are among the subjects required to pay environmental protection fees for emissions.

Are thermal power plants required to pay environmental protection fees for emissions in Vietnam? (Image from the Internet)

How to calculate the environmental protection fee for emissions payable during the period in Vietnam?

Based on Article 5 of Decree 153/2024/ND-CP, the regulation on the method of calculating environmental protection fees for emissions is as follows:

- The environmental protection fee for emissions payable during the fee-paying period is calculated using the following formula: F = f + C.

Where:

+ F is the total fee payable in the fee-paying period (quarterly or annually).

+ f is the fixed fee stipulated in clause 1 of Article 6 of Decree 153/2024/ND-CP (quarterly or annually).

+ C is the variable fee, calculated quarterly.

The variable fee of the emission discharging facility (C) is the total variable fee for each emission line (Ci) determined by the formula: C = ΣCi.

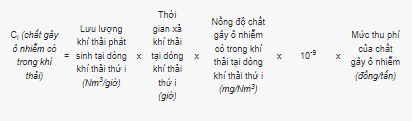

The variable fee for each emission line (Ci) equals the total variable fee of the pollutants specified in clause 2 of Article 6 Decree 153/2024/ND-CP present in the emissions at each emission line (i) determined by the formula:

Ci = Ci (Dust) + Ci (SOx) + Ci (NOx) + Ci (CO)

The variable fee for each pollutant present in the emissions at each emission line (i) is determined as follows:

*Where:

+ The emission discharge time at emission line i is the total emission discharge time during the fee calculation period at emission line i as declared by the fee payer.

+ The discharge flow rate and concentration of each pollutant in the emissions at each emission line occurring during the fee-paying period are determined as follows:

+ For emission discharging facilities conducting periodic monitoring: The discharge flow rate is determined according to the flow recorded in the environmental license; the concentration of each pollutant in the emissions is determined based on periodic monitoring data every three months as stipulated in Article 98 Decree 08/2022/ND-CP.

(i) In case the emission discharging facility conducts periodic monitoring every six months as stipulated in Article 98 Decree 08/2022/ND-CP, the declaration and calculation of the fee for the quarter when monitoring is not conducted is based on previous monitoring data.

(ii) For emission discharging facilities conducting automatic and continuous monitoring: The discharge flow rate and concentration of each pollutant in the emissions are determined according to the average value of the measurement results (according to the technical characteristics of each type of equipment).

- For emission discharging facilities subject to automatic and continuous emissions monitoring or periodic emissions monitoring under an environmental license (hereinafter referred to as subjects required to monitor emissions): The environmental protection fee for emissions payable is the total fee payable (F) determined according to the formula stipulated in clause 1 of Article 5 Decree 153/2024/ND-CP.

- For emission discharging facilities not subject to emissions monitoring: The environmental protection fee for emissions payable is the fixed fee rate (f) stipulated in clause 1 of Article 6 Decree 153/2024/ND-CP.

What is the fee rate for environmental protection concerning dust emissions in Vietnam in 2025?

Based on Article 6 of Decree 153/2024/ND-CP, the regulation on the fee rate for environmental protection concerning emissions from 2025 is as follows:

- For emission discharging facilities not subject to emissions monitoring:

The fixed fee rate (f): VND 3,000,000/year. In case the fee payer pays quarterly, the quarterly fee rate is f/4.

In the case of emission discharging facilities newly operating from the effective date of this Decree or facilities operating before the effective date of this Decree: The fee payable = (f/12) x fee calculation time (months).

Where the fee calculation time is the time from the month following the month the Decree comes into effect (applies to facilities operating before the effective date) or the starting month of operation (applies to facilities operating after the effective date of this Decree) to the end of the quarter or year.

- For emission discharging facilities subject to emissions monitoring:

+ The fixed fee rate (f) is implemented according to the provisions in clause 1 of Article 6 Decree 153/2024/ND-CP.

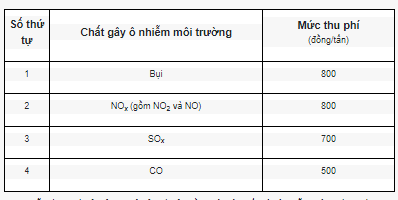

+ The variable fee rate for pollutants in emissions is as follows:

+ For each emission line at the emission discharging facility, if the average concentration of a pollutant in the emissions (calculated within the fee-paying period) is less than 30% compared to the concentration of that pollutant specified in the environmental technical regulations on emissions or local government regulations (if any): The variable fee rate for that substance equals 75% of the fee payable calculated according to the formula specifying the variable fee for each pollutant in the emissions line as regulated in point c, clause 1 of Article 5 Decree 153/2024/ND-CP.

+ For each emission line at the emission discharging facility, if the average concentration of a pollutant in the emissions (calculated within the fee-paying period) is 30% or more below the concentration of that pollutant specified in the environmental technical regulations on emissions or local government regulations (if any): The variable fee rate for that substance is 50% of the fee payable calculated according to the formula specifying the variable fee for each pollutant in the emissions line as regulated in point c, clause 1 of Article 5 Decree 153/2024/ND-CP.

The basis for determining the fee rate specified in point c, point d of clause 2, Article 5 Decree 153/2024/ND-CP is the result of emissions monitoring (automatic, continuous, or periodic) and the environmental technical regulations on emissions or local government regulations on pollutant concentrations in emissions (if any).

Thus, it can be noted that the fee rate for environmental protection concerning dust emissions in 2025 is VND 800 per ton of emissions released into the environment.