Are there penalties for supplementing tax returns in Vietnam?

Are there penalties for supplementing tax returns in Vietnam?

Pursuant to Article 9 of Decree 125/2020/ND-CP, the regulations are as follows:

Cases not subject to administrative penalties for tax and invoice violations

1. Administrative penalties for tax and invoice violations shall not be imposed in the cases where administrative penalties are not applied according to the regulations of the law on handling administrative violations.

Taxpayers who are late in performing tax and invoice procedures via electronic methods due to technical issues of the information technology system as announced on the electronic portal of the tax authority are considered to have committed violations due to force majeure events as stipulated in Clause 4, Article 11 of the Law on Handling Administrative Violations.

2. No administrative penalties for tax violations and no late payment interest on tax shall be imposed on taxpayers who violate tax administration regulations due to acting according to guidance documents or handling decisions of tax authorities or other state authorities related to tax obligation determination (including guidance documents or handling decisions issued before this Decree takes effect), except in cases where tax inspections at the taxpayer's headquarters did not identify errors in tax return, determination of payable tax amounts, or exempted/reduced/refunded tax amounts, but afterwards, the tax administrative violations were detected.

3. No administrative penalties for tax violations shall be imposed on cases where taxpayers declare incorrectly, then submit supplementary tax returns, and voluntarily pay the full amount of tax due before the tax authority announces a decision to inspect or audit tax at the taxpayer's headquarters, before the tax authority discovers the errors without inspection or audit, or before another competent authority discovers the errors.

4. No administrative penalties for tax procedure violations shall be imposed on individuals directly finalizing personal income tax who are late in submitting the tax finalization dossier, resulting in a refundable tax amount; on business households and individual businesses whose taxes have been determined according to Article 51 of the Law on Tax Administration.

5. No penalties for late submission of tax returns shall be imposed during the period the taxpayer is granted an extension for submitting the tax return.

Therefore, taxpayers who have supplemented tax returns upon discovering errors and voluntarily paid the full amount of tax due before the tax authority announces a decision to inspect or audit tax at their headquarters, or before the tax authority discovers the errors without inspection or audit, or before another competent authority discovers the error, will not be penalized.

Are there penalties for supplementing tax returns in Vietnam? (Image from the Internet)

Vietnam: What does a supplementary tax returns include?

According to the regulations in Article 47 of the Law on Tax Administration 2019, the supplementary tax return dossier includes:

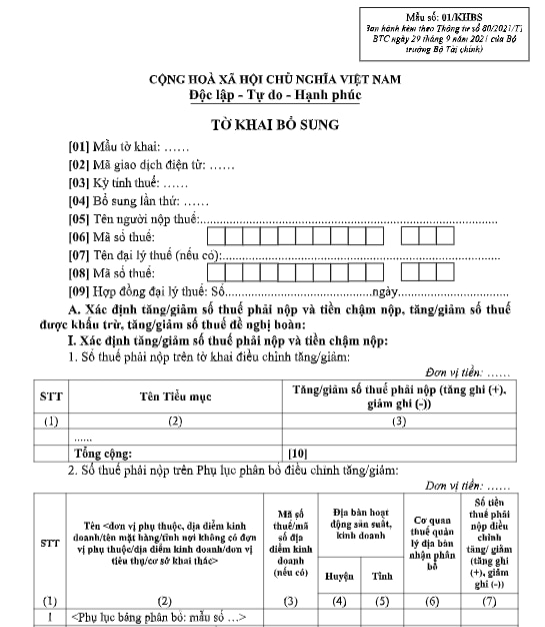

(1) The supplementary declaration form according to Form 01/KHBS issued with Circular 80/2021/TT-BTC:

Download the supplementary declaration form here

(2) An explanatory document for the supplementary declaration and related documents.

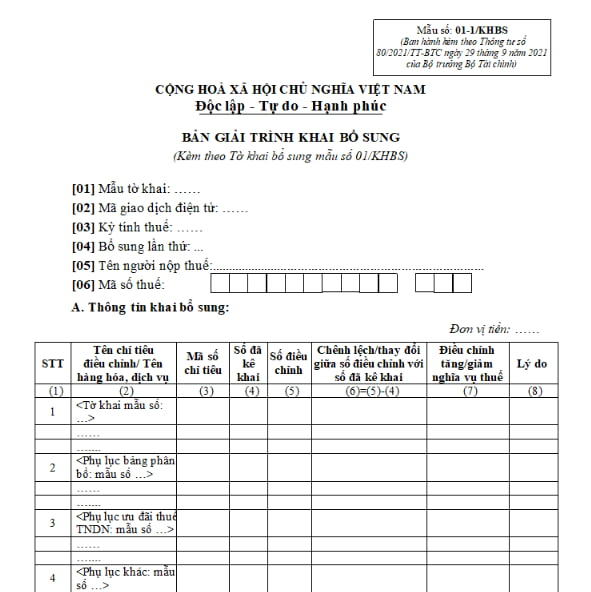

The explanatory document for the supplementary declaration, Form No. 01-1/KHBS in Appendix II issued with Circular 80/2021/TT-BTC is as follows:

Download the explanatory document for the supplementary tax return here

Vietnam: How to submit supplementary tax returns when errors are discovered?

According to Clause 4, Article 7 of Decree 126/2020/ND-CP, taxpayers are allowed to submit an supplementary declaration for each erroneous tax return.

Submit the supplementary declaration as follows:

- In cases where the supplementary declaration does not change the tax obligation, only the explanatory document and related documents need to be submitted, not the supplementary declaration form.

- If the annual tax finalization report has not been submitted, taxpayers submit supplementary monthly or quarterly tax return dossiers with errors and simultaneously aggregate the supplementary data in the annual tax finalization report.

- If the annual tax finalization report has been submitted, only the annual tax finalization report needs to be supplemented; concurrently, in cases of the personal income tax finalization declaration for organizations and individuals paying income from wages and salaries, the corresponding erroneous monthly or quarterly declarations must also be supplemented.

- If the supplementary declaration leads to an increase in the payable tax amount or a decrease in the previously refunded tax amount, the taxpayer must pay the increased payable tax amount or the excessively refunded tax amount and any late payment interest to the state budget (if any).

In cases where the supplementary declaration only adjusts the amount of refundable value-added tax carried forward to the next period, the adjustment must be declared in the current tax period. Taxpayers are only allowed to supplement the increased amount of refundable value-added tax when the tax return dossier for the subsequent tax period has not been submitted and the tax refund request dossier has not been submitted.