Are revenues collected by educational institutions of catering service providers subject to VAT in Vietnam?

Are revenues collected by educational institutions of catering service providers subject to VAT in Vietnam?

Pursuant to Clause 13, Article 4 of Circular 219/2013/TT-BTC, the regulations are as follows:

Objects not subject to VAT

...

13. Teaching, vocational training as prescribed by law including language teaching, IT; teaching dance, singing, painting, music, drama, circus, gymnastics, sports; child care and teaching other vocations aimed at raising cultural, professional knowledge, skills.

In cases where educational institutions from kindergarten to high school collect fees for meals, student transportation, and other fees in the form of collecting on behalf or paying on behalf, then the meal fees*, student transportation fees, and these collected or paid fees are also not subject to tax.*

Income from boarding fees of students, training activities (including the organization of examinations and issuance of certificates within the training process) provided by the training institution is not subject to VAT. In cases where the training institution does not directly organize training but only organizes examinations and issues certificates within the training process, these activities are also not subject to VAT. If providing examination services and issuing certificates not within the training process, they are subject to VAT.

Example 7: Training Center X is authorized to provide training to issue insurance agent practicing certificates. Training Center X delegates the training task to Unit Y, while Training Center X organizes the examination and issuance of insurance agent practicing certificates. Therefore, these activities at Training Center X are not subject to VAT.

...

Thus, a catering service provider for students in schools and having revenues collected by educational institutions on its behalf is not subject to value-added tax.

When is the timing for determining VAT on services in Vietnam?

Article 5 of Decree 209/2013/ND-CP regulates the timing for determining value-added tax as follows:

Timing for determining value-added tax

1. The timing for determining VAT on goods is when ownership or use rights are transferred to the buyer, regardless of whether payment has been collected.

2. The timing for determining VAT on services is when the service is completed or when the service invoice is issued, regardless of whether payment has been collected.

3. The Ministry of Finance provides specific guidance on the timing for determining VAT for certain particular cases.

Thus, the timing for determining VAT on services is when the service is completed or when the service invoice is issued, regardless of whether payment has been collected.

Are revenues collected by educational institutions of catering service providers subject to VAT in Vietnam? (Image from the Internet)

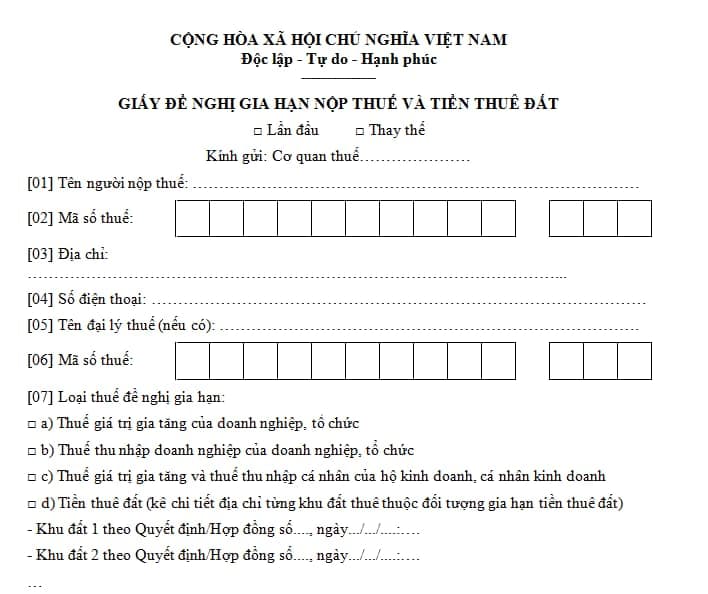

What is the form for VAT referral in Vietnam?

The Appendix issued together with Decree 64/2024/ND-CP provides the form for VAT referral as follows:

Download the request form for the extension of VAT payment 2024.

When is the VAT payment deadline in Vietnam for the third quarter of 2024?

According to Article 55 of Tax Management Law 2019, the timing for VAT payment is regulated as follows:

Time limit for tax payment

1. In cases of self-assessment by the taxpayer, the payment must be made no later than the last day of the tax declaration submission deadline. If there is a revised tax return, the payment must be made within the deadline of the tax period relevant to the mistake.

For corporate income tax, it is paid quarterly, with the latest payment deadline being the 30th day of the first month of the following quarter.

The VAT payment deadline for the quarterly tax period is the last day of the tax declaration submission deadline.

According to Article 44 of the Tax Management Law 2019, the VAT payment deadline for the quarterly tax period is no later than the last day of the first month of the quarter following the quarter in which the tax obligation arises.

Simultaneously, based on Article 4 of Decree 64/2024/ND-CP regulating the extension of tax payment and land rent:

Extension of tax payment and land rent

1. For value-added tax (except VAT on import)

...

Enterprises, organizations subject to extension shall declare and submit monthly, quarterly VAT returns under current law. Still, they are not required to pay the VAT arising on the declared VAT return. The Payment deadlines for extended VAT are as follows:

...

The VAT payment deadline for the tax period of the third quarter of 2024 is no later than December 31, 2024.

...

According to the above regulation, the deadline for filing and paying VAT for the third quarter of 2024 is no later than December 31, 2024.