Are personal income taxpayers facing difficulties due to storms eligible for tax reduction in Vietnam?

Are personal income taxpayers facing difficulties due to storms eligible for tax reduction in Vietnam?

According to the regulations in Article 5 of the Personal Income Tax Law 2007:

Tax reduction

Taxpayers facing difficulties due to natural disasters, fires, accidents, serious illnesses affecting their tax payment ability shall be considered for tax reduction corresponding to the extent of damage, but not exceeding the amount of tax payable.

In cases where individual taxpayers encounter difficulties due to natural disasters impacting their ability to pay taxes, they will be considered for a tax reduction corresponding to the extent of the damage.

However, the reduction cannot exceed the tax payable.

Additionally, the tax authority will notify and decide on tax exemptions and reductions according to Article 52 of Circular 80/2021/TT-BTC, which stipulates that the tax authority shall notify and decide on tax exemptions and reductions in the following cases:

- Exemption from personal income tax on income specified in Clauses 1, 2, 3, 4, 5, and 6 of Article 4 of the Personal Income Tax Law 2007;

- Tax reduction according to regulations for individuals, business households, and individual businesses facing difficulties due to natural disasters, fires, accidents, serious illnesses affecting their tax payment ability;

- Special consumption tax reduction for taxpayers producing goods subject to special consumption tax facing difficulties due to natural disasters or unexpected accidents according to special consumption tax law;

- Exemption and reduction of resource tax for taxpayers encountering disasters, fires, or unexpected accidents causing losses to the declared and paid resources;- Exemption and reduction of non-agricultural land use tax;

- Exemption and reduction of agricultural land use tax according to the Agricultural Land Use Tax Law and National Assembly Resolutions;

Based on the regulations, individual taxpayers facing difficulties due to storms affecting their tax payment ability will be considered for tax reduction.

Are personal income taxpayers facing difficulties due to storms eligible for tax reduction in Vietnam? (Image from the Internet)

How do individual taxpayers in Vietnam determine the tax reduction due to storms?

According to Article 4 of Circular 111/2013/TT-BTC, regulations on tax reductions due to storms are as follows:

The determination of the personal income tax reduction due to storms is as follows:

- The consideration for tax reduction is carried out based on the tax year. Taxpayers facing difficulties due to natural disasters, fires, accidents, or serious illnesses in any tax year will be considered for a reduction of tax payable for that tax year.

- The amount of tax payable used as the basis for considering tax reduction is the total personal income tax payable by the taxpayer in the tax year, including:

+ Personal income tax already paid or deducted for income from capital investment, capital transfer, real estate transfer, winnings, royalties, franchise, inheritance, and gifts.

+ Personal income tax payable for income from business and income from wages and salaries.

- The basis for determining the extent of the damage entitled to tax reduction is the total actual expenses incurred to overcome the damage minus (-) any compensation received from an insurance organization (if any) or from the organization or individual causing the accident (if any).

- The tax reduction amount is determined as follows:

+ In case the tax payable in the tax year is greater than the extent of the damage, the tax reduction is equal to the extent of the damage.

+ In case the tax payable in the tax year is less than the extent of the damage, the tax reduction is equal to the tax payable.

What documents do individual taxpayers in Vietnam need to prepare for a tax reduction due to storms?

According to Article 54 of Circular 80/2021/TT-BTC, individual taxpayers seeking a tax reduction due to storms need to prepare the following documents:

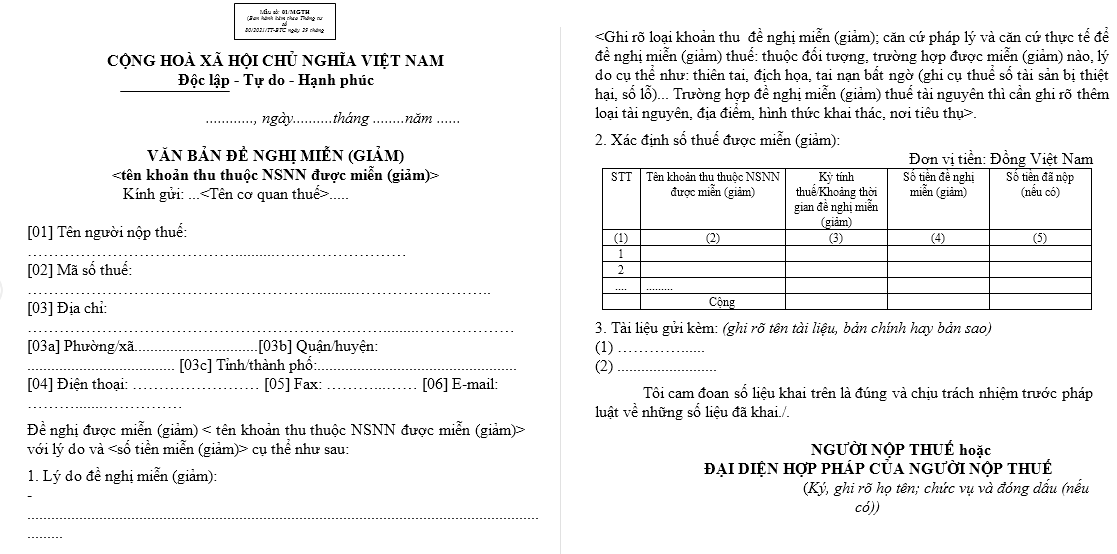

[1] Proposal letter as per Form No. 01/MGTH Download issued with Appendix I of Circular 80/2021/TT-BTC;

[2] Minutes determining the extent and value of the damage to property by the competent authority and confirmation from the local commune government where the natural disaster or fire occurred according to Form No. 02/MGTH Download issued with Appendix I of Circular 80/2021/TT-BTC. The competent authority determining the extent and value of the damage is the financial authority or inspection bodies that determine the extent and value of the property damage;

[3] In case of damage to goods, the taxpayer must provide an inspection report (inspection certificate) on the extent of the damage from the inspection body, and the inspection body must bear legal responsibility for the accuracy of the inspection certificate according to the relevant laws;

[4] In case of damage to land and crops, the financial authority is responsible for assessment;

[5] Documentation determining the compensation from the insurance authority or settlement agreement on compensation from the party causing the fire (if any);

[6] Vouchers directly related to the expenses for overcoming the natural disaster or fire;

[7] Personal income tax finalization declaration as per Form No. 02/QTT-TNCN Download issued with Appendix II of Circular 80/2021/TT-BTC (if the taxpayer requests a tax reduction for personal income from wages and salaries).

Based on Appendix I of the Form List issued with Circular 80/2021/TT-BTC, the tax reduction proposal form 01/MGTH is as follows:

>>> Download the tax reduction proposal form 01/MGTH.