Are industrial emissions subject to environmental protection fees in Vietnam under the new Decree?

Are industrial emissions subject to environmental protection fees in Vietnam under the new Decree?

Based on Article 88 of the Law on Environmental Protection 2020, it is stipulated as follows:

Management and control of dust and emissions

1. Organizations and individuals engaged in production, business, and services that emit dust and emissions must control and treat dust and emissions to ensure environmental technical standards. Dust with harmful elements exceeding the prescribed threshold must be managed following legal regulations on hazardous waste management.

2. Vehicles, machinery, equipment, and construction works emitting dust and emissions must have filtering devices, emission reduction, shielding equipment, or other measures to minimize dust to ensure environmental technical standards.

3. Relevant Ministries and ministerial-level agencies shall guide the implementation of activities for prevention, inspection, monitoring, and treatment of dust and emission sources that cause air pollution.

According to the above provisions, there are two emission sources causing air pollution that must be managed and controlled: dust and emissions.

Simultaneously, as per Clause 1, Article 3 of Decree 153/2024/ND-CP, it is stated as follows:

Subjects liable to fees and fee payers

1. The subjects liable to environmental protection fees for emissions under this Decree are industrial dust and emissions discharged into the environment that must be treated by projects, production facilities, business, and service providers subject to an environmental license as stipulated by environmental protection law, which includes licensing for emission discharge (hereinafter referred to as emission disposal facilities).

Emission disposal facilities under this Decree include:

a) Iron and steel production, metallurgical facilities (except rolling, drawing, casting from raw materials).

b) Basic inorganic chemical production (except industrial gases), inorganic fertilizers and nitrogen compounds (excluding blending, decanting, packaging), chemical plant protection substances (excluding blending, decanting).

c) Refining and petrochemical facilities.

d) Facilities recycling, treating solid domestic waste, ordinary industrial waste, hazardous waste; using imported scrap from abroad as production materials.

đ) Coke production, gas production facilities.

e) Thermal power plants.

g) Cement production facilities.

h) Other production, business, service facilities emitting industrial dust and emissions not covered under points a, b, c, d, đ, e, and g of this clause.

2. The payer of environmental protection fees for emissions stipulated under this Decree are the emission disposal facilities defined in Clause 1 of this Article.

The subjects liable to environmental protection fees for emissions are the industrial dust and emissions discharged into the environment that must be treated by emission disposal facilities.

Emission disposal facilities under Decree 153/2024/ND-CP include:

Iron and steel production, metallurgical facilities (except rolling, drawing, casting from raw materials).

Basic inorganic chemical production (except industrial gases), inorganic fertilizers and nitrogen compounds (except blending, decanting, packaging), chemical plant protection substances (except blending, decanting).

Refining and petrochemical facilities.

Facilities recycling, treating solid domestic waste, ordinary industrial waste, hazardous waste; using imported scrap from abroad as production materials.

Coke production, gas production facilities.

Thermal power plants.

Cement production facilities.

Other production, business, service facilities emitting industrial dust and emissions not included in points a, b, c, d, đ, e, and g of this clause.

Such emission disposal facilities must have an environmental license as stipulated by environmental protection law, which includes licensing for emission discharge.

Thus, industrial emissions are subject to environmental protection fees under Decree 153/2024/ND-CP when in effect.

Decree 153/2024/ND-CP will take effect from January 05, 2025.

Are industrial emissions subject to environmental protection fees in Vietnam under the new Decree? (Image from the Internet)

What is the fee rate of environmental protection for emissions not subject to air emission monitoring in Vietnam from January 05, 2025?

According to Article 6 of Decree 153/2024/ND-CP, it is stated as follows:

Fee rate

1. For emission disposal facilities not subject to emission monitoring

Fixed fee rate (f): 3,000,000 VND/year. If the payer pays quarterly, the fee rate for one quarter is f/4.

If the emission disposal facility starts operation from the date this Decree takes effect or was operational before the Decree took effect: The payable fee = (f/12) x the fee calculation time (months). Where the fee calculation time is from the month following the implementation month of this Decree (applicable for operating facilities) or the start operation month (applicable for new facilities from the date this Decree takes effect) to the end of the quarter or year.

2. For emission disposal facilities subject to emission monitoring

a) Fixed fee rate (f) is applied as per Clause 1 of this Article.

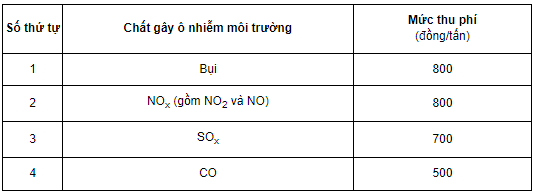

b) Variable fee rate for air pollutants in emissions is as follows:

c) For each emission line of the emission disposal facility, where the average concentration of an environmental pollutant in emissions (calculated during the fee payment period) is less than 30% of the concentration of that substance stipulated in environmental technical standards or local government regulations (if any): The variable fee rate for that pollutant is 75% of the payable fee calculated by the formula for determining the variable fee rate of each environmental pollutant in the emission line specified in point c, Clause 1, Article 5 of this Decree.

d) For each emission line of the emission disposal facility, where the average concentration of an environmental pollutant in emissions is less than 30% or more compared to the concentration of that substance stipulated in environmental technical standards or local government regulations (if any): The variable fee rate for that pollutant is 50% of the payable fee calculated by the formula for determining the variable fee rate of each environmental pollutant in the emission line specified in point c, Clause 1, Article 5 of this Decree.

The basis for determining the fee rate specified in points c, d, Clause 2 of this Article is the emission monitoring results (automatic, continuous or periodic) and environmental technical standards on emissions or local government regulations on pollutant concentrations in emissions (if any).

Thus, the environmental protection fee rate for emissions not subject to air emission monitoring from January 05, 2025, is 3,000,000 VND/year.

What is the method of paying the environmental protection fee for emissions not subject to air emission monitoring in Vietnam?

According to Clause 1, Article 7 of Decree 153/2024/ND-CP, the fee payers shall pay the fee using one of the following methods:

Non-cash: The fee payer transfers the money into the fee collection account of the fee collection organization maintained at a credit institution.

Into the fee pending state budget account of the fee collection organization maintained at the State Treasury.

Into the account of another agency or organization receiving the payment different from the fee collection organization: Within 24 hours, the agency or organization receiving the payment must transfer the total collected fee amount into the fee collection account of the fee collection organization or transfer the total amount into the fee pending state budget account of the fee collection organization.