Are individuals allowed to exploit bambusa balcooa for their daily-life needs exempt from severance tax in Vietnam?

Are individuals allowed to exploit bambusa balcooa for their daily-life needs exempt from severance tax in Vietnam?

Based on the provisions stipulated in Article 9 of the 2009 Law on Severance Tax as amended by Clause 2, Article 4 of the 2014 Law Amending and Supplementing Various Tax Laws regarding tax exemption and reduction, the following applies:

Exemption and Reduction of Taxes

1. Taxpayers who suffer natural disasters, fires, unexpected accidents causing damage to resources that have been declared and paid, will be considered for tax exemption, reduction for the damaged resources; in cases where the tax has already been paid, the amount paid will be refunded or deducted from the severance tax payable for the next period.

2. Exemption of tax for natural seafood.

3. Exemption of tax for branches, tops, firewood, bamboo, bambusa balcooa, mai, giang, reed, bambusa nutans, and bambusa balcooa exploited by individuals for living purposes.

4. Exemption of tax for natural water used for hydroelectric power production by households and individuals for domestic use.

5. Exemption of tax for natural water exploited by households and individuals for domestic use.

6. Exemption of tax for land exploited and used on assigned or leased land areas; land exploited for leveling, construction of security, military, and dike works.

7. Other tax-exempt cases as stipulated by the Standing Committee of the National Assembly.

Simultaneously, at point b, clause 1, Article 51 of Circular 80/2021/TT-BTC the regulation reads as follows:

Procedures for tax exemption dossiers and cases where taxpayers self-determine the amount of exempted or reduced tax

1. Cases where taxpayers self-determine the amount of tax exempted or reduced:

a) Corporate income tax: Taxpayers entitled to preferential tax rates, tax exemption periods, tax reduction, and tax-exempt incomes based on corporate income tax law;

b) severance tax: Organizations and individuals engaged in the exploitation of natural seafood are eligible for severance tax exemption; individuals allowed to exploit branches, tops, firewood, bamboo, reed, bambusa nutans, and bambusa balcooa for living purposes are eligible for severance tax exemption ; natural water exploited by households and individuals for domestic use; natural water used for hydroelectric power production by households and individuals for domestic use; land exploited and used on assigned or leased land areas; land exploited for leveling and construction of security, military, and dike works;

c) License fee: Taxpayers eligible for license fee exemption as stipulated in Article 3 of Decree No. 139/2016/ND-CP dated October 4, 2016, of the Government regulating license fees, Clause 1, Article 1 of Decree No. 22/2020/ND-CP dated February 24, 2020, of the Government amending and supplementing several articles of Decree No. 139/2016/ND-CP dated October 4, 2016, of the Government regulating license fees.

...

Thus, according to the above provisions, individuals allowed to exploit bamboo (including bambusa balcooa) for use are eligible for severance tax exemption.

Are individuals allowed to exploit bambusa balcooa for their daily-life needs exempt from severance tax in Vietnam? (Image from Internet)

What is the form for the proposal of severance tax exemption for individuals allowed to exploit bambusa balcooa in Vietnam?

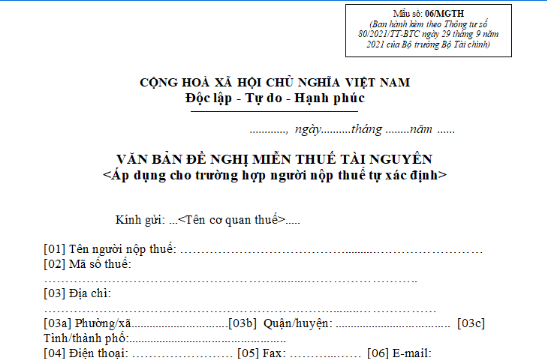

The template for the Proposal for Severance Tax Exemption is stipulated in Section 7, Appendix 1, issued with Circular 80/2021/TT-BTC as Form No. 06/MGTH below:

>> Download the latest 2024 severance tax exemption proposal template for individuals allowed to exploit bambusa balcooa.

*Note: This form applies to cases where taxpayers self-determine.

What is the procedure for severance tax exemption for individuals exploiting bambusa balcooa in Vietnam?

According to the provisions at point b, clause 2, Article 51 of Circular 80/2021/TT-BTC, the procedure and dossier for tax exemption for individuals allowed to exploit bamboo for living use are as follows:

Step 1: Prepare a tax exemption proposal document

Individuals needing to exploit bambusa balcooa for living purposes shall prepare a tax exemption proposal document using Form No. 06/MGTH issued with Appendix 1 Circular 80/2021/TT-BTC.

>> Download the latest 2024 severance tax exemption proposal template for individuals allowed to exploit bambusa balcooa.

Step 2: Obtain confirmation of the document

After completing the tax exemption proposal document according to the prescribed form, individuals need to bring the application to the Commune People's Committee where they reside for confirmation.

Step 3: Submit the document to the Tax Sub-department

Individuals needing to exploit bamboo for living purposes shall submit the tax exemption proposal document confirmed by the Commune People's Committee to the Tax Sub-department where they reside.

The severance tax exemption proposal document must be submitted once before exploitation to the Tax Sub-department.

*Note: Individuals do not need to file monthly severance tax returns and annual severance tax finalization.