Are gasoline-powered cars subject to environmental protection tax in Vietnam?

Are gasoline-powered cars subject to environmental protection tax in Vietnam?

Pursuant to Point a, Clause 1, Article 3 of the Law on Environmental Protection Tax 2010, it is stipulated as follows:

Taxable Objects

1. Gasoline, oil, lubricants, including:

a) Gasoline, excluding ethanol;

b) Jet fuel;

c) Diesel oil;

...

Furthermore, according to Article 2 of Circular 152/2011/TT-BTC, the regulation is as follows:

Non-taxable Objects

1. Goods not specified in Article 3 of the Law on Environmental Protection Tax and guided in Article 2 of Decree No. 67/2011/ND-CP, Article 1 of this Circular are not subject to environmental protection tax.

2. Goods specified in Article 3 of the Law on Environmental Protection Tax and guided in Article 2 of Decree No. 67/2011/ND-CP, Article 1 of this Circular are not taxable in the following cases:

2.1. Goods transported from the exporting country to the importing country through Vietnamese border gates (transit or transshipment via border gates, including cases having been brought into bonded warehouses) but do not carry out import procedures into Vietnam and do not carry out export procedures out of Vietnam.

2.2. Goods transiting through the customs border, Vietnamese border on the basis of an agreement signed between the Government of Vietnam and a foreign government or between organizations, representatives authorized by the Government of Vietnam and a foreign government as prescribed by law.

2.3. Temporarily imported goods for re-export within the prescribed period by law.

2.4. Goods exported abroad by production facilities (including processing) directly for export or by proxy for export businesses to export, except for organizations, households, and individuals purchasing goods subject to environmental protection tax for export.

Therefore, although gasoline is subject to the environmental protection tax, it is not taxable if it falls under the provisions of Clause 2, Article 2 of Circular 152/2011/TT-BTC, such as: Gasoline transported from the exporting country to the importing country through Vietnamese customs (transiting or transferring via border gates, including those brought into bonded warehouses) but do not undertake import procedures into Vietnam and do not undertake export procedures out of Vietnam, or other cases mentioned above.

The environmental protection tax is an indirect tax applied to products and goods that adversely impact the environment when used. The current retail price of gasoline includes the environmental protection tax.

Thus, when operating a gasoline-powered automobile, environmental protection tax is paid on the gasoline product (the retail price of gasoline already includes the environmental protection tax).

Are gasoline-powered cars subject to environmental protection tax in Vietnam? (Image from Internet)

Which form is used for the environmental protection tax declaration when trading gasoline, oil, lubricants in Vietnam?

The environmental protection tax declaration form applied when trading gasoline, oil, lubricants is stipulated in Clause 3, Article 16 of Circular 80/2021/TT-BTC. Specifically:

Tax declaration, calculation, allocation, and payment for environmental protection tax

...

3. Tax declaration, tax payment:

a) For gasoline and oil:

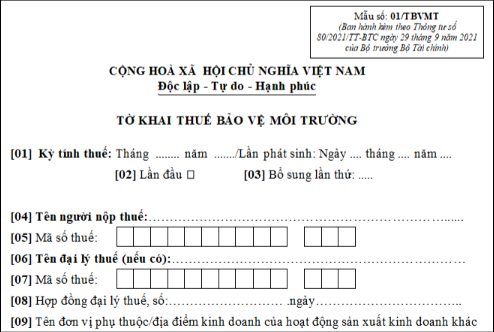

Dependent units of principal traders or dependent units of subsidiaries of principal traders conducting business in a different provincial area from where the principal traders, subsidiaries of principal traders are headquartered without accounting separately for environmental protection tax shall have the principal traders or their subsidiaries declare and submit the environmental protection tax return using Form No. 01/TBVMT, and the appendix allocating the number of environmental protection taxes to be paid for the localities entitled to revenues from gasoline and oil according to Form No. 01-2/TBVMT issued with Appendix II of this Circular to the directly managing tax agency; pay the allocated tax amount to the province where the dependent unit is headquartered according to regulations in Clause 4, Article 12 of this Circular.

b) For domestically extracted and consumed coal:

Enterprises involved in domestic coal extraction and consumption through management and allocation to subsidiaries or dependent units for extraction, processing, and consumption shall have the unit responsible for coal consumption declare tax for the total environmental protection tax amount arising for the extracted coal and submit tax returns using Form No. 01/TBVMT, and the appendix determining the number of environmental protection taxes to be paid for the localities entitled to revenue from coal according to Form No. 01-1/TBVMT issued with Appendix II of this Circular to the directly managing tax authority; pay the allocated amount to the province where the coal extraction company is headquartered according to regulations in Clause 4, Article 12 of this Circular.

According to the above regulations, the environmental protection tax declaration form applied when trading gasoline, oil, lubricants is Form No. 01/TBVMT issued with Circular 80/2021/TT-BTC as follows:

Download The latest environmental protection tax declaration form for trading gasoline, oil, lubricants 2024.

When is the time for calculating the environmental protection tax upon importing gasoline, oil, lubricants to Vietnam?

According to the regulation in Article 9 of the Law on Environmental Protection Tax 2010, the time for calculating the environmental protection tax upon importing gasoline, oil, lubricants is as follows:

Time for Tax Calculation

1. For goods produced and sold, exchanged, or gifted, the time for tax calculation is when ownership or usage rights of the goods are transferred.

2. For goods produced and used internally, the time for tax calculation is when the goods are put into use.

3. For imported goods, the time for tax calculation is when the customs declaration is registered.

4. For gasoline, oil produced or imported for sale, the time for tax calculation is when the principal oil and gasoline trader sells them.

Hence, according to the above regulation, the time for calculating the environmental protection tax upon importing gasoline, oil, lubricants is when the customs declaration is registered.