Are entities selling playing cards in Vietnam required to pay excise tax?

Are entities selling playing cards in Vietnam required to pay excise tax?

Currently, the Vietnamese law does not specify the definition of excise tax. However, based on the taxable and non-taxable objects under Article 2 of the Excise Tax Law 2008 (amended by Clause 1 Article 1 of the Law on Amendments to Excise Tax Law 2014) and Article 3 of the Excise Tax Law 2008, the definition of excise tax may be defined.

Simultaneously, under Article 5 of the Excise Tax Law 2008:

Tax bases

Excise tax bases include the taxed price of a taxable goods or service and the tax rate. The payable excise tax amount is the excise taxed price multiplied by the excise tax rate.

From the synthesis of the above regulations, the excise tax is an indirect tax levied on certain luxury goods and services to regulate production, importation, and societal consumption.

Simultaneously, it strongly regulates the income of consumers, contributing to increasing the State Budget revenue and strengthening business production management for taxable goods and services.

The excise tax is paid by the facilities directly producing the goods, but the consumers pay the tax as it is included in the sale price.

Under Article 2 of the Law on excise tax 2008 and Article 2 of Decree 108/2015/ND-CP, the objects subject to excise tax include:

Taxable objects

1. Goods:

a/ Cigarettes, cigars and other tobacco preparations used for smoking, inhaling, chewing, sniffing or keeping in mouth;

b/ Liquor;

c/ Beer;

d/ Under-24 seat cars, including cars for both passenger and cargo transportation with two or more rows of seats and fixed partitions between passenger holds and cargo holds;

e/ Two- and three-wheeled motorcycles of a cylinder capacity of over 125 cm3;

f/ Aircraft and yachts;

g/ Gasoline;

h/ Air-conditioners of 90,000 BTU or less;

i/ Playing cards;

j/ Votive gilt papers and votive objects.

2. Services:

a/ Dance halls:

b/ Massage parlors and karaoke bars;

c/ Casinos; prize-winning video games, including jackpot and slot games and games on similar machines;

d/ Betting;

e/ Golf business, including the sale of membership cards and golf playing tickets;

f/ Lottery business.

Thus, according to the above regulations, entities selling playing cards in Vietnam are required to pay excise tax.

Are entities selling playing cards in Vietnam required to pay excise tax? (Image from the Internet)

What are the cases of reduction of excise tax on playing cards in Vietnam?

According to Article 9 of the Excise Tax Law 2008, the provisions for tax reduction are as follows:

- Taxpayers that produce excise taxable goods and face difficulties caused by natural disasters or unexpected accidents are entitled to tax reduction.

- The tax reduction level shall be determined based on the actual extent of damage caused by natural disasters or unexpected accidents but must neither exceed 30% of the payable tax amount in the year the damage occurs nor exceed the balance between the value of damaged assets and the received compensation (if any).

Therefore, if the above conditions are met, the excise tax on playing cards will be reduced.

What is the excise tax rate applicable to playing cards in Vietnam?

Article 5 of the Excise Tax Law 2008 provides for the tax bases:

Tax bases

Excise tax bases include the taxed price of a taxable goods or service and the tax rate. The payable excise tax amount is the excise taxed price multiplied by the excise tax rate.

Furthermore, the payable excise tax amount is determined by the following formula:

excise tax payable = Taxable price x Tax rate

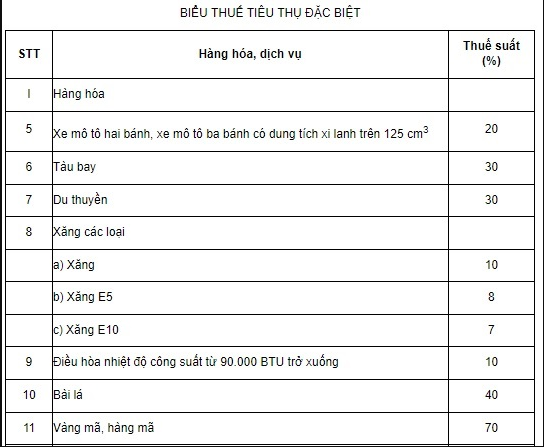

Additionally, according to Article 7 of the excise tax Law 2008 (amended by Clause 4 Article 1 of the Law on Amendments to Excise Tax Law 2014, Clause 2 Article 2 of the Law on Amendments to Law on Value Added Tax Law, Excise Tax Law, and Tax Administration Law 2016 and Article 8 of the Law on Amendments to Law on Public Investment Law, Public-Private Partnership Investment Law, Investment Law, Housing Law, Bidding Law, Electricity Law, Enterprise Law, excise tax Law, and Civil Judgment Enforcement Law 2022) the excise tax rates for types of goods are as follows:

Tax Rates

The excise tax rates for goods and services are specified in the excise tax Tariff below:

...

Thus, according to the regulations, the excise tax rate of 40% applies to playing cards.