Are dental floss products eligible for a VAT reduction in Vietnam in 2024?

What is the basis for determining VAT in Vietnam?

According to Article 6 of the 2008 Law on VAT, the basis for determining VAT is the taxable price and the tax rate.

Are dental floss products eligible for a VAT reduction in Vietnam in 2024?

The groups of goods and services not eligible for a VAT reduction in 2024 are stipulated in Clause 1, Article 1 of Decree 72/2024/ND-CP on the policy of reducing VAT as follows:

* Reducing VAT for groups of goods and services currently applying the 10% tax rate, except for the following groups of goods and services:

[1] Telecommunications, financial, banking, securities, insurance activities, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, refined petroleum, and chemical products. Details in Appendix 1 issued together with this Decree. (Download Appendix 1)

[2] Products and services subject to special consumption tax. Details in Appendix 2 issued together with this Decree. (Download Appendix 2)

[3] Information technology products and services in accordance with the law on information technology. Details in Appendix 3 issued together with this Decree. (Download Appendix 3)

[4] The VAT reduction for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP is uniformly applied across the stages of importation, production, processing, and commercial business.

For coal sold after extraction (including cases where the coal is processed through screening, classification, and then sold in a closed process) subject to VAT reduction, coal products listed in Appendix 1 issued with this Decree (Download Appendix 1), are not eligible for VAT reduction at stages other than extraction.

Economic groups, conglomerates implementing a closed process for selling extracted coal are also subject to VAT reduction.

If goods and services listed in Appendices 1, 2, and 3 issued with this Decree are exempt from VAT or subject to a 5% VAT according to the Law on VAT, they will follow the regulations of the Law on VAT and are not eligible for the VAT reduction.

Therefore, groups of goods and services subject to a 10% VAT previously will get a 2% VAT reduction, excluding the exceptions mentioned above.

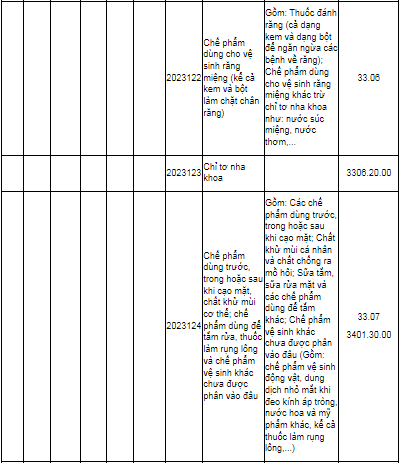

Dental floss products are among the goods and services not eligible for a VAT reduction.

Thus, dental floss products will not receive a VAT reduction.

Are dental floss products eligible for a VAT reduction in Vietnam in 2024? (Image from the Internet)

Which entities are VAT payers for export services in Vietnam?

According to Article 3 of Circular 219/2013/TT-BTC, the subjects are regulated as follows:

Taxpayers

VAT payers are organizations and individuals that produce and trade goods and services subject to VAT in Vietnam, regardless of their sector, business form, or organization (hereinafter referred to as business establishments), and organizations and individuals importing goods or purchasing services from abroad subject to VAT (hereinafter referred to as importers), including:

1. Business organizations established and registered under the Law on Enterprises, the Law on State Enterprises (now the Law on Enterprises), the Law on Cooperatives, and other specialized business laws;

2. Economic organizations of political organizations, socio-political organizations, social organizations, socio-professional organizations, armed forces units, public service organizations, and other organizations;

3. Enterprises with foreign investment and foreign parties engaging in business cooperation under the Law on Foreign Investment in Vietnam (now the Law on Investment); foreign organizations and individuals doing business in Vietnam but not establishing legal entities in Vietnam;

4. Individuals, households, independent groups of businesspersons, and other subjects engaged in production, business, or import activities;

5. Organizations and individuals producing business in Vietnam purchasing services (including cases of purchasing services attached to goods) from foreign organizations without a permanent establishment in Vietnam, individuals overseas who are non-residents in Vietnam, the organizations and individuals purchasing the services are the taxpayers unless they are not required to declare, calculate, or pay VAT as guided in Clause 2, Article 5 of this Circular.

Regulations on permanent establishments and non-resident subjects follow the laws on corporate income tax and personal income tax.

6. Branches of export-processing enterprises established to carry out trading activities and related activities on goods trading in Vietnam, following the provisions of the law on industrial zones, export-processing zones, and economic zones.

Example 1: Sanko Limited Liability Company is an export-processing enterprise. Besides manufacturing for export, Sanko Limited Liability Company is also licensed to undertake import operations for resale or export. Sanko Limited Liability Company must establish a branch to carry out these activities by law; its branch must account for, declare, and pay VAT separately for these activities and not aggregate them with manufacturing for export.

When importing goods for distribution (resale), the branch of Sanko Limited Liability Company must declare and pay VAT at the import stage. When reselling (including exports), Sanko Limited Liability Company uses invoices and declares and pays VAT according to the regulations.

The entity responsible for paying VAT on export services is the organization, individual producing, and trading goods, and services subject to VAT in Vietnam, regardless of their sector, business form, or organization.