Application and procedures for participating in the tax incentive program for automobile supporting industry in Vietnam

Application and procedures for participating in the tax incentive program for automobile supporting industry in Vietnam

Pursuant to Clause 5, Article 9 of Decree No. 26/2023/ND-CP, the applications and procedures for registering to participate in the tax incentive program for automobile supporting industry are as follows:

(1) The registration application for the tax incentive program for automobile supporting industry includes:

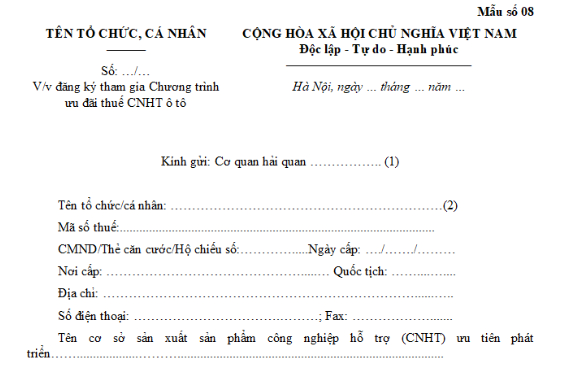

- Official Dispatch for registration to participate in the tax incentive program for automobile supporting industry according to Form No. 08 in Appendix 2 issued together with Decree No. 26/2023/ND-CP: 01 original copy;

- Investment Certificate or Investment Registration Certificate or Enterprise Registration Certificate or Business Registration Certificate (applied in the case specified at Point a, Clause 2, Article 9 of Decree No. 26/2023/ND-CP): 01 notarized copy;

- Notification document of production, processing (assembly) facilities; machinery and equipment at production, processing (assembly) facilities to customs authorities according to Form No. 09 in Appendix 2 issued together with Decree No. 26/2023/ND-CP: 01 original copy.

Land use rights certificate issued by competent state authority to the enterprise or Land use rights certificate issued by competent authority to the land owner and lease or borrow contract of land, premises, workshop in case the enterprise leases or borrows for production purposes: 01 notarized copy;

- Certificate of eligibility for automobile production and assembly issued by the Ministry of Industry and Trade (applied in the case specified at Point b, Clause 2, Article 9 of Decree No. 26/2023/ND-CP): 01 notarized copy.

(2) Procedures for registering to participate in the tax incentive program for automobile supporting industry

Enterprises shall submit the registration application to participate in the tax incentive program for automobile supporting industry directly or send it via the electronic data system of the customs authorities or via postal mail to the customs office where the enterprise's headquarters or production, processing (assembly) facilities are located for registration immediately after this Decree comes into effect or at any time of the year.

The participation time is calculated from the date of the Official Dispatch registering for the tax incentive program for automobile supporting industry onwards.

Application and procedures for participating in the tax incentive program for automobile supporting industry in Vietnam in 2024 (Image from the Internet)

Conditions for applying the tax incentive program for automobile supporting industry in Vietnam in 2024

Pursuant to Clause 3, Article 9 of Decree No. 26/2023/ND-CP, the conditions for applying the tax incentive program for automobile supporting industry 2024 are as follows:

(1) Enterprises producing, processing (assembling) automobile components and parts must meet the following conditions:

- Have a sales contract for automotive supporting industry products with enterprises manufacturing and assembling automobiles that have a Certificate of eligibility for automobile production and assembly issued by the Ministry of Industry and Trade;

- Investment Certificate or Investment Registration Certificate or Enterprise Registration Certificate or Business Registration Certificate detailing the project objectives or business lines including the production of parts and accessories for automobiles and other motor vehicles;

- Have ownership or usage rights over the production, processing (assembly) facilities and machinery, equipment at production, processing (assembly) facilities within the territory of Vietnam.

(2) Enterprises manufacturing and assembling automobiles that self-produce, process (assemble) automotive components and parts must have a Certificate of eligibility for automobile production and assembly issued by the Ministry of Industry and Trade.

(3) Imported materials, supplies, and components must meet the following conditions:

- Imported materials, supplies, and components (including materials, supplies, and components imported since the effective date of this Decree still in stock from previous incentive periods to the subsequent incentive period; excluding materials, supplies, and components put into use but damaged or faulty) for the production, processing (assembly) of automotive supporting industry products listed in the priority list for the development of the automotive manufacturing and assembly industry as stipulated in Section 4 of the Appendix issued together with Decree No. 111/2015/ND-CP on the development of the supporting industry and its amendments and supplements (if any).

In the case of simple assembly of products with simple devices such as screws, bolts, nuts, rivets, without undergoing any production or processing to become a complete product, it is not eligible for the tax incentive program for automobile supporting industry.

- Imported materials, supplies, and components that are not produced domestically by the enterprise specified in Clause 2, Article 9 of Decree No. 26/2023/ND-CP directly imported, entrusted for import, or authorized for import. The identification of domestically unproduced materials, supplies, and components is based on the regulations of the Ministry of Planning and Investment on the list of domestically produced materials, supplies, and semi-finished products.

Enterprises specified in Clause 2, Article 9 of Decree No. 26/2023/ND-CP meeting the regulations at Points a, b, and c of this Clause and the regulations in Clauses 4, 5, 6, 7, 8, Article 9 of Decree No. 26/2023/ND-CP are eligible for a preferential import tax rate of 0% for imported materials, supplies, and components to produce, process (assemble) automotive supporting industry products in the incentive assessment period.

Download Form No. 08 - Official Dispatch for participating in the tax incentive program for automobile supporting industry in Vietnam

The Official Dispatch for registering to participate in the tax incentive program for automobile supporting industry according to Form No. 08 in Appendix 2 issued together with Decree No. 26/2023/ND-CP is as follows:

>> Download Official Dispatch Registering to Participate in the tax incentive program for automobile supporting industry Form No. 08