5 Steps to Extend Tax Payment Deadline in Vietnam in 2024

5 Steps to Extend Tax Payment Deadline in Vietnam in 2024

Based on Article 5 Decree 64/2024/ND-CP, the 5 steps to extend tax payment in 2024 are as follows:

Step 1. The taxpayer directly declares and submits the tax to the tax authority under the eligible entities for extension by sending the Request for Extension of Tax and Land Rent Payment (hereinafter referred to as the Request for Extension) for the first time or as a replacement when errors are found (electronic submission; direct submission to the tax authority, or through postal services) to the directly managing tax authority once for the entire amount of tax and land rent arising in the extended tax calculation periods together with the time of submitting the tax declaration dossier monthly (or quarterly) in accordance with the law on tax management.

In case the Request for Extension is not submitted together with the tax declaration dossier submission time monthly (or quarterly), the deadline for submission is September 30, 2024. The tax authority still processes the extension of tax and land rent for the periods eligible for extension before the Request for Extension submission date.

In case the taxpayer has amounts subject to extension managed by different tax authorities, the directly managing tax authority of the taxpayer is responsible for transmitting information and the Request for Extension to the relevant managing tax authorities.

Step 2. The taxpayer self-determines and is responsible for the extension proposal ensuring the correct entities are extended according to Decree 64/2024/ND-CP.

If the taxpayer sends the Request for Extension to the tax authority after September 30, 2024, the tax and land rent will not be extended in accordance with Decree 64/2024/ND-CP.

In case the taxpayer supplements the tax declaration dossier of the extended tax period leading to an increase in the payable amount and submits it to the tax authority before the extended deadline, the extended tax amount includes the additional payable amount due to the supplementary declaration.

If the taxpayer supplements the tax declaration dossier of the extended tax period after the extended deadline, the additional payable amount due to the supplementary declaration will not be extended.

Step 3. The tax authority is not required to notify the taxpayer about the acceptance of the tax and land rent extension.

In case during the extension period, the tax authority determines that the taxpayer is not eligible for the extension, the tax authority will issue a written notification to the taxpayer, indicating non-extension, and the taxpayer must pay the full amount of tax, land rent, and late payment interest for the extended time to the state budget.

In case after the extension period, through inspection or audit, the competent state authority discovers that the taxpayer is not eligible for the tax and land rent extension under Decree 64/2024/ND-CP, the taxpayer must pay the outstanding tax amount, fines, and late payment interest to the state budget.

Step 4. No late payment interest is calculated for the extended tax and land rent amounts within the extension period (including cases where the taxpayer sends the Request for Extension to the tax authority after submitting the tax declaration dossier under Step 1 and cases where the competent authority, through inspection or audit, determines the taxpayer eligible for the extension has an increased payable amount in the extended tax periods).

In case the tax authority has calculated late payment interest (if any) for tax dossiers eligible for extension under Decree 64/2024/ND-CP, the tax authority will adjust and not calculate the late payment interest.

Step 5. Investors in projects, construction items funded by the state budget, payments from the state budget for construction projects using ODA funds subject to value-added tax must attach a notification from the tax authority that the Request for Extension has been received or the Request for Extension with confirmation of submission to the tax authority of the contractor implementing the project when making payment procedures with the State Treasury.

The State Treasury will not deduct value-added tax within the extension period based on the dossier submitted by the investor.

At the end of the extension period, the contractor must pay the full extended tax amount as prescribed.

5 steps to extend tax payment deadline in Vietnam in 2024 (Image from the Internet)

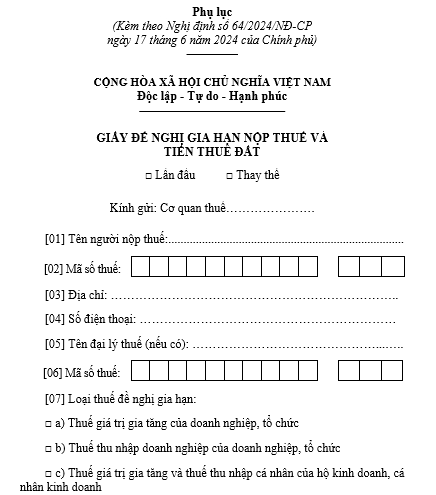

What is the Sample Request for Extension of Tax and Land Rent Payment in 2024?

The Sample Request for Extension of Tax and Land Rent Payment in 2024 is the sample in the Appendix issued with Decree 64/2024/ND-CP:

>> Download the Sample Request for Extension of Tax and Land Rent Payment in 2024: Download

Are Beverage Manufacturing Enterprises Eligible for Tax Payment Extension in Vietnam in 2024?

Article 3 of Decree 64/2024/ND-CP regulates that enterprises operating in the following industries are eligible for an extension of value-added tax and corporate income tax payment:

(1) Agriculture, forestry, and fisheries;

(2) Food production and processing; textile; apparel production; leather and related products; wood processing and wood, bamboo products manufacturing (except for beds, wardrobes, tables, chairs); straw, chaff, and woven materials products manufacturing; paper and paper products manufacturing; rubber and plastic products manufacturing; non-metallic mineral products manufacturing; metal manufacturing; mechanical processing; metal treatment and coating; electronic products, computer, and optical products manufacturing; automobiles and other motor vehicles manufacturing; beds, wardrobes, tables, chairs manufacturing;

(3) Construction;

(4) Publishing activities; film production, television programming, music recording, and publishing;

(5) Crude oil and natural gas extraction (no corporate income tax extension for crude oil, condensate, natural gas collected under agreements, contracts);

(6) Beverage production; recording media copying; coke, refined petroleum products manufacturing; chemicals and chemical products manufacturing; fabricated metal products manufacturing (except for machinery, equipment); motorcycle, motorbike manufacturing; machinery and equipment repair, maintenance, and installation;

(7) Sewerage and wastewater treatment.

Thus, beverage manufacturing enterprises will be eligible for a tax payment extension in 2024.