What are the cases of suspension and termination of unemployment allowance receipt in Vietnam?

What are the cases of suspension and termination of unemployment allowance receipt in Vietnam? - Huy Hoang (Binh Dinh)

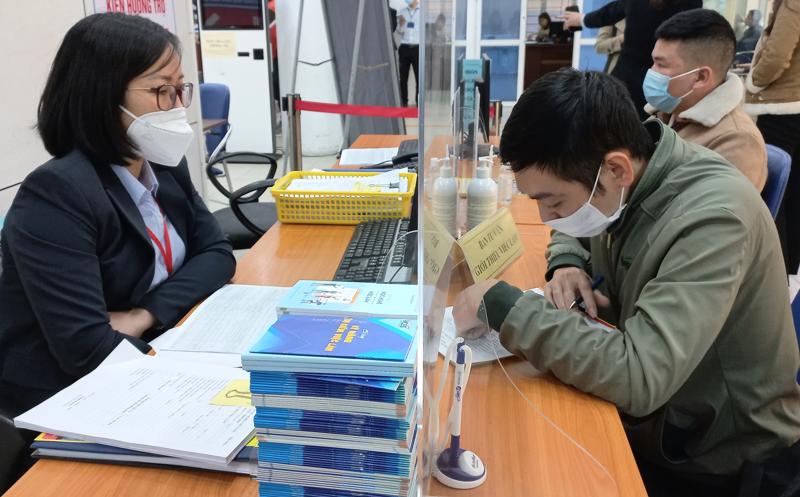

What are the cases of suspension and termination of unemployment allowance receipt in Vietnam? (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Conditions for unemployment allowance receipt in Vietnam

A worker working under labor contracts or working contracts of indefinite time, labor contracts or working contracts of definite time or seasonal or job-based working contracts with a term of between full 3 months and under 12 months who currently pays unemployment insurance premiums may receive unemployment allowance when fully meeting the following conditions:

- Terminating the labor contract or working contract, except the following cases:

+ He/she unilaterally terminates the labor contract or working contract in contravention of law;

+ He/she receives monthly pension or working capacity loss allowance.

- Having paid unemployment insurance premiums for at least full 12 months within 24 months before terminating the labor contract or working contract, for the case specified at Points a and b, Clause 1, Article 43 of the Employment Law 2013; or having paid unemployment insurance premiums for at least full 12 months within 36 months before terminating the labor contract, for the case specified at Point c, Clause 1, Article 43 of the Employment Law 2013.

- Having submitted a dossier for receipt of unemployment allowance to an employment service center under Clause 1, Article 46 of the Employment Law 2013.

- Having not yet found any job after 15 days from the date of submission of the dossier for receipt of unemployment allowance, except the following cases:

+ He/she performs the military or public security obligation;

+ He/she attends a training course of full 12 months or longer;

+ He/she serves a decision on application of the measure to send him/her to a reformatory, compulsory education institution or compulsory detoxification establishment;

+ He/she is kept in temporary detention or serves a prison sentence;

+ He/she goes abroad for settlement or as guest worker;

+ He/she dies.

(Article 49 of the Employment Law 2013)

2. What are the cases of suspension and termination of unemployment allowance receipt in Vietnam?

According to Article 53 of the Employment Law 2013:

- Persons on unemployment allowance will be suspended from receiving it if they fail to monthly notify their job seeking under Article 52 of the Employment Law 2013.

- Workers who are suspended from receiving unemployment allowance may continue receiving it under the decisions on unemployment allowance receipt if the receipt duration has not yet expired and they monthly notify their job seeking under Article 52 of the Employment Law 2013.

- A person on unemployment allowance will stop receiving it in the following cases:

(1) The duration of unemployment allowance receipt expires;

(2) He/she has found a job;

(3) He/she performs the military or public security service obligation;

(4) He/she receives monthly pension;

(5) He/she has twice refused without a plausible reason to take up the job recommended by the employment service center of the locality where he/she currently receives unemployment allowance;

(6) He/she fails to monthly notify his/her job seeking under Article 52 of the Employment Law 2013 for 3 consecutive months;

(7) He/she goes abroad for settlement or as guest worker;

(8) He/she attends a training course of full 12 months or longer;

(9) He/she is administratively sanctioned for violations of the law on unemployment insurance;

(10) He/she dies;

(11) He/she serves a decision on application of the measure to send him/her to a reformatory, compulsory education institution or compulsory detoxification establishment;

(12) He/she is declared by a court as missing;

(13) He/she is kept in temporary detention or serves a prison sentence.

Note Workers who stop receiving unemployment allowance in the cases specified at Points (3), (4), (8), (11), (12), (13) may have the period of payment of unemployment insurance premiums reserved for calculating the subsequent duration of receipt of unemployment allowance when they fully satisfy the conditions as prescribed.

The reserved period equals the total of the periods of payment of unemployment insurance premiums minus the period during which the worker has received unemployment allowance, with one month of receipt of unemployment allowance equivalent to 12 months of payment of unemployment insurance premiums.

3. Levels, duration and time of receipt of unemployment allowance in Vietnam

According to Article 50 of the Employment Law 2013, the levels, duration and time of receipt of unemployment allowance are specified as follows:

- The monthly unemployment allowance level equals 60% of the average monthly wage of 6 consecutive months before the worker becomes unemployed on which unemployment insurance premiums are based, but must not exceed 5 times the basic wage level, for workers receiving wages under the State-prescribed regime, or must not exceed 5 times the region-based minimum wage level under the Labor Code, for workers who pay unemployment insurance premiums under the wage regime decided by employers at the time of termination of the labor contract or working contract.

- The duration of unemployment allowance receipt is based on the number of months of payment of unemployment insurance premiums. This duration is 3 months if the period of payment of unemployment insurance premiums is between full 12 months and full 36 months, which is added with 1 month for each additional period of payment of full 12 months, but must not exceed 12 months.

- The time for unemployment allowance receipt is counted from the 16th day after the date of submission of a complete dossier for receipt of unemployment allowance as specified in Clause 1, Article 46 of the Employment Law 2013.

Nguyen Ngoc Que Anh

- Key word:

- unemployment allowance

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents