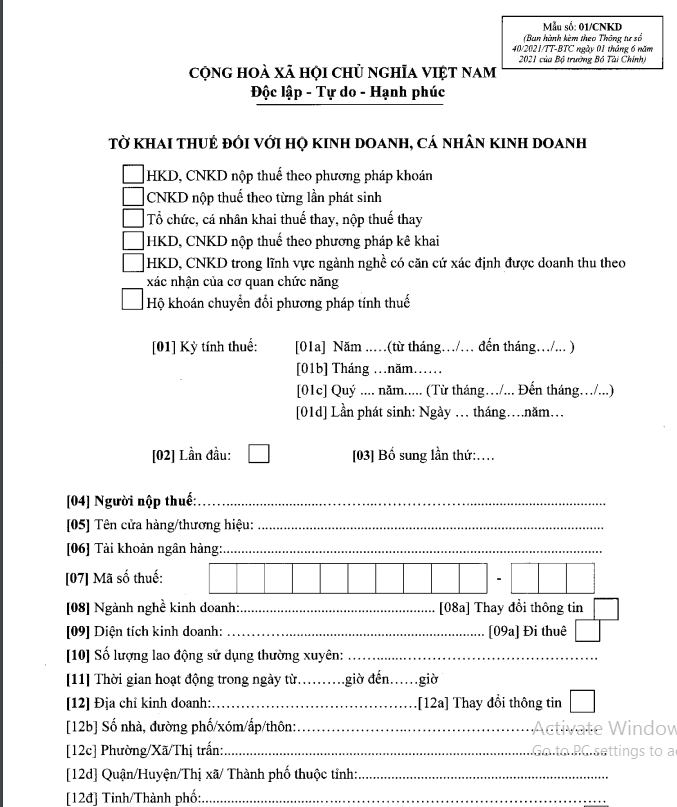

Vietnam: Tax declaration form for household businiesses and individual businesses from August 1, 2021

Form 01/CNKD issued together with Circular 40/2021/TT-BTC dated June 01, 2021, which provides guidance on value-added tax, personal income tax, and tax administration for business households and individual businesses.

Image of a portion of form 01/CNKD

|

Form 01/CNKD: Tax declaration form for household businesses, individual businesses from August 1, 2021 |

Note:

- Criteria [01] Tax period is applied as follows:

+ Criteria [01a] is only declared for household businesses, individual businesses paying tax by the estimated method.

+ Criteria [01b] or [01c] is only declared for household businesses, individual businesses paying tax by the declaration method or organizations, individuals declaring and paying tax on behalf of others on a monthly or quarterly basis.

+ Criteria [01d] is declared for household businesses, individual businesses paying tax on each arising occasion.

- Criteria [08a] is only marked if the information in criteria [08] has changed compared to the immediately preceding declaration.

- Criteria [12a] is only marked if the information in criteria [12b], [12c], [12d], [12đ] has changed compared to the immediately preceding declaration.

- In the criteria for revenue and output: If it is an estimated household, declare the expected average monthly revenue and output for the year; If it is an individual business paying tax on each arising occasion, declare the revenue and output for each arising occasion. If it is a household business, individual business paying tax by the declaration method or an organization declaring and paying tax on behalf of others, declare the revenue and output on a monthly or quarterly basis corresponding to the monthly or quarterly period.

- Household businesses, individual businesses in partnership with organizations will have the organization declare on their behalf along with Appendix 01/CNKD Detail List of household businesses, individual businesses according to form 01-1/BK-CNKD and will not have to declare criteria from [04] to [18].

- Household businesses, individual businesses paying tax by the declaration method must attach to their declaration form 01/CNKD Appendix Activity Details during the period of household businesses, individual businesses according to form 01-2/BK-HDKD except for household businesses, individual businesses in specific industries where revenue can be determined based on the confirmation of relevant authorities.

- Section C only applies to individuals licensed for mineral resource extraction.

Bao Ngoc

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents