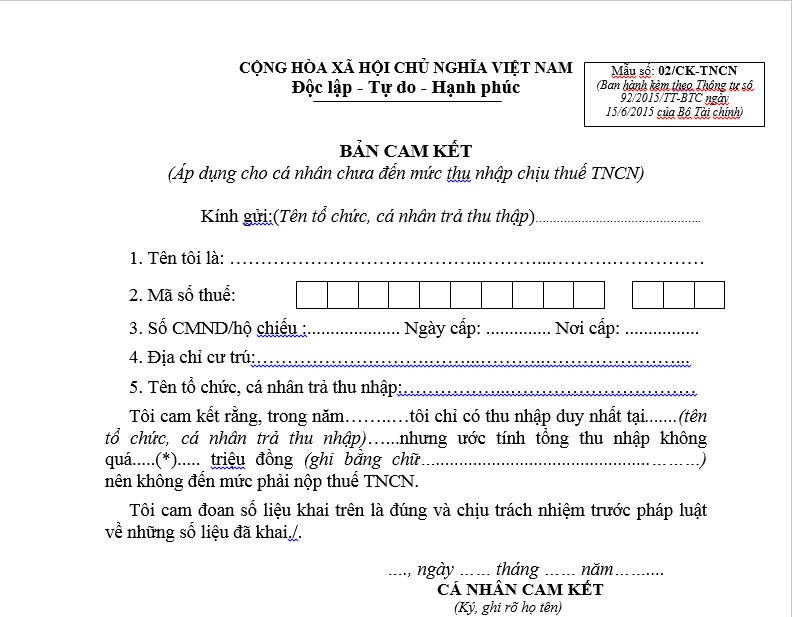

Vietnam: Commitment Form 02/CK-TNCN for Personal Income Tax Exemption

Form 02/CK-TNCN Commitment form applicable to individuals not yet liable for taxable income in Vietnam promulgated together with Circular 92/2015/TT-BTC.

|

Form 02/CK-TNCN |

Photo of part of Form 02/CK-TNCN

Instructions for filling out the commitment form:

- To: Enter the name of the organization or individual paying the income (enter the name of the company, enterprise, business household, paying your salary).

- My name is: Enter the name of the employee.

- Tax code: Enter the tax code in the box in Form 02/CK-TNCN.

- ID/Citizen ID information: Enter the full information of the ID card or citizen identity card including: Number, date of issue, place of issue.

- Residential address: Enter the current residence.

- Commitment content: I commit that, in the year (enter the year) I have only one income from…. (name of the organization or individual paying the income)…. but the estimated total income does not exceed…..(*)….. million VND (written in words) and therefore does not reach the threshold for personal income tax submission.

Note: (*) The amount declared in this section is determined based on the family circumstance deduction calculated for the year according to Resolution 954/2020/UBTVQH14.

Example:

- In case the person making the commitment has no dependents:

Declared amount = 11 million VND x 12 months = 132 million VND.

- In case the person making the commitment has 01 dependent who needs to be supported for 10 months of the year:

Declared amount = 132 million VND + 4.4 million VND x 10 months = 176 million VND.

Bao Ngoc

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents