Rules of offering of bonds in international market in Vietnam

Below are the rules of offering of bonds in international market in Vietnam as stipulated in Decree 153/2020/ND-CP.

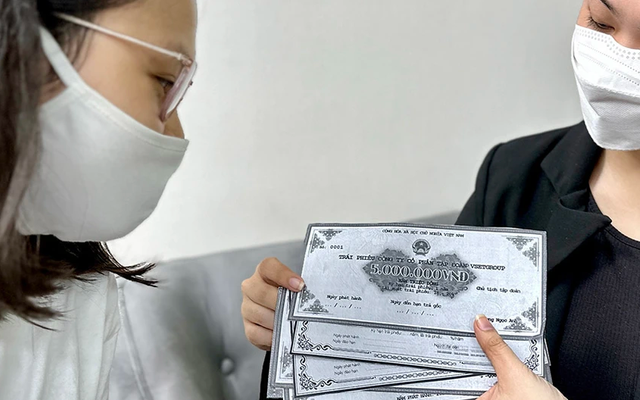

Rules of offering of bonds in international market in Vietnam (Internet image)

1. Rules of offering of bonds in international market in Vietnam

The rules of offering of bonds in international market in Vietnam according to Article 24 of Decree 153/2020/ND-CP are as follows:

- Enterprises offering bonds to the international market (either privately or publicly) must comply with the provisions of Decree 153/2020/ND-CP and satisfy the conditions for offering as stipulated in the issuance market.

- The trading of corporate bonds offered to the international market must follow the regulations in the issuance market.

2. Conditions for offering of bonds in international market in Vietnam

The conditions for offering of bonds in international market in Vietnam according to Article 25 of Decree 153/2020/ND-CP are as follows:

- For non-convertible bonds without warrants:

+ The issuing enterprise must be a joint stock company or a limited liability company established and operating under Vietnamese law;

+ The plan for issuing bonds to the international market must be approved and accepted by the competent authority according to the provisions of Article 28 of Decree 153/2020/ND-CP;

+ Compliance with financial safety ratios and safety assurance ratios in operations as stipulated by specialized laws;

+ Adherence to regulations on the management of foreign borrowing and repayment by enterprises without the Government of Vietnam’s guarantee and foreign exchange management laws;

+ Satisfaction of offering conditions as stipulated in the issuance market.

- For convertible bonds or bonds with warrants:

+ The issuing enterprise must be a joint stock company meeting the issuance conditions specified in Clause 1 Article 25 of Decree 153/2020/ND-CP;

+ The conversion of bonds into shares or the exercise of attached warrants must comply with the foreign investor ownership ratios as stipulated by law;

+ Successive offerings of convertible bonds or bonds with warrants must be at least 06 months apart from the completion date of the nearest offering.

3. Dossiers for offering of bonds in international market in Vietnam

The dossiers for offering of bonds in international market according to Article 27 of Decree 153/2020/ND-CP are as follows:

- The issuing enterprise is responsible for preparing the offering dossier to facilitate the offering, trading, and payment of principal and interest on the bonds.

- The offering dossier includes the following basic documents:

+ The bond offering plan approved and accepted by the competent authority according to the provisions of Article 28 of Decree 153/2020/ND-CP.

+ A certificate of the foreign currency account for issuing securities at a licensed credit institution according to the regulations of the State Bank of Vietnam.

+ A document from the State Bank of Vietnam confirming that the issuance limit is within the national foreign commercial borrowing limit.

+ The decision to approve and accept the bond issuance plan by the competent authority.

+ Financial statements prepared according to international accounting standards if required by the issuance market.

+ The registration dossier for offering with the competent authority in the issuance market or a legal opinion from an international law consultancy company that the enterprise does not need to register with the local competent authority when issuing bonds.

+ For the offering of bonds to the international market by public companies, securities companies, and fund management companies, in addition to documents specified at points a, b, c, d, e, and f of Clause 2 Article 27 of Decree 153/2020/ND-CP, the offering dossier must also include:

++ An application for the issuance of bonds to the international market in the form prescribed in Appendix II issued together with Decree 153/2020/ND-CP.

++ A copy of the resolution of the General Meeting of Shareholders/Board of Directors, Members' Council/Company President approving the dossier of the bond offering to the international market.

- Key word:

- bonds

- Vietnam

- international market

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents