Rules for issuance, management and use of invoices and records in Vietnam

What are the rules for issuance, management and use of invoices and records in Vietnam? - Thanh Tuyen (Long An)

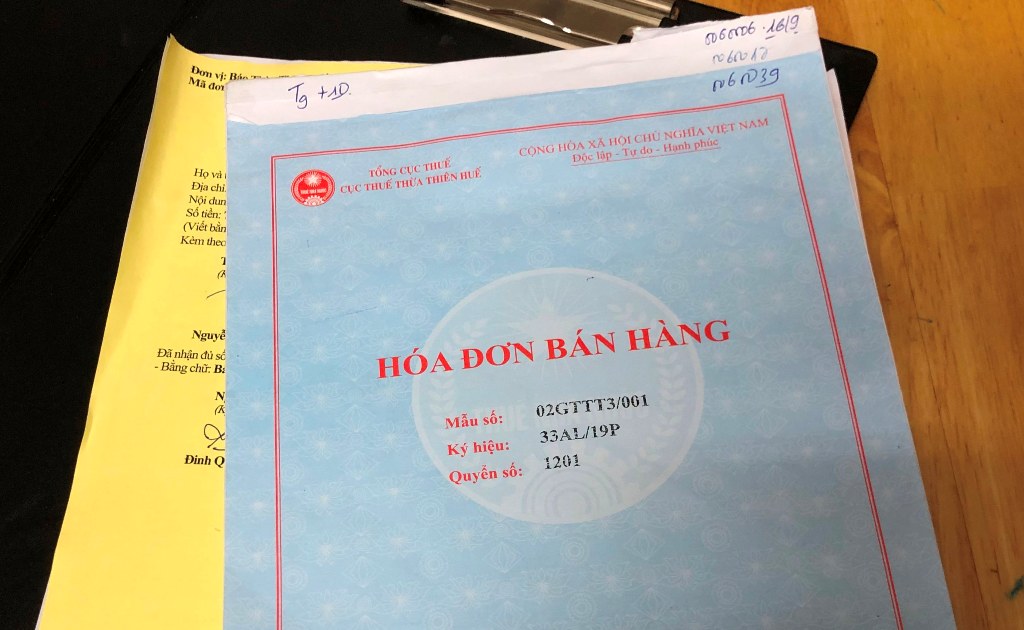

Rules for issuance, management and use of invoices and records in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Rules for issuance, management and use of invoices and records in Vietnam

Rules for issuance, management and use of invoices and records in Vietnam according to Article 4 of Decree 123/2020/ND-CP are as follows:

- When selling goods or providing services, the seller shall issue and send invoices to buyers (including goods/services used for sales promotion, advertising or as samples, goods/services gifted, donated, exchanged or used as salary payment to employees and internal use (except goods which are internally rotated in production process, and goods rented, lent or returned).

Such invoices shall have adequate contents written according to the provisions in Article 10 of Decree 123/2020/ND-CP, except e-invoices which must follow the standard format prescribed by tax authorities as prescribed in Article 12 of Decree 123/2020/ND-CP.

- When deducting personal income tax or collecting taxes, fees or charges, the organization responsible for tax deduction or the tax, fee or charge collector shall make and give certificates of personal income tax withholding or receipts of taxes, fees or charges to persons whose income is deducted or payers.

Such records/receipts must contain adequate information as prescribed in Article 32 of Decree 123/2020/ND-CP. If electronic receipts are used, they must follow the standard format prescribed by tax authorities. If an individual authorizes tax declaration, no certificates of personal income tax withholding are issued.

If a person does not sign an employment contract or signs an employment contract for less than 03 months, the income payer is entitled to issue a certificate of personal income tax withholding for either each deduction or multiple deductions within a tax period. If a person signs an employment contract for 03 months or longer, the income payer shall issue a certificate of personal income tax withholding in a tax period.

- Before using invoices/receipts, enterprises, business entities, other organizations, household/individual businesses, and tax/fee/charge collectors must apply for registration for the use of such invoices/receipts with tax authorities or follow procedures for announcement of issue of such invoices/receipts in accordance with the provisions in Article 15, Article 34 and Clause 1 Article 36 of Decree 123/2020/ND-CP.

Tax authorities shall make announcement of issue of invoices/receipts which are printed according to their orders according to the provisions in Clause 3 Article 24 and Clause 2 Article 36 of Decree 123/2020/ND-CP.

- Organizations, and household/individual businesses shall submit reports on their use of invoices purchased from tax authorities and reports on their use of externally- or internally-printed receipts or receipts purchased from tax authorities according to the provisions in Article 29 and Article 38 of Decree 123/2020/ND-CP.

- The registration, management and use of e-invoices/electronic records shall comply with regulations of the Laws on electronic transactions, accounting, taxation and tax administration, and regulations herein.

- Data of invoices/records issued when selling goods or providing services, and data of records issued when conducting tax payments, tax deduction and payments of taxes, fees and charges shall be collected to build the database used for the purposes of tax management and meeting the needs of concerned organizations and individuals for invoice/record information.

- Good sellers or service providers that are enterprises, business entities or other organizations are allowed to authorize third parties to issue e-invoices for their sale of goods or provision of services.

An invoice issued by a third party under authorization must still bear the name of the seller that is the authorizing party. The authorizing party and the authorized party must enter into a written authorization which must contain adequate information on invoices to be made under authorization (purposes and duration of authorization, and method of payment for invoices made out under authorization).

Such authorization must be notified to tax authorities when applying for use of e-invoices. In case invoices to be made out under authorization are unauthenticated invoices, the authorizing party shall transmit e-invoice data to tax authorities through the e-invoice service provider. The Ministry of Finance shall provide specific guidance on this content.

- Collectors of fees and charges are allowed to authorize third parties to issue fee/charge receipts. A receipt issued by a third party under authorization must still bear the name of the fee/charge collector that is the authorizing party.

The authorizing party and the authorized party must enter into a written authorization which must contain adequate information on receipts to be made under authorization (purposes and duration of authorization, and method of payment for receipts made out under authorization). Such authorization must be notified to tax authorities when following procedures for announcement of issue of such receipts.

2. Prohibited acts related to invoices and records in Vietnam

Prohibited acts related to invoices and records under Article 5 of Decree 123/2020/ND-CP are as follows:

* For tax officials:

- Disturb or cause difficulties to organizations/individuals buying invoices/records;

- Protect or enter into collusion with organizations/individuals to use illegal invoices/records;

- Take bribes when carrying out invoice-related inspections.

* For goods sellers, service providers, organizations and individuals with related rights and obligations:

- Perform deceitful acts such as use of illegal invoices or illegal use of invoices;

- Obstruct tax officials in performing their tasks, including acts of obstruction that harm the health or dignity of tax officials who are performing invoice/record-related inspections;

- Illegally access, falsify or destroy invoice/record information systems;

- Give bribes or perform other invoice/record-related acts for obtaining illegal benefits.

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents