Rules, duration and effect of compulsory civil liability insurance of motor vehicle users in Vietnam

What are the regulations on the rules, duration and effect of compulsory civil liability insurance of motor vehicle users in Vietnam? - Thuy Lan (Quang Tri, Vietnam)

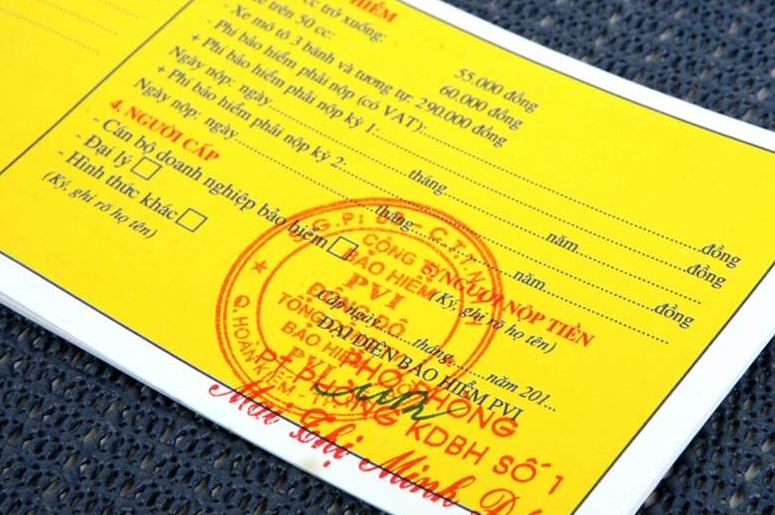

Rules, duration and effect of compulsory civil liability insurance of motor vehicle users in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Rules for compulsory civil liability insurance participation principles in Vietnam

According to Article 4 of Decree 03/2021/ND-CP, the rules for compulsory civil liability insurance participation principles are as follows:

- Insurance enterprises and insurance buyers shall implement compulsory civil liability insurance of motor vehicle users according to Decree 03/2021/ND-CP.

- For each motor vehicle, responsibility for paying for compulsory civil liability insurance of motor vehicle users shall only derive from a single insurance contract.

- In addition to participation in compulsory civil liability insurance of motor vehicle users according to Decree 03/2021/ND-CP, motor vehicle users and insurance enterprises may agree to extend insurance requirements, excess insurance liabilities and respective additional insurance premiums.

In this case, insurance enterprises are responsible for separating compulsory civil liability insurance of motor vehicle users in certificates of insurance.

2. Duration and effect of insurance in Vietnam

Article 9 of Decree 03/2021/ND-CP stipulates the insurance duration is specified on certificates of insurance, to be specific:

- For motorcycles, motorized tricycles, mopeds (including electric mopeds) and similar vehicles according to Law on Road Traffic, the minimum insurance duration is 1 year and the maximum insurance duration is 3 years.

- For remaining motor vehicles, the minimum insurance duration is 1 year and the maximum insurance duration shall conform to valid period of periodic technical safety and environmental protection inspection which has more than 1 year of valid period.

- For following cases, insurance duration shall be less than 1 year:

+ Foreign motor vehicles which temporarily import for re-export participate in traffic within Socialist Republic of Vietnam territory for less than 1 year;

+ Service life of motor vehicles is less than 1 year as per the law;

+ Temporarily registered motor vehicles according to regulations of Ministry of Public Security.

- In case motor vehicle users who have multiple vehicles participating in insurance at different times in a year wish to unify insurance participation time in the following year, insurance duration of these vehicles may be less than 1 year and equal to remaining valid period of the first contract concluded in that year.

Insurance duration of the following year for insurance contracts and certificates of insurance which have been unified in terms of participation time shall conform to Point a and Point b Clause 1 of Article 9 of Decree 03/2021/ND-CP.

Note:

- Insurance effect shall start and end according to the duration specified on certificates of insurance.

- In case shift in ownership of motor vehicles takes place within the duration specified on certificates of insurance, all insurance benefits related to civil responsibilities of the former motor vehicle users shall remain valid for the new motor vehicle users.

3. Scope of compensation for compulsory civil liability insurance of motor vehicle users in Vietnam

The scope of compensation for compulsory civil liability insurance of motor vehicle users is specified in Article 5 of Decree 03/2021/ND-CP, specifically:

- Non-contract damage such as health, life and assets done to a third party by motor vehicles.

- Damage to health and lives of passengers done by motor vehicles.

4. Certificate of compulsory civil liability insurance of motor vehicle users in Vietnam

According to Article 6 of Decree 03/2021/ND-CP, the certificate of compulsory civil liability insurance of motor vehicle users (hereinafter referred to as “certificate of insurance”) is prescribed as follows:

- Certificates of compulsory civil liability insurance of motor vehicle users are proof of concluding compulsory civil liability insurance contracts between motor vehicle users and insurance enterprises. Each motor vehicle shall be issued with 1 certificate of insurance.

Motor vehicle users whose certificates of insurance are lost must request insurance enterprises (which have previously issued the lost certificates of insurance) in writing to reissue certificates of insurance.

- Upon purchasing compulsory civil liability insurance of motor vehicle users, motor vehicle users shall be issued with certificates of insurance by insurance enterprises.

Insurance enterprises shall only issue certificates of insurance for motor vehicle users if the motor vehicle users have adequately paid insurance premiums or agreed with the insurance enterprises on deadline for paying insurance premiums according to Ministry of Finance.

- Certificates of insurance shall be designed by insurance enterprises and include following details:

+ Name, address and phone number (if any) of motor vehicle users.

+ License plate or chassis number, engine number.

+ Type of vehicle, payload, number of seats and use purpose in case of automobiles.

+ Name, address and hotline number of insurance enterprises.

+ Civil insurance liabilities for third party and passengers.

+ Responsibilities of motor vehicle users and operators in case of accidents.

+ Insurance duration, insurance premiums and payment deadline of insurance premiums.

+ Date of issue of certificates of insurance.

+ Number code and barcode registered, managed and used according to Ministry of Science and Technology to enable storage, transmission and extraction of ID information of insurance enterprises and basic contents of certificates of insurance.

- In case of issuance of electronic certificates of insurance, insurance enterprises must comply with Law on Electronic Transactions and guiding documents; Electronic certificates of insurance must closely comply with applicable regulations and law and Clause 3 of Article 6 of Decree 03/2021/ND-CP.

Nguyen Nhu Mai

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Vietnam: 04 things to know about compulsory civil ...

- 09:49, 10/10/2022

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents